Euro Falls On Concerns Over Greece's IMF Debt Default

May 20 2015 - 4:06AM

RTTF2

The euro drifted lower against the other major currencies on

Wednesday, following a warning by Greek law maker that Greece may

miss loan repayment due to the International Monetary Fund on June

5, unless it reach a deal with its lenders soon.

Speaking to ANT1 television, Greek parliamentary speaker Nikos

Filis told that Greece will give priority to pay the pensions and

wages rather than repaying the IMF, if its EU creditors don't

release some of the €7.2 billion in outstanding bailout funds.

Greek government owes a repayment of EUR 305 million to the IMF

on June 5.

The single currency has already been hurt by comments made by

ECB's Coeure that the lender will accelerate its QE program in May

and June.

The ECB executive board member Benoit Coeure on Tuesday said

that the central bank will "frontload" its asset purchases in May

and June in order to maintain its monthly average of 60 billion

euros, due to an expected drop in liquidity in the summer vacation

period. Elsewhere, ECB Governing Council member Christian Noyer

said the bank stands ready to take further steps to meet its price

stability mandate.

The euro fell sharply on Tuesday after the comments by ECB's

Coeure, as well as worries about Greece's standoff with its

creditors.

In European morning deals, the 19-nation currency declined to a

6-day low of 1.0396 against the franc, off its early high of

1.0448. At yesterday's close, the pair was valued at 1.0444. The

euro-franc pair may possibly challenge support around the 1.00

mark.

The euro slipped to a 3-week low of 1.1061 against greenback,

from Tuesday's closing value of 1.1148. Continuation of the euro's

downtrend may lead it to a support near the 1.00 region.

The common currency hit a 1-week low of 0.7144 against the pound

and an 8-day low of 133.90 against the yen, after advancing to

0.7189 and 134.76, respectively in early deals. The euro is seen

finding support around 0.70 against the pound and 130.00 against

the yen.

The euro dipped to a weekly low of 1.3549 against the loonie,

down from a high of 1.3636 hit at 7:30 pm ET. If the euro continues

slide, it may find support around the 1.34 mark.

The euro pared gains to 1.5080 against the kiwi and 1.4012

against the aussie, from its early highs of 1.5184 and 1.4087,

respectively. On the downside, 1.48 and 1.37 are seen as the next

downside levels of the euro against the kiwi and the aussie,

respectively.

Looking ahead, the Bank of England's minutes of April meeting,

Swiss ZEW economic sentiment index for May and Eurozone

construction output for March are due shortly.

At 8:30 am ET, Canada wholesale sales for March are set for

release.

The Federal Reserve's minutes of its April 28-29 meeting will be

out at 2:00 pm ET.

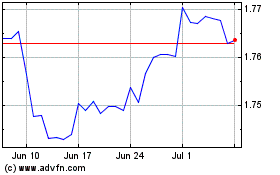

Euro vs NZD (FX:EURNZD)

Forex Chart

From Mar 2024 to Apr 2024

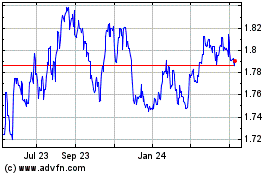

Euro vs NZD (FX:EURNZD)

Forex Chart

From Apr 2023 to Apr 2024