Enterprise Products Partners L.P. (NYSE: EPD, “Enterprise”)

announced today that it has acquired the general partner and

related incentive distribution rights, 15,899,802 common units and

38,899,802 subordinated units in Oiltanking Partners L.P. (NYSE:

OILT, “Oiltanking Partners”) held by Oiltanking Holding Americas,

Inc. (“Oiltanking Holding”). Enterprise paid total consideration of

approximately $4.41 billion to Oiltanking Holding comprised of

$2.21 billion in cash and 54,807,352 Enterprise common units.

Enterprise also paid $228 million to assume notes receivable issued

by Oiltanking Partners.

Upon the payment of the Oiltanking Partners’ distribution with

respect to the third quarter of 2014, which is expected to be paid

in mid-November 2014, the subordination period with respect to the

Oiltanking Partners subordinated units will end. At that time, the

subordinated units will convert into common units on a one-for-one

basis. Upon conversion, Enterprise will own 54,799,604 common

units, or approximately 66 percent of Oiltanking Partners’ then

outstanding common units.

In a second step, Enterprise submitted a proposal to the

conflicts committee of the general partner of Oiltanking Partners

to merge Oiltanking Partners with and into Enterprise. Under the

terms of the proposal, Enterprise would exchange 1.23 Enterprise

common units for each Oiltanking Partners common unit. This

proposed consideration represents an at-market value for Oiltanking

Partners common units based upon the volume weighted average

trading prices of both Oiltanking Partners and Enterprise on

September 30, 2014. The total consideration for this proposal would

be $1.4 billion. The total consideration for step 1 and step 2, as

proposed, would be approximately $6.0 billion.

Oiltanking Partners owns marine terminals on the Houston Ship

Channel and the Port of Beaumont with a total of twelve ship and

barge docks and approximately 24 million barrels of crude oil and

petroleum products storage capacity on the Texas Gulf Coast.

“We are pleased to announce this two-step transaction that would

result in the merger of Oiltanking Partners into Enterprise,” said

Michael A. Creel, chief executive officer of the general partner of

Enterprise. “We have had a strategic relationship and enjoyed

mutual growth with Oiltanking Partners and its predecessors since

1983. The combination of Enterprise’s system of midstream assets

and Oiltanking Partners’ access to waterborne markets and crude oil

and petroleum products storage assets would extend and broaden

Enterprise’s midstream energy services business. This combination

would benefit our producing and consuming customers by enhancing

their respective access to supplies, domestic and international

markets, and storage.”

“We believe there would be three principle avenues for long-term

value creation from the merger of Oiltanking Partners into

Enterprise: (1) at least $30 million of synergies and cost savings

from the complete integration of Oiltanking Partners’ business into

Enterprise’s system; (2) opportunities for new business and

repurposing existing assets for ‘best use’ to meet the growing

demand for export and logistical services for petroleum products

related to the increase in North American crude oil, condensate and

NGL production from the shale and non-conventional plays; and (3)

securing ownership and control of Oiltanking Partners’ assets that

are essential to our midstream business. We believe the acquisition

of Oiltanking Partners would be accretive to Enterprise’s

distributable cash flow per unit beginning in 2016,” stated

Creel.

Oiltanking Partners’ marine terminal on the Houston Ship Channel

is connected with Enterprise’s Mont Belvieu facility and integral

to our growing LPG export, octane enhancement and propylene

businesses. Enterprise has loaded or unloaded over 3,500 ships with

more than 600 million barrels of LPG across Oiltanking Partners’

docks over the past thirty-one years. Enterprise’s ECHO facilities

are also connected to Oiltanking’s system.

Enterprise is Oiltanking Partners’ largest customer,

representing approximately 30 percent of Oiltanking Partners’ 2013

revenue. We estimate that approximately 40 percent of Oiltanking

Partners’ 2013 earnings before interest, taxes, depreciation and

amortization were attributable to Enterprise.

This proposed combination would convert essential dock and land

access associated with our LPG export and octane enhancement

business from a services agreement to ownership. These two

businesses accounted for approximately 10 percent of Enterprise’s

gross operating margin in 2013. We expect the contribution from

these businesses to increase in association with volume growth

related to the completion of expansions of our LPG export facility

in 2015 and 2016 and improvements to our octane enhancement

facility in 2015. Upon completion of the expansions of our LPG

export facility in 2016, we estimate that Enterprise will have over

$1.5 billion of assets on land currently owned by Oiltanking

Partners.

