Europe Bank Recovery Hit By Market Tumult

January 22 2016 - 3:02AM

Dow Jones News

(FROM THE WALL STREET JOURNAL 1/22/16)

By Margot Patrick, Max Colchester and Jenny Strasburg

LONDON -- Europe's banks had been on a long, slow march to

recovery. But this month's market turmoil is likely to hinder that

journey and, in turn, could threaten the Continent's economic

prospects.

Worries over China's slowing economy, plunging oil prices and a

deepening crisis at Italian banks have sent shares of European

banks into a tailspin just as many of those banks were making

progress at stabilizing their businesses after years of financial

and economic crises. In the first three weeks of 2016, the European

bank sector has fallen 16%, compared with a 10% slide in the

broader Stoxx Europe 600 index.

The downturn threatens more than bank shareholders. Analysts

said the conditions mean Deutsche Bank AG, Barclays PLC and

Standard Chartered PLC could take longer to carry out yearslong

restructurings and improve returns under new chief executives

installed last year. If conditions continue to deteriorate, banks

could ratchet back lending and central banks may again have to step

in to encourage banks to pump credit into the wider economy.

"It is a key risk at the moment," said Filippo Alloatti, a

senior analyst at Hermes Credit.

Shares in Deutsche Bank fell 3.4% on Thursday after the bank

said challenging market conditions helped push it to a full-year

loss for 2015. The German bank's shares are nearing levels last

seen in 2009 in the heat of the global financial crisis.

Other lenders starting the day in the red got a boost after

European Central Bank President Mario Draghi signaled that the bank

may decide to provide more stimulus at its governing council's next

meeting in March.

Mr. Draghi expressed confidence in the health of the financial

system. "I'm confident that all the actions that have been

undertaken have produced a much stronger banking sector than it was

before the crisis," he said. "The gyrations . . . in other times

would have severely tested the resilience of the banking systems.

So far we have seen that they stand pretty resilient."

Standard Chartered's shares have tumbled 15% this year on

worries that falling currencies and rising bad loans will delay its

attempted return to health under new Chief Executive Bill Winters.

Larger rival HSBC Holdings PLC, which is retreating from some

countries to double down on Asia, also is exposed to currency and

market falls throughout Asia.

Barclays, whose shares also are off 15% this year, this week is

starting to cut about 1,000 investment-banking jobs, mainly in

Asia, in its latest attempt to lower costs and divert resources to

more profitable parts of the bank. Thousands of jobs already have

gone from the bank over the past few years, but new CEO Jes Staley

is trying to accelerate the restructuring.

The sector's woes are a reminder of how the Continent continues

to suffer from its slow progress at cleaning up its banks. Many

large European lenders for years delayed efforts to fortify their

capital cushions. Even now, eight years after the financial crisis,

Deutsche Bank, Barclays and other giant lenders are scrambling to

convince regulators and investors that they have enough capital to

weather another financial storm.

"The European banks are in such a state of delayed recovery,"

said Stephen Schwarzman, chief executive of private-equity firm

Blackstone Group, at a World Economic Forum panel discussion. "I

don't know what they were doing for years. It's a mystery to

me."

Analysts say most of Europe's large banks are resilient enough

to ride out a global slowdown. But persistently low interest rates

and waning client activity in markets could hurt earnings and limit

dividends.

If the outlook continues to darken, there is also the prospect

of a negative feedback loop, in which banks pulling back on lending

and exiting from markets weaken the global economy.

"It creates a more difficult environment for restructuring. If

you have a big noncore business that is still in wind-down mode,

tighter liquidity makes it very tough to exit certain noncore

assets," said Joe Dickerson, a banking analyst at Jefferies.

(END) Dow Jones Newswires

January 22, 2016 02:47 ET (07:47 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

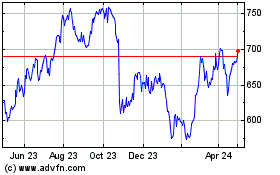

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Mar 2024 to Apr 2024

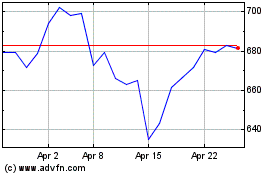

Standard Chartered (LSE:STAN)

Historical Stock Chart

From Apr 2023 to Apr 2024