Euro Dips After Eurozone Inflation Turns Negative Unexpectedly

September 30 2015 - 3:12AM

RTTF2

The euro drifted lower against its most major rivals in European

deals on Wednesday, as data showed that Eurozone consumer prices

fell for the first time in six months in September, largely due a

slump in oil prices.

Flash data from Eurostat showed that consumer prices fell

unexpectedly by 0.1 percent year-on-year in September, offsetting a

0.1 percent rise in August. Economists had forecast prices to

remain flat.

The European Central Bank's targets to bring inflation to

'below, but close to, 2 percent over the medium term'.

Excluding energy, food, alcohol and tobacco, core inflation

remained unchanged at 0.9 percent in September. The rate came in

line with expectations.

Eurozone unemployment rate remained unchanged in August,

separate data from the same agency showed.

The jobless rate held steady at double-digit 11 percent in

August. It was expected to remain at July's originally estimated

rate of 10.9 percent.

The European Central Bank President Mario Draghi had already

warned that the region could experience deflation in the coming

months, and the bank needs more time to assess whether the weakness

is a temporary or lasting phenomenon before further action.

The euro was trading lower against the greenback, pound and the

yen in the Asian session. Against the franc, the euro trended

higher.

In European deals, the euro fell to a 2-day low of 0.7379

against the pound, a 0.4 percent decline from its previous high of

0.7431. Continuation of the euro's downtrend may drive it down to a

support around the 0.725 mark. The euro-pound pair finished

Tuesday's deals at 0.7423.

Extending early slide, the common currency depreciated by 0.4

percent to 1.1202 against the greenback. The pair was quoted at

1.1247 when it closed Tuesday's deals. The euro may test support

around the 1.10 level.

The single currency pared gains to 1.0907 against the Swiss

franc, from a high of 1.0945 hit at 3:45 am ET. If the euro extends

slide, it may locate support near the 1.08 region. The euro-franc

finished Tuesday's trading at 1.0924.

The common currency reached as low as 1.5009 against the loonie

and 1.7549 against the kiwi, compared to Tuesday's closing values

of 1.5096 and 1.7720, respectively. If the euro extends slide, it

may find support around 1.48 against the loonie and 1.73 against

the kiwi.

The euro dropped to 1.5928 versus the aussie, a 2-day low, and

was down by 1.04 percent from yesterday's closing quote of 1.6096.

The euro is seen finding support around the 1.57 level.

Meanwhile, the 19-nation currency swung between gains and losses

against the Japanese yen, following a 5-day high of 135.12 hit at

8:30 pm ET. At Tuesday's close, the pair was trading at 134.67.

Looking ahead, U.S. private sector jobs data for September, U.S.

weekly crude oil inventories report for the week ended September 25

and U.S. Chicago PMI for September and Canada GDP data for July are

set to be announced in the New York session.

At 8:00 am ET, Federal Reserve Bank of New York President

William Dudley is expected to speak at the Securities Industry and

Financial Markets Association's Liquidity Forum, in New York.

Subsequently, Federal Reserve Chair Janet Yellen will deliver

opening remarks at the Federal Reserves' annual community banking

conference, in St. Louis at 3:00 pm ET.

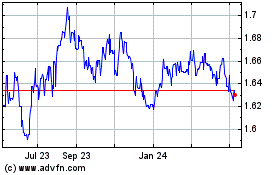

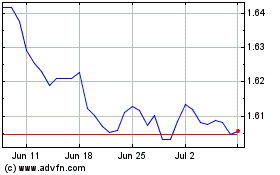

Euro vs AUD (FX:EURAUD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs AUD (FX:EURAUD)

Forex Chart

From Apr 2023 to Apr 2024