Euro Mixed Against Majors As Markets Focus On ECB Meeting

July 02 2012 - 6:31AM

RTTF1

The euro showed mixed trading against other major currencies in

European deals on Monday as investors digested the outcome of the

European Union summit held last week and have now turned their

attention to the unfolding week's European Central Bank monetary

policy meeting.

The ECB is scheduled to hold its regular monthly policy meeting

in Frankfurt on Thursday, just a week after Eurozone leaders

reached a deal to rescue the region's troubled banks.

Speculation grows that the central bank is likely to reduce

rates by 25 basis points to 0.75 percent, a move that could weigh

on the euro.

Though hopes of an interest rate cut by the ECB may strengthen

the single currency in the coming days, the U.S. market holiday on

Wednesday and the much-anticipated non-farm payrolls data due to be

released on Friday may prompt investors to trade currencies in a

narrow-range for most of this week.

The euro declined against its major counterparts in today's

Asian trading as investors doubted the outcome of the EU summit

last week, reasoning that it lacked the necessary detail to ease

concerns over European debt problems over the long-term.

The euro has extended its previous session's slide against

commodity currencies in early European deals and showed

directionless trading against the franc and pound. Against the

dollar and yen, the euro that attempted to recover its Asian

session's losses pulled back shortly.

The euro is currently worth 1.2630 against the dollar and 100.50

against the yen, down from highs of 1.2669 and 101.01, hit

respectively at 5:15 am ET. If the euro weakens further, it will

break its Asian session lows of 1.2613 against the dollar and

100.36 against the yen.

Against the pound, the euro showed choppy trading after hitting

a low of 0.8056 at 3:10 am ET. At present, the euro-pound pair is

worth 0.8060.

Elsewhere, the euro is trading at a 4-day low of 1.2844 against

the Canadian dollar and near a 4-month low of 1.2309 against the

Australian dollar. The next downside target level for the euro is

seen at 1.282 against the loonie and 1.220 against the aussie.

The euro is also trading at a 4-day low of 1.5723 against the

New Zealand dollar, with 1.560 seen as the next downside target

level.

The euro-franc pair is presently worth 1.2017, just coming off a

low of 1.2012 hit early in the session.

The final June manufacturing PMI reports from Italy, Germany,

France and Eurozone, which were released in the session failed to

influence the euro.

The Eurozone Purchasing Managers' Index for the manufacturing

sector remained unchanged in June at 45.1 from the prior month, but

stayed slightly above the flash estimate of 44.8, final data from

Markit Economics showed.

Looking ahead, the U.S. ISM manufacturing index for June and

construction spending for May are scheduled for release in the New

York morning session.

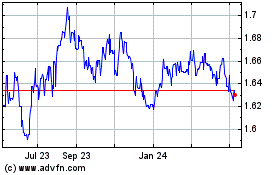

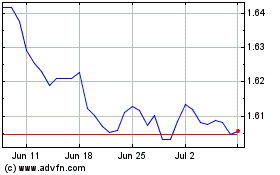

Euro vs AUD (FX:EURAUD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

From Apr 2023 to Apr 2024