Euro Higher After Upbeat German Data, ECB Minutes

January 12 2017 - 3:37AM

RTTF2

The euro was higher against its key counterparts in the European

session on Thursday, after data showed that German economy expanded

at the fastest pace in five years in 2016 and minutes from the

European Central Bank's latest monetary policy meeting showed that

the policy makers expect the inflation to rise in coming months in

the light of higher energy prices.

Data published by Destatis showed that German gross domestic

product grew 1.9 percent last year after expanding 1.7 percent in

2015. This was the fastest expansion since 2011, when the biggest

euro area economy grew 3.7 percent.

In calendar-adjusted terms, the GDP growth rate was 1.8 percent

versus 1.5 percent in 2015

The minutes of the bank's December policy meeting showed that

members broadly agreed that the inflation outlook and the risks

surrounding it warranted keeping a very substantial degree of

monetary accommodation in place and extending the asset purchase

program beyond March 2017.

Very broad support emerged among members for the option to

continue purchases beyond March 2017 at a monthly pace of €60

billion for an intended horizon of nine months, the minuted

showed.

In the meeting, the bank left all its three interest rates

unchanged for a sixth consecutive session and retained its asset

purchases of EUR 80 billion a month till March next year, but

decided to reduce the size beyond that to EUR 60 billion a month

till December 2017.

In other economic news, figures from Eurostat showed that

Eurozone industrial production grew much more than expected in

November.

Industrial production grew 1.5 percent month-on-month in

November, faster than October's revised 0.1 percent rise and the

expected expansion of 0.5 percent.

The euro showed mixed performance in the Asian session. While

the euro climbed against the greenback and the pound, it held

steady against the franc. Against the yen, it declined.

The single currency firmed to a 2-day high of 1.0747 against the

Swiss franc, after having declined to 1.0710 at 4:45 am ET. The

euro is seen finding resistance around the 1.09 level.

The euro spiked up to 1.0683 against the greenback, its

strongest since December 8. If the euro-greenback pair extends

rise, 1.10 is possibly seen as its next resistance level.

Following a decline to near a 5-week low of 121.19 against the

Japanese yen at 4:30 am ET, the euro bounced off with the pair

trading at 121.79. On the upside, the euro may challenge resistance

around the 124.00 area.

Data from the Ministry of Finance showed that Japan recorded a

current account surplus of 1.415 trillion yen in November, up 28.0

percent on year.

The headline figure was shy of expectations for a surplus of

1.460 trillion yen and down from 1.719 trillion yen in October.

The 19-nation currency reclaimed some of its lost ground against

the pound with the pair trading at 0.8684, off its early low of

0.8655. The next possible resistance for the euro-pound pair pair

may be found around the 0.88 region.

The National Institute of Economic and Social Research showed

that the U.K. economy expanded at a steady pace in the fourth

quarter.

Output grew 0.5 percent in the fourth quarter, the same pace as

seen in three months ended November.

The common currency bounced off to 1.3949 against the loonie,

1.4225 against the aussie and 1.5007 against the kiwi, from its

previous low of 1.3860, multi-week lows of 1.4156 and 1.4916,

respectively. The euro may possibly locate resistance around 1.41

against the loonie, 1.44 against the aussie and 1.51 against the

kiwi.

Looking ahead, Canada new housing price index for November, U.S.

import price index for December, and U.S. weekly jobless claims for

the week ended January 7 are set to be published in the New York

session.

At 8:30 am ET, Federal Reserve Bank of Chicago President Charles

Evans and Federal Reserve Bank of Atlanta President Dennis Lockhart

are expected to speak about the economic outlook and monetary

policy at the American Council of Life Insurers, in Naples.

At the same time, Federal Reserve Bank of Philadelphia President

Patrick Harker will deliver a speech at the Desmond Hotel, in

Pennsylvania.

At 1:15 pm ET, Federal Reserve Bank of St. Louis President James

Bullard gives a presentation on the U.S. economy and monetary

policy before the Forecasters Club of New York.

At 1:45 pm ET, Federal Reserve Bank of Dallas President Robert

Kaplan participates in a moderated Q&A before the Dallas

Regional Chamber Annual Meeting, in Dallas, U.S.

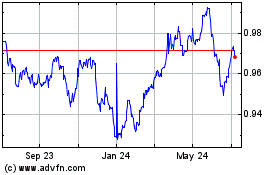

Euro vs CHF (FX:EURCHF)

Forex Chart

From Mar 2024 to Apr 2024

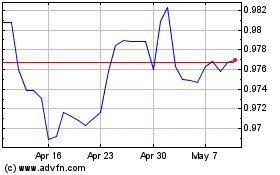

Euro vs CHF (FX:EURCHF)

Forex Chart

From Apr 2023 to Apr 2024