Euro Declines Amid Catalonia Tensions

October 23 2017 - 1:51AM

RTTF2

The euro slipped against its major counterparts in early

European deals on Monday, as worries over Catalonia continued after

the region's leaders refused to back off from their demand for

independence from Spain, ignoring steps to impose direct rule by

Prime Minister Mariano Rajoy. Catalan authorities will not abide by

orders from Madrid, but will only listen to the will of the Catalan

people, Catalan's foreign affairs spokesman Raul Romeva told BBC

Radio. The parliament will meet today to debate and decide next

steps on Madrid's attempt to liquidate the self-government. On

Saturday, Spanish Prime Minister Mariano Rajoy asked lawmakers to

grant him unprecedented power to remove the leaders of Catalonia

and temporarily control the region from Madrid.

He said that Spain's central government ministries would

administer the region's agencies until new elections are called, a

shake-up meant to quell Catalan leaders' insurrection.

The European Central Bank reviews its monetary policy on

Thursday, with investors waiting to see whether President Mario

Draghi will announce the long-awaited start of tapering.

The currency has been trading in a negative territory in the

Asian session.

The euro dropped to 5-day lows of 1.1740 against the greenback

and 0.8903 versus the pound, off its early highs of 1.1777 and

0.8928, respectively. The euro is seen finding support around 1.16

against the greenback and 0.88 against the pound.

The euro fell to 1.1571 against the franc, 133.61 against the

Japanese yen and 1.6835 against the kiwi, from its early high of

1.1600, 4-week high of 134.13 and a 1-1/2-year high of 1.6959,

respectively. If the euro falls further, it may challenge support

around 1.14 against the franc, 132.00 against the yen and 1.67

against the kiwi.

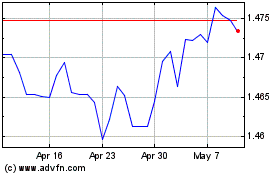

The single currency retreated to 1.4831 against the loonie, from

an early high of 1.4873. On the downside, 1.47 is likely seen as

the next support for the euro-loonie pair.

The euro, having advanced to 1.5071 against the aussie at 6:15

pm ET, reversed direction and fell to a 4-day low of 1.5023.

Continuation of the euro's downtrend may see it challenging support

around against the 1.49 area.

Looking ahead, Canada wholesale sales for August and Eurozone

preliminary consumer sentiment index for October are due in the New

York session.

Euro vs CAD (FX:EURCAD)

Forex Chart

From Mar 2024 to Apr 2024

Euro vs CAD (FX:EURCAD)

Forex Chart

From Apr 2023 to Apr 2024