Enterprise to Sell Offshore Gulf of Mexico Business to Genesis

July 16 2015 - 6:32AM

Business Wire

Enterprise Products Partners L.P. (NYSE:EPD) today announced

that it has executed definitive agreements to sell its offshore

Gulf of Mexico pipelines and services business, which primarily

consists of its Offshore Pipelines & Services business segment

to Genesis Energy, L.P. (“Genesis”) for approximately $1.5 billion

in cash. The transaction is expected to close during the third

quarter of 2015. Enterprise’s offshore assets include its ownership

interest in nine crude oil pipeline systems with more than 1,100

miles of pipeline; nine natural gas pipeline systems totaling

approximately 1,200 miles of pipeline; and its ownership interest

in six offshore hub platforms.

“We are pleased to execute this agreement to sell our offshore

Gulf of Mexico business to Genesis,” said Michael A. Creel, chief

executive officer for Enterprise’s general partner. “In recent

years, earnings from our offshore business represented only three

percent of Enterprise’s gross operating margin, and our offshore

assets do not effectively integrate with our downstream crude oil

and natural gas pipeline systems. We plan to redeploy proceeds from

this sale into attractive growth opportunities that would extend

and expand our integrated midstream system and should generate

higher risk-adjusted returns on capital, such as acquisitions and

organic projects in the Eagle Ford and Permian shale plays. In

addition to enhancing our overall financial flexibility, the

proceeds from this sale will effectively provide funds to finance

the first installment of our recent acquisition of EFS Midstream

LLC in the Eagle Ford and, furthermore, eliminates our need for

equity capital for the remainder of 2015 based on our current

expectations.”

“I cannot think of a better owner for the future development of

these assets than Genesis. For over twenty years, Grant Sims, the

chief executive officer of Genesis, has been a pioneer and a

visionary in the development of midstream energy infrastructure in

the Gulf of Mexico. These assets should be very complementary to

Genesis’ existing offshore investments. Furthermore we would like

to thank the Enterprise employees who will join Genesis in this

transaction. These employees have built and operated award-winning

offshore assets such as the Independence Hub platform and Trail

pipeline and the Poseidon, Cameron Highway, Shenzi and Southeast

Keathley Canyon crude oil pipelines in a safe and efficient

manner,” stated Creel.

Enterprise expects to record non-cash asset impairment and

related charges of approximately $100 million, or $0.05 per common

unit on a fully-diluted basis in connection with the sale of its

offshore Gulf of Mexico pipelines and services business. Since

these assets were viewed as held-for-sale at June 30, 2015, these

non-cash charges will be reflected in Enterprise’s consolidated

results for the three and six months ended June 30, 2015.

Enterprise Products Partners L.P. is one of the largest publicly

traded partnerships and a leading North American provider of

midstream energy services to producers and consumers of natural

gas, NGLs, crude oil, refined products and petrochemicals. Our

services include: natural gas gathering, treating, processing,

transportation and storage; NGL transportation, fractionation,

storage and import and export terminals; crude oil and refined

products transportation, storage and terminals; petrochemical

transportation and services; and a marine transportation business

that operates primarily on the United States inland and

Intracoastal Waterway systems. The partnership’s assets include

approximately 49,000 miles of onshore pipelines; 225 million

barrels of storage capacity for NGLs, crude oil, refined products

and petrochemicals; and 14 billion cubic feet of natural gas

storage capacity.

This press release includes “forward-looking statements” as

defined by the Securities and Exchange Commission. All statements,

other than statements of historical fact, included herein that

address activities, events, developments or transactions that

Enterprise and its general partner expect, believe or anticipate

will or may occur in the future are forward-looking statements.

These forward-looking statements are subject to risks and

uncertainties that may cause actual results to differ materially

from expectations, including required approvals by regulatory

agencies, the possibility that the anticipated benefits from such

activities, events, developments or transactions cannot be fully

realized, the possibility that costs or difficulties related

thereto will be greater than expected, the impact of competition,

and other risk factors included in Enterprise’s reports filed with

the Securities and Exchange Commission. Readers are cautioned not

to place undue reliance on these forward-looking statements, which

speak only as of their dates. Except as required by law, Enterprise

does not intend to update or revise its forward-looking statements,

whether as a result of new information, future events or

otherwise.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20150716005515/en/

Enterprise Products Partners L.P.Randy Burkhalter, (713)

381-6812Investor RelationsorRick Rainey, (713) 381-3635Media

Relations

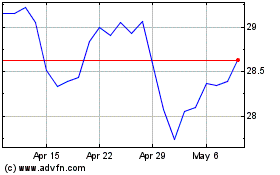

Enterprise Products Part... (NYSE:EPD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Enterprise Products Part... (NYSE:EPD)

Historical Stock Chart

From Apr 2023 to Apr 2024