Enterprise paid $228 million to an affiliate of Oiltanking

Holding to purchase notes receivables and accrued interest thereon

due from Oiltanking Partners and its subsidiaries. These notes

include (1) the $125 million 4.55 percent note payable by

Oiltanking Houston, L.P. due 2022; (2) the $50 million 5.435

percent note payable by Oiltanking Houston, L.P. due 2023; (3) the

outstanding $37 million balance associated with Oiltanking

Partners’ $150 million revolving credit facility with a maturity

date of November 30, 2017; as well as the remaining notes payable

outstanding. The assigned notes and credit facility have been

amended to reflect Enterprise Products Operating LLC as the lender.

The material terms of these amended notes and credit facility are

substantially the same as those of the previous notes and credit

facility.

Enterprise funded the total cash consideration of $2.438 billion

from cash on hand and borrowings under its commercial paper

facility and a new $1.5 billion 364-day revolving credit facility.

The new 364-day facility matures in September 2015.

Oiltanking Holding is wholly owned by an affiliate of Oiltanking

GmbH, the world’s second largest independent storage provider for

crude oil, refined products, liquid chemicals and gases. Christian

Flach has been named as a director of Enterprise’s general partner.

Dr. Flach is managing director of Oiltanking GmbH and was formerly

chairman of the board of the general partner of Oiltanking

Partners.

Today, Enterprise, as sole member of the general partner of

Oiltanking Partners, named four new directors to the board of

directors of Oiltanking Partners’ general partner. Gregory C. King,

Thomas M. Hart III and D. Mark Leland will continue to serve as

independent directors of the board of Oiltanking Partners’ general

partner and comprise its conflicts committee. Mr. King is chair of

the conflicts committee.

Merger Proposal; Benefits to Public Holders of Oiltanking

Partners Common Units

Enterprise also today announced a proposal to merge a

wholly-owned subsidiary of Enterprise with Oiltanking Partners. The

proposed merger would occur in a unit-for-unit exchange, at a ratio

of 1.23 Enterprise common units for each outstanding Oiltanking

Partners common unit. This non-taxable exchange represents an

at-market value for Oiltanking Partners common units based on the

volume weighted average trading prices of both Oiltanking Partners

and Enterprise common units on September 30, 2014.

The terms of the Proposed Merger will be subject to negotiation,

review and approval by the board of directors of the general

partner of Enterprise, and the conflicts committee of the board of

directors of the general partner of Oiltanking Partners. The

Proposed Merger will also be subject to approval by holders of

Oiltanking Partners common units in accordance with the Oiltanking

Partners partnership agreement. Enterprise cannot predict whether

the terms of a potential combination will be agreed upon by the

conflicts committee of the board of directors of the general

partner of Oiltanking Partners or the board of directors of the

general partner of Enterprise.

Enterprise believes the proposal should be attractive to public

holders of Oiltanking Partners common units. It would permit

Oiltanking Partners unitholders to participate in the future growth

of Enterprise’s businesses (including Oiltanking Partners’ existing

business), Enterprise’s substantial backlog of capital projects and

larger, more diversified asset base. It would also allow Oiltanking

Partners unitholders to benefit from Enterprise’s financial

flexibility, investment grade credit rating and access to capital

markets.

At the proposed exchange rate, public unitholders of Oiltanking

Partners would receive a 70 percent increase in cash distributions

based on the respective cash distributions per unit paid by

Enterprise and Oiltanking Partners in August 2014 with respect to

the second quarter of 2014. The combination would also provide

public holders of Oiltanking Partners common units a more liquid

security. Enterprise’s 2014 average daily trading volume for its

common units, through September 30, was approximately 2.1 million

units per day compared to approximately 84 thousand units per day

for Oiltanking Partners common units for the same period.

Enterprise does not intend to comment further on discussions

unless and until a definitive agreement is reached.

Investor Conference Call

Enterprise will hold a conference call with investors at 10:00

a.m. EDT Wednesday, October 1, 2014 to discuss the substance of

this press release. A presentation and a link to the live webcast

will be available at www.enterpriseproducts.com shortly before

10:00 a.m. EDT. Participants should access the website at least ten

minutes prior to the start of the conference call to download and

install any necessary audio software.

Advisors

Citi acted as financial advisors and Andrews Kurth LLP and Akin

Gump Strauss Hauer & Feld LLP acted as legal counsel to

Enterprise. Additionally, Citi acted as lead arranger for

Enterprise’s new $1.5 billion 364-day revolving credit

facility.

