Euro Falls Against Most Majors On Risk Aversion

May 25 2012 - 9:40AM

RTTF2

The euro fell sharply against most major currencies on Friday as

traders sold riskier assets amid worries over Spanish debt.

Continued worries over a possible Greek exit from the Eurozone

also hurt sentiment.

Meanwhile, confidence among German consumers is likely to stay

unchanged in June, a survey by market research group GfK showed

today.

The consumer confidence index for June was at 5.7, unchanged

from the revised reading of May. The May score was revised from 5.6

reported previously

The euro fell to near a 2-year low of 1.2505 against the US

dollar, compared to an early high of 1.2603. If the euro declines

further, it may target 1.24 level. At Thursday's close, the pair

was worth 1.2533.

After reaching a 2-day high of 0.8048 against the pound in early

European deals, the euro slipped soon. The euro hit a 9-day low of

0.7982 against the pound with 0.77 seen as the next downside target

level. The euro-pound pair finished yesterday's deals at

0.7999.

The European single currency dropped to as low as 99.50 against

the yen from a 2-day high of 100.35 hit at 4:15 am ET. On the

downside, the euro may target 99.00 level. The pair was worth 99.77

at yesterday's close.

The Reuters and the University of Michigan's final report on the

consumer sentiment index for May is due shortly.

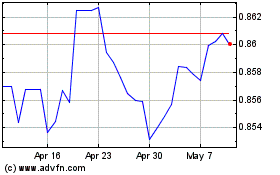

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Mar 2024 to Apr 2024

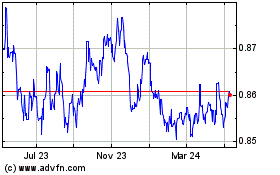

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Apr 2023 to Apr 2024