Euro Up As Eurozone CPI Falls Less-than-forecast; Jobless Rate At Near 3-yr Low

March 02 2015 - 6:35AM

RTTF2

The euro gained ground against its major opponents on Monday's

European deals, after data showed that Eurozone jobless rate in

January declined to the lowest since April 2012, and fall in

consumer prices were less forecast in February, ahead of the

European Central Bank's meeting this week.

Flash estimate from Eurostat showed that the rate of decline in

Eurozone consumer prices slowed more than expected.

The harmonized index of consumer prices fell 0.3 percent from

last year, slower than January's 0.6 percent decline and the

expected decrease of 0.5 percent.

The European Central Bank aims to bring inflation towards the

target of below, but close to, 2 percent over the medium term.

The euro area jobless rate declined to the lowest since April

2012, separate data from the same agency showed.

The unemployment rate dropped marginally to 11.2 percent in

January from revised 11.3 percent in December. It was forecast to

remain at December's originally estimated rate of 11.4 percent.

The euro was already higher after PMI reports across euro area

showed that business activity is picking up in most parts of the

region.

With the ECB policy makers due to meet in Cyprus for a 2-day

monetary policy meeting, traders now focus on the commencement of

the bank's quantitative easing program. The bank will provide more

details about the QE, which is expected to begin in March.

The single currency climbed to 4-day highs of 1.0729 against the

Swiss franc and 134.47 against the Japanese yen, coming off from

early lows of 1.0649 and 133.67, respectively. Next key resistance

levels for the euro lies around 1.2 against the franc and 135.00

against the yen.

Having fallen to a multi-week low of 1.1159 against the U.S.

dollar at 6:45 pm ET, the euro recovered to 1.1217. Extension of

the euro's uptrend may take it to a resistance surrounding the 1.14

zone.

The 19-nation currency edged up to 0.7276 against the Sterling,

following more than a 7-year decline to 0.7238 at 6:15 pm ET. The

euro is poised to test resistance around the 0.75 mark.

British manufacturing activity was the strongest in seven months

during February with growth in output and new orders strengthening

further, creating more jobs, results of a survey by Markit

Economics showed.

The seasonally adjusted Markit/CIPS Purchasing Manager's Index

for the manufacturing sector climbed to 54.1 in February.

Economists had forecast a score of 53.3. January's reading was

revised up to 53.1 from 53.

Reversing from an early record low of 1.4776 against the NZ

dollar and nearly 5-week low of 1.4314 against the aussie, the euro

strengthened to 4-day highs of 1.4898 and 1.4418, respectively. The

euro may locate resistance around 1.50 versus the kiwi and 1.45

against the aussie.

The common currency advanced to 1.4020 against the Canadian

dollar, up by 0.4 percent from its previous low of 1.3964. If the

euro extends rise, 1.41 is likely seen as its next resistance

level.

Looking ahead, U.S. personal income and spending data for

January, ISM manufacturing index for February and construction

spending for January are due in the New York session.

Euro vs CAD (FX:EURCAD)

Forex Chart

From Mar 2024 to Apr 2024

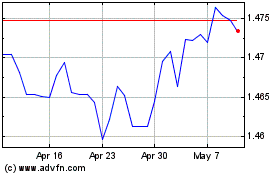

Euro vs CAD (FX:EURCAD)

Forex Chart

From Apr 2023 to Apr 2024