Euro Dips After Soft Services PMI Data; Focus On ECB Decision

March 04 2015 - 6:06AM

RTTF2

The euro came under pressure in early European deals on

Thursday, as service sector activities across the euro region

slowed more than initially estimated in February. Traders focus on

the European Central Bank's 2-day meeting starting today for more

details about the execution of quantitative easing program, which

begins this month.

The ECB policy setting meeting in Cyprus and President Mario

Draghi's press conference will be closely watched for additional

features of €60 billion-per-month asset purchase program that was

unveiled in January. Till now, the ECB has only said that the

government bond purchases will start sometime this month, and run

through at least September 2016.

The ECB officials have previously told that they would buy

government bonds in line with the central bank's capital key.

The bank is unlikely to unveil new policy measures, retaining

main refinancing rate unchanged at 0.05 percent.

The Eurozone private sector expanded at a slower than initially

estimated pace in February, survey data from Markit Economics

showed.

Although the services Purchasing Managers' Index rose to a

7-month high of 53.7 in February, it was below 53.9 estimated on

February 20.

The composite output index rose to 53.3 in February, compared to

flash score of 53.5.

Separate data showed that Germany's final services activity rose

to a 5-month high of 54.7 in February, slower than the flash score

of 55.5. The composite PMI also came in weaker-than-expected at

53.8 in February.

Italy's service sector activity stagnated unexpectedly in

February after expanding in the previous month, another data from

Markit Economics showed.

The headline Markit/ADACI services Purchasing Managers' Index

decreased to 50 in February from 51.2 in January. Economist had

forecast the index to increase to 51.4.

In Spain, the headline services purchasing managers' index edged

down to 56.2 in February from 56.7 in January, less than the

consensus estimate of 56.6.

The euro depreciated to 132.92 against the Japanese yen for the

first time since February 5. The euro is likely to find support

around against the 132.00 zone.

The euro hit 1.1114 against the U.S. dollar, its lowest since

January 26, when it hit more than 11-year low. Continuation of

downtrend may drive the euro down to a support around the 1.10

mark.

The euro gave back early gains against the franc, trading at

1.0702. The next key support for the euro-franc is possibly found

near the level.

The single currency fell to more than 7-year low of 0.7235

against the Sterling at 4:10 am ET, before recovering a bit in a

short while. At yesterday's close, the pair was worth 0.7268.

The U.K. service sector expansion slowed unexpectedly in

February, survey data from Markit showed.

The Markit/Chartered Institute of Purchasing and Supply

Purchasing Managers' Index for the service sector decreased to 56.7

in February from 57.2 in January. The score was forecast to rise to

57.5.

The 19-nation currency drifted lower to a record low of 1.4662

against the NZ dollar, down from Tuesday's closing value of 1.4797.

Against the aussie, the euro slipped to a 5-week low of 1.4197. On

the downside, 1.41 is seen as the euro's next support level against

the aussie.

The euro eased to 1.3909 against the Canadian dollar, from an

early high of 1.3976. The euro may locate downside target around

the 1.38 area.

Looking ahead, Markit's U.S. PMI, ISM U.S. non-manufacturing PMI

and private sector employment report - all for February are slated

for release in the New York session.

At 9:00 am ET, U.S. Federal Reserve Bank of Chicago President

Charles Evans will deliver a speech about the economic outlook and

monetary policy at the Lake Forest-Lake Bluff Rotary Club 2015

Economic Breakfast in Lake Forest.

Around 45 minutes later, Bank of England's Deputy Governor

Andrew Bailey is expected to speak on currency at Treasury

Committee Hearing, U.K.

The Bank of Canada will announce its interest rate decision at

10:00 am ET. Economists expect the bank to retain interest rates

unchanged at 0.75 percent.

At 2:00 pm ET, U.S. Federal Reserve releases Beige Book

report.

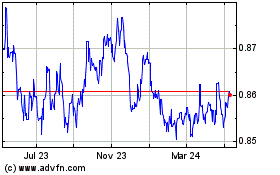

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Mar 2024 to Apr 2024

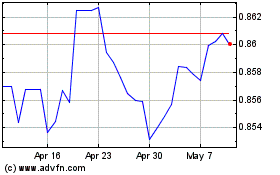

Euro vs Sterling (FX:EURGBP)

Forex Chart

From Apr 2023 to Apr 2024