Enterprise Prices $1.7 Billion Principal Amount of Junior Subordinated Notes

August 07 2017 - 4:41PM

Business Wire

Enterprise Products Partners L.P. (NYSE: EPD) today announced

that its operating subsidiary, Enterprise Products Operating LLC

(“EPO”), has priced a public offering of two series of junior

subordinated notes comprised of $700 million aggregate principal

amount of Junior Subordinated Notes D due August 16, 2077 (the

“non-call 5 notes”) and $1.0 billion aggregate principal

amount of Junior Subordinated Notes E due August 16, 2077 (the

“non-call 10 notes”). Enterprise Products Partners L.P. will

guarantee both series of junior subordinated notes on a

subordinated, unsecured basis under an unconditional guarantee.

Settlement of this offering is expected to occur on August

16, 2017.

The non-call 5 notes will be redeemable at EPO’s

option, in whole or in part, on one or more occasions, on or after

August 16, 2022 at 100% of their principal amount, plus

any accrued and unpaid interest thereon, and will bear interest at

a fixed rate of 4.875% per year up to, but not including, August

16, 2022. From, and including August 16, 2022, the

non-call 5 notes will bear interest at a floating rate

based on a three-month LIBOR rate plus 298.6 basis points

(2.986%), reset quarterly.

The non-call 10 notes will be redeemable at EPO’s

option, in whole or in part, on one or more occasions, on or after

August 16, 2027 at 100% of their principal amount, plus

any accrued and unpaid interest thereon, and will bear interest at

a fixed rate of 5.25% per year up to, but not including, August

16, 2027. From, and including August 16, 2027, the

non-call 10 notes will bear interest at a floating rate

based on a three-month LIBOR rate plus 303.3 basis points

(3.033%), reset quarterly.

Citigroup Global Markets Inc., Barclays Capital Inc., Mizuho

Securities USA LLC and MUFG Securities Americas Inc. acted as joint

book-running managers for the offering. An investor may obtain a

free copy of the prospectus as supplemented by visiting EDGAR on

the SEC website at www.sec.gov. Alternatively, EPO or any

underwriter or dealer participating in this offering will arrange

to send a prospectus as supplemented to an investor if requested by

contacting Citigroup Global Markets Inc. at (800) 831-9146,

Barclays Capital Inc. at (888) 603-5847, Mizuho Securities USA LLC

at (866) 271-7403, or MUFG Securities Americas Inc. at (877)

649-6848.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy the securities described in this

press release, nor shall there be any sale of these securities in

any state or jurisdiction in which such an offer, solicitation or

sale would be unlawful prior to registration or qualification under

the securities laws of any such jurisdiction. The offering is being

made only by means of a prospectus and related prospectus

supplement, which are part of an effective registration

statement.

Enterprise Products Partners L.P. is one of the largest publicly

traded partnerships and a leading North American provider of

midstream energy services to producers and consumers of natural

gas, NGLs, crude oil, refined products and petrochemicals. Our

services include: natural gas gathering, treating, processing,

transportation and storage; NGL transportation, fractionation,

storage and import and export terminals; crude oil gathering,

transportation, storage and terminals; petrochemical and refined

products transportation, storage and terminals; and a marine

transportation business that operates primarily on the United

States inland and Intracoastal Waterway systems. Our assets include

approximately 50,000 miles of pipelines; 260 million barrels of

storage capacity for NGLs, crude oil, refined products and

petrochemicals; and 14 billion cubic feet of natural gas storage

capacity.

This press release includes “forward-looking statements” as

defined by the United States Securities and Exchange Commission.

All statements, other than statements of historical fact, included

herein that address activities, events, developments or

transactions that we expect, believe or anticipate will or may

occur in the future are forward-looking statements. These

forward-looking statements are subject to risks and uncertainties

that may cause actual results to differ materially from

expectations. Readers are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date

of this press release. Except as required by law, we do not intend

to update or revise our forward-looking statements, whether as a

result of new information, future events or otherwise.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20170807006011/en/

Enterprise Products Partners L.P.Investor RelationsRandy

Burkhalter, 713-381-6812 or 866-230-0745orMedia RelationsRick

Rainey, 713-381-3635

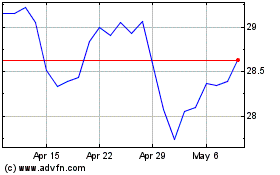

Enterprise Products Part... (NYSE:EPD)

Historical Stock Chart

From Mar 2024 to Apr 2024

Enterprise Products Part... (NYSE:EPD)

Historical Stock Chart

From Apr 2023 to Apr 2024