Euro Rises Amid Risk Appetite

July 31 2015 - 4:00AM

RTTF2

The euro strengthened against most major currencies ahead of

European session on Friday amid risk appetite, with some companies

posting strong gains in the corporate earnings.

The U.K.'s FTSE 100 index is currently up 0.57 percent or 37.87

points at 6,668, France's CAC 40 index is up 0.58 percent or 28.9

points at 5,046 and Germany's DAX is up 0.40 percent or 45.30

points at 11,257.

Traders await the eurozone data, such as inflation and

unemployment figures, due to be released shortly. Flash inflation

is forecast to remain unchanged at 0.2 percent in July. The jobless

rate is expected to drop to 11 percent in June from 11.1 percent in

May.

EU harmonized inflation is seen rising to 0.3 percent in July

from 0.2 percent in June.

In Greece, the Hellenic nation's Prime Minister Alexis Tsipras

will hold an emergency party congress in September to reassert his

control over the left-wing Syriza party, who opposed bailout

talks.

In other economic news, data from Destatis showed Germany's

retail sales fell a calendar and seasonally adjusted 2.3 percent

month-on-month in June, in contrast to a 0.4 percent rise in May.

Economists had expected a 0.3 percent increase for the month. It

was the first fall in three months.

On an annual basis, retail sales grew 5.1 percent in June,

exceeding economists' expectations for a 4.0 percent hike. In May,

sales had dropped 1.0 percent, which was revised from a 0.4 percent

decline.

In the Asian trading, the euro held steady against its major

rivals.

Ahead of European session today, the euro rose to a 3-day high

of 1.6662 against the NZ dollar and a 2-day high of 1.4269 against

the Canadian dollar, from early lows of 1.6515 and 1.4200,

respectively. If the euro extends its uptrend, it is likely to find

resistance around 1.68 against the kiwi and 1.45 against the

loonie.

The euro advanced to 0.7025 against the pound and 136.09 against

the yen, from early lows of 0.7002 and 135.57, respectively. The

euro may test resistance near 0.71 against the pound and 137.00

against the yen.

Against the U.S. and the Australian dollars, the euro edged up

to 1.0966 and 1.5046 from early lows of 1.0927 and 1.4973,

respectively. On the upside, 1.11 against the greenback and 1.53

against the aussie are seen as the next resistance levels for the

euro.

Looking ahead, Eurozone unemployment rate for June and CPI for

July are set to be published shortly.

In the New York session, Canada GDP for May, U.S. Chicago PMI

for July and University of Michigan's final U.S. consumer sentiment

index for July are due.

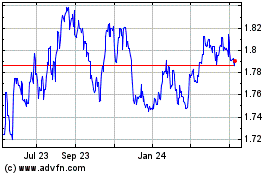

Euro vs NZD (FX:EURNZD)

Forex Chart

From Mar 2024 to Apr 2024

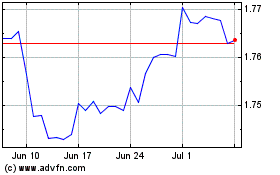

Euro vs NZD (FX:EURNZD)

Forex Chart

From Apr 2023 to Apr 2024