Euro Weakens Amid Risk Aversion

April 13 2017 - 1:47AM

RTTF2

The euro declined against its major counterparts in the early

European session on Thursday, as European markets fell tracking

weak cues from Wall Street, amid lingering geopolitical concerns

and Trump's comments on the dollar and interest rates.

Investors digested Trump's comments that the greenback is

getting too strong and he preferred the Federal Reserve to keep

interest rates low.

Oil prices eased for a second day as rising U.S. inventories

stoked worries about global oversupply.

Nervousness over upcoming French Presidential elections also

weighed on the currency, after polls showed a tightening race on

April 23.

The latest Ifop-Fiducial poll on Wednesday showed far-right

leader Le Pen leading centrist Emmanuel Macron by one point to 23.5

percent in the first round on voting.

Final figures from Destatis showed that German consumer price

inflation remained unchanged at a four-month low in March.

The consumer price index rose 1.6 percent year-on-year following

2.2 percent surge in February. The inflation figure was the weakest

since November.

The currency was higher against its major rivals in the Asian

session, with the exception of the Japanese yen.

The euro weakened to a 1-1/2-month low of 0.8475 against the

pound, from a high of 0.8510 hit at 5:00 pm ET. If the euro extends

decline, 0.82 is likely seen as its next support level.

Survey data from the mortgage lender Halifax and IHS Markit

showed that U.K. house prices increased at the slowest pace in four

years in the three months ended March from a year ago.

House prices climbed 3.6 percent year-over-year in the first

quarter, slower than the 6.5 percent spike in the fourth

quarter.

The euro fell to 115.93 against the yen, 1.0679 against the

franc and 1.0642 against the greenback, off its early highs of

116.45 and 1.0698, and a weekly high of 1.0678, respectively. The

next possible support levels for the euro are seen around 113.00

against the yen and 1.04 against both the franc and the

greenback.

The common currency slid to 9-day lows of 1.4019 against the

aussie and 1.5199 against the kiwi, from its prior highs of 1.4178

and 1.5306, respectively. The euro is poised to find support around

1.38 against the aussie and 1.50 against the kiwi.

Reversing from an early high of 1.4137 against the loonie, the

euro slipped to 1.4074. On the downside, 1.39 is likely seen as the

next support level for the euro-loonie pair.

Looking ahead, Canada new housing price index and manufacturing

sales data, for February, U.S. PPI for March, U.S. weekly jobless

claims for the week ended April 8, U.S. University of Michigan's

preliminary consumer sentiment index for April and U.S. Baker

Hughes rig count data are slated for release in the New York

session.

At 10:00 am ET, Bank of Canada Governor Stephen Poloz is

expected to testify along with Senior Deputy Governor Carolyn

Wilkins before the Standing Senate Committee on Banking, Trade and

Commerce, in Ottawa.

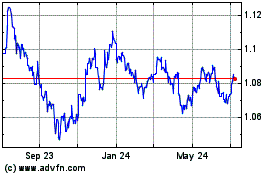

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Mar 2024 to Apr 2024

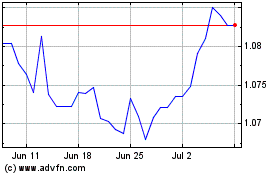

Euro vs US Dollar (FX:EURUSD)

Forex Chart

From Apr 2023 to Apr 2024