Euro Mixed After German Ifo Business Confidence Data

March 25 2015 - 6:56AM

RTTF2

The euro showed mixed trading against the other major currencies

in the European session on Wednesday, following the release of

Germany's business confidence data in March.

Data from Ifo institute showed that German business morale

improved for the fifth straight month in March. The Ifo Business

Climate index climbed to 107.9 in March from 106.8 in February. It

was forecast to rise to 107.3.

The current conditions index improved to 112, in line with

expectations, from 111.3 in the prior month.

At the same time, the expectations index rose to 103.9 from

102.5 in February and stayed above the expected score of 103.

With regard to Greece, Athens needs to come up with a list of

its own reforms by early next week to get fresh aid from its

creditors and avoid a messy default. Government spokesman Gabriel

Sakellaridis told Mega TV yesterday that the detailed reform

proposals would be delivered by Monday at the latest. Greece will

run out of money by April 20 without any release of funds.

Meanwhile, the European stock markets were also mixed.

In the European trading today, the euro advanced to more than a

4-week high of 0.7376 against the pound, from an early low of

0.7342 and held steady thereafter. The euro fell to 1.4320 against

the NZ dollar, from an early 5-day high of 1.4364. This may be

compared to an early 2-day low of 1.4238. If the euro extends its

downtrend, it is likely to find support around the 1.40 area.

Moving away from early lows of 1.0459 against the Swiss franc

and 130.57 against the yen, the euro edged up to 1.0508 and 131.23,

respectively and held steady thereafter.

Against the U.S., the Australia and the Canadian dollars, the

euro edged up to 1.0966, 1.3929 and 1.3701 from early lows of

1.0899, 1.3846 and 1.3634, respectively. Thereafter, the euro held

steady against the greenback, the aussie and the loonie.

Looking ahead, European Central Bank policymaker Peter Praet is

expected to take part in panel discussion on "Global Economic

Recovery - a Tale of Many Parts" at the International Financial

Services Forum in London at 6:25 am ET. After 5 minutes, U.S.

Federal Reserve Bank of Chicago President Charles Evans will

deliver a speech titled "Monetary Policy and the Economy" at the

Official Monetary and Financial Institutions Forum, in London.

In the New York session, U.S. durable goods orders for February

and crude oil inventories report for the week ended March 20 are

slated for release.

At 2:30 pm ET, U.S. Treasury Secretary Jack Lew will testify

before the Senate Banking Committee in Washington.

After an hour, the Bank of Canada Deputy Governor Timothy Lane

gives presentation as part of the bank's regional outreach program

in Kelowna.

Euro vs CAD (FX:EURCAD)

Forex Chart

From Mar 2024 to Apr 2024

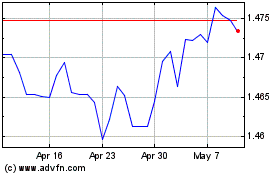

Euro vs CAD (FX:EURCAD)

Forex Chart

From Apr 2023 to Apr 2024