Euro Higher As Eurozone Business Growth Picks Up; ECB Decision Due

September 03 2015 - 2:10AM

RTTF2

The euro was firmer against its most major rivals in European

deals on Thursday, as economic activity across the currency bloc

gathered pace in August, and traders await the European Central

Bank's interest rate decision, due later in the day.

Final data from Markit showed that Eurozone private sector

growth improved more than estimated in August.

The final composite output index rose to 54.3 in August from

53.9 in July. The flash reading for August was 54.1.

Business activity improved at the fastest pace in over four

years. Levels of incoming new business also rose at a solid, albeit

slightly slower pace to support the second-quickest rate of job

creation since May 2011, the survey showed.

The services Purchasing Managers' Index came in at 54.4,

matching June's four-year high. It was up from 54 in July and

slightly above the flash score of 54.3.

Separate data from Markit showed that Germany's private sector

growth accelerated more than initially estimated to a 5-month high

in August.

The composite output index rose to 55 in August from 53.7 in

July. The flash reading for August was 54.0. The index signaled the

strongest increase in private sector output since March.

The final services Purchasing Managers' Index climbed to 54.9

from 53.8 in July. The reading was well above the flash score of

53.6.

The European markets are trading higher, ahead of the European

Central Bank's interest rate decision at 7:45 am ET. While the bank

is expected to stay pat on rates, it is forecast to downgrade

inflation view due to crashing commodity prices.

The ECB chief Mario Draghi will hold customary press conference

at 8.30 am ET.

The euro showed mixed performance in the previous session. While

the euro held steady against the yen, it was down against the

greenback, franc and the pound.

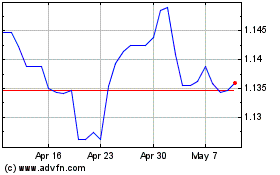

In European trading, the European currency gained to 1.1243

against the greenback, an increase of 0.3 percent from an early

3-day low of 1.1204. The next possible resistance for the

euro-greenback pair is seen around the 1.135 level. At yesterday's

close, the pair was valued at 1.1223.

The euro edged up to 0.7374 against the pound, off early 2-day

low of 0.7322. The euro-pound pair was trading at 0.7334 at

yesterday's close. The euro is likely to find upside target around

the 0.75 mark.

Bouncing off from its previous low of 1.0869 against the Swiss

franc, the euro rose to 1.0901. If the euro extends rise, it may

find upside target around the 1.10 area. The euro-franc pair

finished Wednesday's trading at 1.0877.

The euro was trading higher at 135.13 against the Japanese yen,

following a decline to 134.95 at 3:00 am ET. On the upside, the

euro may locate resistance around the 136.00 region.

The euro recovered from an early low of 1.4865 against the

loonie with the pair trading at 1.4924. The pair ended yesterday's

trading at 1.4895. Further uptrend may lead the euro to a

resistance surrounding the 1.50 mark.

Looking ahead, Canada and U.S. trade data for July, U.S. weekly

jobless claims for the week ended August 29 and U.S. ISM

non-manufacturing PMI for August are slated for release in the New

York session.

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Mar 2024 to Apr 2024

Sterling vs CHF (FX:GBPCHF)

Forex Chart

From Apr 2023 to Apr 2024