Euro Rebounds As Greece Accepts Bailout Proposals

July 01 2015 - 6:20AM

RTTF2

The euro recovered from its early lows against most major

counterparts in the early European session on Wednesday, as a media

report showed that Greek Prime Minister Alexis Tsipiras gave nod to

accept the creditors' bailout proposal, but with some minor

changes.

Tsipiras' send a letter to the heads of the European Commission,

International Monetary Fund and European Central Bank on late

Tuesday, indicating willingness to accept most reforms of VAT

system and pension plan, Financial Times reported.

Although Greece's bailout program ended on Tuesday, Tsipiras'

new letter could act as a basis for a new bailout in coming

days.

Eurozone finance ministers are due to hold a conference call

later in the day, to disuss about Tsipras' new proposal for a third

bailout.

The European stocks are also trading higher. The U.K.'s FTSE 100

index is currently up 1.31 percent or 85.28 points at 6,606,

France's CAC 40 index is up 1.02 percent or 48.80 points at 4,839

and Germany's DAX is up 2.12 percent or 232.37 points at

11,177.

In other economic news, data from Markit showed that the euro

area manufacturing sector expanded as initially estimated in June.

The Purchasing Managers' Index rose to 52.5 in June from 52.2 in

May. The reading came in line with flash estimate published on June

23. It was the highest reading since April 2014.

In the Asian trading, the euro held steady against its major

rivals.

In the European trading now, the euro rose to a 5-day high of

1.0470 against the Swiss franc, from an early low of 1.0402. If the

euro extends its uptrend, it is likely to find resistance around

the 1.06 area.

Against the U.S., the Australia and the New Zealand dollars, the

euro advanced to 1.1170, 1.4476 and 1.6462 from early 2-day lows of

1.1094, 1.4387 and 1.6343, respectively. On the upside, 1.15

against the greenback, 1.48 against the aussie and 1.66 against the

kiwi are seen as the next resistance levels for the euro.

Moving away from an early 2-day low of 0.7059 against the pound,

the euro climbed to 0.7127. The euro may test resistance near the

0.73 region.

The euro edged up to 1.3950 against the Canadian dollar and

137.40 against the yen, from early lows of 1.3867 and 136.05,

respectively. The euro is likely to find resistance around against

the loonie and 140.00 against the yen.

Looking ahead, U.S. manufacturing PMI reports for June, U.S.

construction spending for May and weekly U.S. oil inventories

report are slated for release in the New York session.

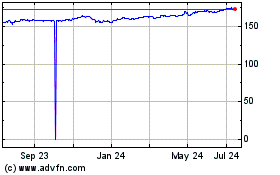

Euro vs Yen (FX:EURJPY)

Forex Chart

From Mar 2024 to Apr 2024

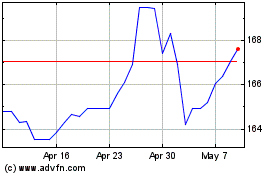

Euro vs Yen (FX:EURJPY)

Forex Chart

From Apr 2023 to Apr 2024