Euro Weakens As German Industrial Output Falls Unexpectedly

October 07 2015 - 12:11AM

RTTF2

The euro slipped against its major rivals in early European

trading on Wednesday, as Germany's industrial production declined

unexpectedly in August and traders await the minutes of the

European Central Bank's September meeting for further insight

regarding the expansion of quantitative easing programme.

Data from Destatis showed that industrial production declined

1.2 percent in August from the prior month, offsetting the 1.2

percent rise in July. Economists had forecast the growth rate to

ease to 0.2 percent. July's growth was revised up from 0.7

percent.

The data added to evidence that slowing growth in China and

weakness in other developing markets are hurting German

industry.

The European Central Bank releases account of the monetary

policy meeting in September on Thursday. Investors seek more clues

about any discussion of additional stimulus in the minutes, given

slowing global growth and low inflation.

In its latest World Economic Outlook released on Tuesday, the

International Monetary Fund lowered the global growth forecast for

this year to 3.1 percent from 3.3 percent, saying global growth

remains 'moderate and uneven' amid the modest pick-up in advanced

economies and the slowdown in emerging market.

Euro area growth forecast for this year was retained at 1.5

percent, while the outlook for next year was cut to 1.6 percent

from 1.5 percent.

Market participants cautiously await the start of earnings

season, with aluminum giant Alcoa due to announce its third-quarter

results on Thursday.

The currency was modestly lower in the previous session.

In early European deals, the euro slipped to a 6-day low of

1.0878 against the Swiss franc, compared to 1.0895 hit late New

York Tuesday. The next possible support for the euro-franc pair may

be located around the 1.075 level.

The euro was trading lower at 0.7381 against the pound, 1.1257

against the greenback and 135.11 against the yen, off its early

high of 0.7404, 2-day highs of 1.1284 and 135.63, respectively. If

the euro extends decline, it is likely to find support around 1.11

against the greenback, 0.725 against the pound and 134.00 against

the yen.

The euro reached as low as 1.4608 against the loonie, from its

early high of 1.4710. Continuation of the euro's downtrend may

drive the euro down to a support around the 1.45 area.

The 19-nation currency weakened to 1.6968 against the kiwi, its

lowest since August 21, while touching nearly a 6-week low of

1.5597 against the aussie. On the downside, the euro may locate

support around 1.68 against the kiwi and 1.54 against the

aussie.

Looking ahead, U.K. industrial and manufacturing output for

August will be published in the European session.

Canada building permits for August, Energy Information

Administration's weekly crude inventory data for the week October 2

and U.S. consumer credit for August are to be released in the New

York session.

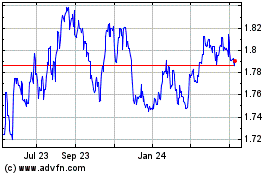

Euro vs NZD (FX:EURNZD)

Forex Chart

From Mar 2024 to Apr 2024

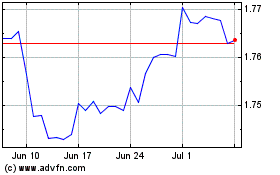

Euro vs NZD (FX:EURNZD)

Forex Chart

From Apr 2023 to Apr 2024