Euro Higher After Eurozone Consumer Price Inflation

March 31 2016 - 2:30AM

RTTF2

The euro gained ground against the other major currencies in

European trading on Thursday, after data showed that inflation in

the euro area improved modestly in March, albeit remaining negative

due to sharp falls in the energy prices.

Flash data from Eurostat showed that consumer prices fell 0.1

percent in March from a year ago following a 0.2 percent drop in

February. The annual decline matched economists' expectations.

Headline inflation has been below the European Central Bank's

target of 'below, but close to 2 percent' since early 2013.

The core HICP that excludes fresh food and energy prices,

accelerated more-than-expected to 1 percent from 0.8 percent a

month ago. Prices were expected to gain 0.9 percent in March.

In other economic news, preliminary figures from Destatis showed

that Germany's unemployment rate held steady in February.

The jobless rate came in at an adjusted 4.3 percent in February,

the same rate as in the previous month. In the corresponding month

last year, the unemployment rate was 4.8 percent.

The currency showed mixed trading in Asian deals. While the euro

declined against the greenback and the yen, it was steady against

the franc and the pound.

The single currency spiked up to 1.1369 against the greenback,

its highest since February 11. This is up by 0.3 percent from

yesterday's closing value of 1.1336. If the euro-greenback pair

extends rise, 1.15 is possibly seen as its next resistance

level.

The euro appreciated to a weekly high of 0.7914 against the

pound at 4:00 am ET, and has been steady thereafter. The next

possible resistance for the euro-pound pair is seen around the 0.80

zone. The pair was worth 0.7884 when it ended Wednesday's

trading.

Data from the Office for National Statistics showed that the

U.K. economy expanded more than previously estimated in the fourth

quarter.

Gross domestic product climbed 0.6 percent in the fourth quarter

from prior three months, which was revised up from 0.5 percent

estimated on February 25.

The 19-nation currency, having fallen to 1.0919 against the

franc at 2:45 am ET, reversed direction and climbed to a 2-week

high of 1.0953. Continuation of the euro's uptrend may lead it to a

resistance surrounding the 1.12 zone. At yesterday's close, the

pair was worth 1.0940.

The euro reversed from an early low of 126.96 against the

Japanese yen, advancing to 127.81. On the upside, the euro may

challenge resistance around the 129.00 mark.

Data from the Ministry of Land, Infrastructure, Transport and

Tourism showed that Japan housing starts grew unexpectedly in

February, while construction orders declined for the second

straight month.

Housing starts grew 7.8 percent year-on-year in February,

confounding expectations for a 2.8 percent drop and faster than

January's 0.2 percent rise. This was the fastest growth since

August 2015, when it climbed 8.8 percent.

The euro edged up to 1.4735 against the loonie, compared to

1.4689 hit late New York Wednesday. The euro is seen finding

resistance around the 1.49 area.

The common currency strengthened to a 2-day high of 1.4848

against the aussie in European morning deals, and held steady

thereafter. The pair finished yesterday's trading at 1.4776.

Data from the Housing Industry Association showed that

Australia's new home sales decreased notably in February.

Total new home sales fell a seasonally adjusted 5.3 percent

month-over-month in February.

The euro was trading higher at 1.6433 against the kiwi, up from

yesterday's closing value of 1.6364. The euro is poised to find

resistance around the 1.66 zone.

Looking ahead, U.S. Chicago PMI for March, U.S. weekly jobless

claims for the week ended March 26 and Canada GDP data for January

are to be announced in the New York session.

At 9:30 am ET, Federal Reserve Bank of Chicago President Charles

Evans participates in discussion on current economic conditions and

monetary policy before the Quinnipiac G.A.M.E. VI Forum, in New

York.

At 12:30 pm ET, Swiss National Bank Governing Board Member

Andrea Maechler will deliver speech titled "Investment Policy in

Times of High Foreign Exchange Reserves" at the Swiss National

Bank's Money Market Event, in Zurich.

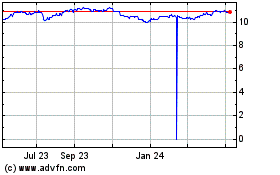

US Dollar vs SEK (FX:USDSEK)

Forex Chart

From Mar 2024 to Apr 2024

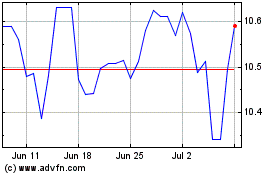

US Dollar vs SEK (FX:USDSEK)

Forex Chart

From Apr 2023 to Apr 2024