Enterprise Products Partners L.P. is one of the largest publicly

traded partnerships and a leading North American provider of

midstream energy services to producers and consumers of natural

gas, NGLs, crude oil, refined products and petrochemicals. Our

services include: natural gas gathering, treating, processing,

transportation and storage; NGL transportation, fractionation,

storage and import and export terminals (including liquefied

petroleum gas or LPG); crude oil and refined products

transportation, storage and terminals; offshore production

platforms; petrochemical transportation and services; and a marine

transportation business that operates primarily on the United

States inland and Intracoastal Waterway systems and in the Gulf of

Mexico. Additional information regarding Enterprise can be found on

its website, www.enterpriseproducts.com.

This press release includes "forward-looking statements" as

defined by the U.S. Securities and Exchange Commission (the “SEC”).

All statements, other than statements of historical fact, included

herein that address activities, events, developments or

transactions that Enterprise expects, believes or anticipates will

or may occur in the future, including anticipated benefits and

other aspects of such activities, events, developments or

transactions, are forward-looking statements. These forward-looking

statements are subject to risks and uncertainties that may cause

actual results to differ materially, including approval of the

proposed merger by Oiltanking Partners’ conflicts committee and

unitholders, any approvals by regulatory agencies, the possibility

that the anticipated benefits from such activities, events,

developments or transactions cannot be fully realized, the

possibility that costs or difficulties related thereto will be

greater than expected, the impact of competition and other risk

factors included in the reports filed with the SEC by Enterprise.

Readers are cautioned not to place undue reliance on these

forward-looking statements, which speak only as of their dates.

Except as required by law, Enterprise does not intend to update or

revise its forward-looking statements, whether as a result of new

information, future events or otherwise.

ADDITIONAL INFORMATION

This communication does not constitute an offer to buy or

solicitation of an offer to sell any securities. This communication

relates to a proposal which Enterprise has made for a business

combination transaction with Oiltanking Partners. In furtherance of

this proposal and subject to future developments, Enterprise (and,

if a negotiated transaction is agreed, Oiltanking Partners) may

file one or more registration statements, proxy statements or other

documents with the SEC. This communication is not a substitute for

any proxy statement, registration statement, prospectus or other

document Enterprise and/or Oiltanking Partners may file with the

SEC in connection with the proposed transaction. INVESTORS AND

SECURITY HOLDERS OF ENTERPRISE AND OILTANKING PARTNERS ARE URGED TO

READ THE PROXY STATEMENT, REGISTRATION STATEMENT, PROSPECTUS AND

OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY IN THEIR ENTIRETY IF

AND WHEN THEY BECOME AVAILABLE AS THEY WILL CONTAIN IMPORTANT

INFORMATION ABOUT THE PROPOSED TRANSACTION. Any definitive

proxy statement (if and when available) will be mailed to

unitholders of Oiltanking Partners. Investors and security holders

will be able to obtain free copies of these documents (if and when

available) and other documents filed with the SEC by Enterprise

and/or Oiltanking Partners through the web site maintained by the

SEC at http://www.sec.gov.

Enterprise, Oiltanking Partners and their respective general

partners, and the directors and certain of the executive officers

of the respective general partners, may be deemed to be

participants in the solicitation of proxies from the unitholders of

Oiltanking Partners in connection with the proposed merger.

Information about the directors and executive officers of the

respective general partners of Enterprise and Oiltanking Partners

is set forth in each company’s Annual Report on Form 10-K for the

year ended December 31, 2013, filed with the SEC on March 3, 2014

and February 25, 2014, respectively. These documents can be

obtained free of charge from the sources listed above. Other

information regarding the person who may be “participants” in the

proxy solicitation and a description of their direct and indirect

interests, by security holdings or otherwise, will be contained in

the proxy statement/prospectus and other relevant materials to be

filed with the SEC when they become available.

Enterprise Products Partners L.P.Randy Burkhalter, 713-381-6812

or 866-230-0745Investor RelationsorRick Rainey, 713-381-3635Media

Relations

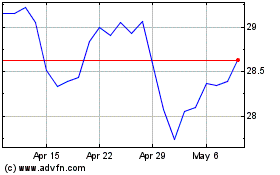

Enterprise Products Part... (NYSE:EPD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Enterprise Products Part... (NYSE:EPD)

Historical Stock Chart

From Apr 2023 to Apr 2024