Euro Recovers As ECB President Draghi Set To Unveil QE Details

March 05 2015 - 8:26AM

RTTF2

The euro trimmed its early losses against its major rivals

during European deals on Thursday, as the European Central Bank

President Mario Draghi is expected flesh out more details of the

bank's quantitative easing program at his press conference at 8.30

am ET.

The expanded asset purchase program worth 1.1 trillion euros was

introduced at January meeting, and was aimed to boost the economy

and prevent deflationary spiral in the euro area. He is also set to

unveil the latest set of ECB Staff macroeconomic projections, which

would give the forecasts for 2017 for the first time.

At its rate setting meeting in the Cypriot capital Nicosia, the

ECB held the refinancing rate at a record low 0.05 percent, in line

with economists' expectations.

The bank also held the deposit rate steady at -0.20 percent and

the marginal lending rate at 0.30 percent. The three rates were

lowered by 10 basis points in September.

In economic front, Germany's factory orders declined at the

fastest pace since last August, data released by Destatis

showed.

Factory orders fell 3.9 percent in January from the prior month,

which was the biggest drop since August, when it plunged 4.2

percent. Economists had forecast a 1 percent drop in January after

rising 4.4 percent in December.

The euro bounced off slightly versus the greenback with pair

trading at 1.1057, after falling to more than 11-year low of 1.1025

in early deals. The pair was worth 1.1076 at Wednesday's close. If

the euro continues its upward trading, it may test resistance

surrounding the 1.12 area.

Reversing from an early more than 4-week low of 132.14 against

the Japanese yen, the euro advanced to 133.13. Continuation of the

euro's uptrend may lead it to a resistance around the 134.00

mark.

The euro that fell to 0.7237 against the pound and 1.0651

against the franc in early deals changed path and was trading at

0.7256 and 1.0704, respectively. The next possible resistance for

the euro may be located around 0.74 against the pound and 1.2

against the franc.

Looking ahead, U.S. weekly jobless claims for the week ended

February 28, factory orders for January and Canada Ivey's PMI for

February are slated for release in the New York session.

At 10:00 am ET, U.S. Federal Reserve Bank of San Francisco

President John Williams will deliver a speech about the economic

outlook at the Chartered Financial Analysts Society Hawaii 10th

Annual Economic Forecast Dinner, in Honolulu.

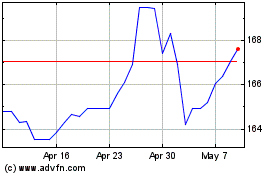

Euro vs Yen (FX:EURJPY)

Forex Chart

From Mar 2024 to Apr 2024

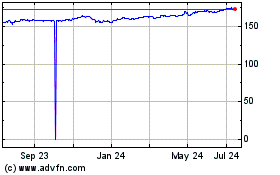

Euro vs Yen (FX:EURJPY)

Forex Chart

From Apr 2023 to Apr 2024