Ericsson Shares Tumble After Results Miss Expectations - 2nd Update

April 21 2016 - 4:23AM

Dow Jones News

By Matthias Verbergt

STOCKHOLM-- Ericsson AB missed market expectations for

first-quarter sales and profit and announced a sweeping corporate

reorganization, raising questions about the Swedish

telecommunications-equipment maker's ability to find new sources of

growth amid rapid technological and market change.

The company's shares fell heavily in early trading in Stockholm,

opening down around 10% before recovering a little to trade around

8% lower.

Ericsson, one of the world's largest wireless telecoms equipment

providers, said on Thursday that net profit rose 49% to 1.97

billion Swedish kronor ($242.6 million) in the three months to

end-March from 1.32 billion kronor a year earlier on a 2% slide in

revenue to 52.21 billion kronor from 53.52 billion kronor.

The company attributed the decline in sales to slower economic

growth in emerging markets in the Middle East and Latin America as

well as in Europe where a number of large broadband projects were

completed last year. Equipment sales in North America and China

improved.

The results came in below analysts' expectations. Analysts

polled by FactSet expected a net profit of 3.13 billion Swedish

kronor, and sales of 54.52 billion kronor.

"We aren't satisfied with our overall growth and profitability

development over past years," said President and Chief Executive

Hans Vestberg. Ericsson said its gross operating profit margin

shrank to 33.3% in the quarter from 35.4% in the same period a year

earlier.

Ericsson also announced sweeping changes to its executive team,

with the departure of three senior vice presidents and a number of

promotions, as part of a broader reorganization of the company into

five business units and one dedicated customer-service unit.

"We are today announcing further actions to accelerate strategy

execution and to drive efficiency and growth across the company

even harder," Mr. Vestberg said.

The shake-up at the Swedish company come as companies in the

sector, including Cisco Systems Inc. and Nokia Corp. face pressure

from telecom companies for a broader range of equipment, from

wireless gear to Internet routers, but have opted for different

solutions to achieve that goal.

While Nokia has agreed to a takeover of rival Alcatel-Lucent,

Ericsson has struck a broad technological and commercial

partnership with Cisco Systems Inc. that falls short of a merger.

Ericsson, a leader in wireless equipment, has agreed to put its

global sales force at the disposal of Cisco, which dominates the

market for Internet gear such as routers and switches, but has a

much smaller retail footprint.

Mr. Vestberg said Ericsson needed to adapt its business to cope

better the development of next generation, or 5G, mobile technology

as well as growth in the market for connected devices and cloud

computing.

"As 5G, the Internet of Things, and Cloud drive the next phase

of industry development, the time is just right to make these

changes," he said.

Ericsson said two business units would focus on network products

and services respectively, with another two on information

technology and cloud computing, and a fifth on media.

The company raised its estimate of this year's likely

restructuring costs to 4 billion to 5 billion kronor from a

previous estimate of 3 billion to 4 billion kronor.

Write to Matthias Verbergt at Matthias.Verbergt@wsj.co

(END) Dow Jones Newswires

April 21, 2016 04:08 ET (08:08 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

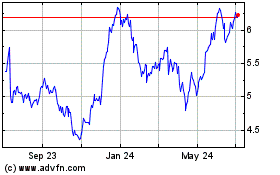

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

From Mar 2024 to Apr 2024

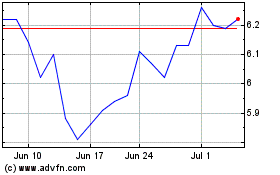

Ericsson (NASDAQ:ERIC)

Historical Stock Chart

From Apr 2023 to Apr 2024