Euro Weakens Against Majors

March 30 2017 - 2:33AM

RTTF2

The euro declined against its major counterparts in the early

European session on Thursday, as Eurozone bond yields declined

after a slowdown in consumer price inflation in Spain and on

continued expectations that the European Central Bank would stick

to accommodative monetary policy to boost inflation.

Flash data from the statistical office INE showed that Spain's

inflation slowed more than forecast in March.

Consumer price inflation eased to a 3-month low of 2.3 percent

in March from 3 percent in February. Economists had forecast the

rate to fall to 2.6 percent.

The European Central bank is unlikely to change monetary policy

and QE measures soon and the markets had misinterpreted recent

tweaks that raised expectations of the winding of QE program and a

rate hike, according to a report from Reuters on Wednesday.

The ECB officials sounded caution in changing their monetary

policy before June and the policy language of the March 9 press

conference was over-interpreted, the report showed.

Eurozone government bond yields fell broadly, with benchmark

yield on 10-year bunds down by 0.34 percent. Yields move inversely

to bond prices.

Investors await the Eurozone flash consumer price inflation for

March, scheduled to be released tomorrow, for more clues about the

outlook of the economy.

Survey results from the European Commission showed that Eurozone

economic confidence weakened unexpectedly in March.

The economic sentiment index fell slightly to 107.9 in March

from 108.0 in February. The score was forecast to rise to

108.3.

The euro showed mixed performance in the Asian session. While

the euro held steady against the franc and the pound, it dropped

against the greenback. Against the yen, it was modestly higher.

Reversing from an early high of 1.0729 against the Swiss franc,

the euro declined to a 2-day low of 1.0694. Continuation of the

euro's downtrend may see it challenging support around the 1.04

region.

Data from the KOF Institute showed that Swiss economy is set to

grow at above-average rates in the near future.

The KOF Economic Barometer climbed to 107.6 from 106.9 in

February, revised down from 107.2. In contrast, economists had

expected a decline to 105.8.

The euro retreated to 1.0731 against the greenback, from a high

of 1.0770 hit at 5:15 pm ET. The euro is poised to find support

around the 1.05 area.

The euro, having advanced to 119.85 against the yen at 9:30 pm

ET, reversed direction and edged down to 119.16. If the euro-yen

pair extends fall, 117.00 is possibly seen as its next support

level.

The 19-nation currency weakened to 0.8626 against the pound,

compared to Wednesday's closing value of 0.8656. The euro is seen

finding support around the 0.84 level.

The euro dropped to 9-day lows of 1.4310 against the loonie and

1.3999 against the aussie, off its early highs of 1.4356 and

1.4061,respectively. The next possible support level for the euro

is seen around 1.41 against the loonie and 1.38 against the

aussie.

The 19-nation currency eased back to 1.5291 against the kiwi,

from a high of 1.5345 hit at 3:30 am ET. The euro had already set

an 8-day low of 1.5277 in the early Asian session. The euro may

possibly challenge support around the 1.51 mark.

At 8:00 am ET, German preliminary consumer price index for March

is due.

In the New York session, U.S. fourth quarter GDP for March and

weekly jobless claims for the week ended March 25, as well as

Canada industrial product price index for February are set for

release.

Chicago Fed President Loretta Mester speaks on "Payment System

Improvement" before the closed Tenth Annual Risk Conference

co-hosted by the Federal Reserve Bank of Chicago and the DePaul

University Center for Financial Services at 9:45 am ET.

Dallas Fed President Robert Kaplan speaks at the US Chamber of

Commerce in Washington DC at 11:00 am ET.

San Francisco Fed President John Williams participates in a

panel before the Strong, Prosperous and Resilient Communities

Challenge (SPARCC) event at 11:15 am ET.

New York Fed President William Dudley speaks before the

Financial Literacy Day and Laboratory Dedication hosted by the

University of South Florida at 4:30 pm ET.

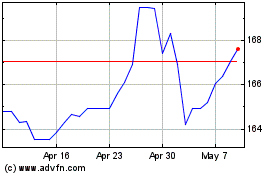

Euro vs Yen (FX:EURJPY)

Forex Chart

From Mar 2024 to Apr 2024

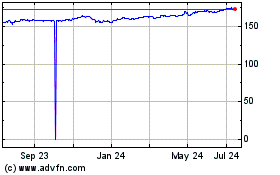

Euro vs Yen (FX:EURJPY)

Forex Chart

From Apr 2023 to Apr 2024