Euro Falls As German Import Prices Fall To More Than 5-yr Low

February 27 2015 - 4:27AM

RTTF2

The euro declined against its most major rivals in early

European deals on Friday, after data showed that Germany's import

prices registered its worst fall in more than five years in

January.

The import price index fell 4.4 percent year-on-year at the

start of the year, faster than December's 3.7 percent decline.

Economists had forecast a 4.6 percent fall for the month.

The latest decline was the sharpest since November 2009, when

prices had fallen 5.0 percent.

Traders now focus on German inflation data for February, due

later in the day.

Inflation is expected to remain in a deflationary territory in

February, with a 0.3 percent fall annually after the 0.4 percent

drop last month. The harmonized measure of consumer prices are

expected to fall at the stable rate of 0.5 percent in February.

The currency has been already under pressure, as the European

Central Bank is starting its quantitative easing program at next

week's meeting. The quantitative easing program tends to depreciate

currency.

Elsewhere, German lawmakers are expected to approve a four-month

extension of Greece's bailout in a parliament vote later today

despite irritation among some lawmakers over recent comments by

Greek officials. Parliaments in several other European countries

must also accept the aid proposals before the current bailout

program expires Saturday.

The 19-nation currency declined to a new 3-week low of 133.51

against the yen in early deals and has been steady is subsequent

trading. At yesterday's close, the pair was quoted at 133.69.

The euro fell to a 9-day low of 1.0628 against the Swiss franc,

pulling away from an early high of 1.0691. If the euro extends

slide, 1.00 is seen as its next support level.

The single currency fell back to 1.1196 against the greenback,

not far from yesterday's more than 4-week low of 1.1183.

Continuation of the euro's downtrend may lead it to a support

around the 1.10 zone.

The euro hit 0.7256 against the Sterling, a level unseen since

December 2007. The euro may possibly find support around the 0.70

mark.

Looking ahead, the second estimate of U.S. fourth quarter GDP

data, pending home sales for January and Reuters/University of

Michigan's final consumer sentiment index for February are due in

the New York session.

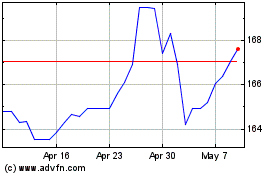

Euro vs Yen (FX:EURJPY)

Forex Chart

From Mar 2024 to Apr 2024

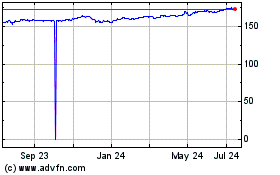

Euro vs Yen (FX:EURJPY)

Forex Chart

From Apr 2023 to Apr 2024