Eurozone Finance Chief Criticizes Apple's Response to Tax Ruling

September 04 2016 - 10:30PM

Dow Jones News

CERNOBBIO, Italy—Apple Inc.'s aggressive response to a €13

billion ($14.5 billion) tax ruling by the European Commission shows

the U.S. technology company doesn't understand the moral obligation

on big companies to pay taxes, according to the leader of the

eurozone's finance ministers.

Jeroen Dijsselbloem said Apple had "failed to grasp" the public

outcry over tax avoidance by large companies.

The comments are likely to inflame an increasingly angry

trans-Atlantic dispute about the ruling, which has pitched the

White House against the European Commission and seen the heavily

indebted Irish government resist a €13 billion tax windfall.

"The Apple response shows that they don't grasp what's going on

in society and they do not grasp what's going on in the public

debate," Mr. Dijsselbloem, president of the Eurogroup of finance

ministers, said on the sidelines of the Ambrosetti forum of

business leaders in Italy. "This is a very strong moral issue and

large companies, even if they're this large, can't say 'this is not

about us, there's no problem here.'"

"American companies or any company that uses all these different

tax plans and at the end of the day pays no tax, that's not

fair."

The European Commission ruled last week that Ireland breached

competition law by allowing Apple to pay a tax rate in the

country—where Apple books the bulk of its European profits—that it

said reached 0.005% in 2014. Apple was told to repay the money to

Ireland.

Apple has hit back hard at the ruling, with Chief Executive Tim

Cook warning in a public letter that it threatens to "upend the

international tax system." He also denied the commission's factual

claims. He later told Irish broadcaster RTE that it was reasonable

to discuss both the level of tax and which countries it was paid

to, but "that conversation should be about future taxes, not

retroactive taxes. The EU Commission's overreach in this regard, is

unbelievable to us."

Both Ireland and Apple plan to appeal the commission's ruling.

Apple declined to comment further on Sunday.

John Bruton, who was Irish prime minister for part of the period

covered by the tax ruling, warned that it endangered the country's

ability to provide a stable tax regime for companies. "What's

really threatening is the idea of retrospective tax liabilities on

the basis of reinterpretation of tax rulings by people who don't

have a direct competence," he said.

The White House has also raised concerns that the European

ruling will undermine tax cooperation. But Mr. Dijsselbloem said

there was no need for a transatlantic "tax war," and called for the

strengthening of international standards.

European Commission President Jean-Claude Juncker used a press

conference at the meeting of the Group of 20 large economies in

Hangzhou, China, to deny accusations that the ruling was a

political decision, or aimed at the U.S. "It would be totally

absurd to choose the area of taxation to attack the U.S.," he said.

"We are basing our decisions on facts and the legislation that

applies here." He pointed out that 35 European companies had also

been found in breach of state-aid rules so far this year.

U.S. presidential candidates Donald Trump and Hillary Clinton

have said they aim to reform U.S. taxes on offshore profits to

secure a chunk of the $1.7 trillion in cash estimated by Moody's

Investors Services to be hoarded offshore by American companies.

U.S. corporate taxes are applied only when overseas profits are

repatriated.

Australian Prime Minister Malcolm Turnbull said addressing

corporate tax avoidance is an issue related to resisting

protectionism and isolation taking hold in many nations. "Paying

taxes is not optional. Businesses must pay tax," Mr. Turnbull told

a panel on the G-20 sidelines. It is important for governments to

be able to show that "the people who are making money and doing

well are paying their tax," he said.

Mr. Dijsselbloem is in conflict with the commission over its

ruling in October last year that the Netherlands, where he is

finance minister, offered a sweetheart deal to coffee chain

Starbucks Corp. that amounted to an illegal subsidy. But he said

the case was different, and the Netherlands didn't dispute the

commission's right to ensure fair competition.

Ireland and the Netherlands were at the centre of tax-avoidance

strategies known as the "double Irish" and "Dutch sandwich" used by

multinationals, especially U.S. tech companies.

Valentina Pop and James T. Areddy in Hangzhou, China,

contributed to this article.

Write to James Mackintosh at James.Mackintosh@wsj.com

(END) Dow Jones Newswires

September 04, 2016 22:15 ET (02:15 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

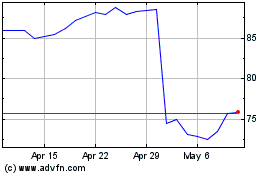

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Mar 2024 to Apr 2024

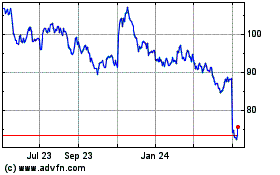

Starbucks (NASDAQ:SBUX)

Historical Stock Chart

From Apr 2023 to Apr 2024