Eni Posts Loss of Nearly $900 Million Amid Oil Price Rout -- Update

April 29 2016 - 7:13AM

Dow Jones News

By Manuela Mesco

MILAN--Oil giant Eni SpA Friday reported a net loss of EUR792

million ($897.8 million) for this year's first quarter, a decline

from its net profit of EUR832 million during the same period last

year due to weak oil prices and a charge related to a

subsidiary.

But shares in Eni, Italy's largest company by market value,

remained stable at EUR14.35 in early trading since the company,

like other European energy producers in recent days, reported

results that weren't as dismal as some investors expected.

Eni said that fundamentals in the oil market remain weak despite

a recent rally in oil prices, presenting a gloomier picture than

some peers have offered.

"The global macroeconomic outlook for 2016 is clouded by a

number of risks and uncertainties, mainly relating to a continued

slowdown of growth in China, caution in the eurozone and in

commodity-exporting countries," the company said in a

statement.

Oil prices face "possible negative pressure" from uncertainties

over energy-demand growth in the short and medium term, the company

said.

Prices have rallied recently, soaring 76% off decade lows seen

at the beginning of this year amid hopes that slowing U.S. oil

production will help remove oversupply from the market.

While a spate of production outages in countries such as Nigeria

and Venezuela and a weaker dollar have strengthened the rally,

analysts say rising oil stocks could halt the rise, and point to a

price jump in the same period last year that fizzled out in the

second half.

In recent days, big European oil producers like BP PLC, Total SA

and Statoil ASA produced better quarterly results than some

investors forecast due to cost-cuts and support from their refining

divisions.

Total reported first-quarter profit of $1.64 billion on

Wednesday as the company slashed costs, boosted production and

benefited from resilient refining earnings. BP posted a surprise

underlying replacement-cost profit--a measure equivalent to the net

profit U.S. oil companies report--on Tuesday from

stronger-than-expected refining and trading performance. Analysts

had predicted BP would report a loss in its underlying replacement

cost profit.

Eldar Saetre, the CEO of Statoil, said the global oil market was

rebalancing while BP CEO Bob Dudley said he expected crude oil

prices to recover toward the end of the year.

Eni's adjusted operating profit, which excludes its chemicals

division Versalis--which it is in the process of selling--fell 69%

to EUR472 million in the first quarter. Analysts had expected

operating profit to fall further to EUR220 million, but

stronger-than-expected performance in the company's natural gas and

power division and resilience in other divisions helped lift

earnings.

The company's share price opened around 1% lower, but rose as

the day progressed to trade mostly unchanged on the day.

Eni reported a "messy set of results, and hard for the market to

read, but we think headlines are OK at best," said Exane BNP

Paribas analyst Aneek Haq.

Eni said it would ramp up efforts to cut costs by rescheduling

projects, being more selective about which exploration prospects it

pursues and renegotiating contracts with suppliers.

Eni's oil and gas production grew 3.4% in the quarter to 1.75

million barrels of oil equivalent a day, due to the startup of the

Goliat oil field in the Barents Sea and three other projects. The

company doesn't expect its production to grow this year compared

with 2015.

Write to Manuela Mesco at manuela.mesco@wsj.com

(END) Dow Jones Newswires

April 29, 2016 06:58 ET (10:58 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

Eni (BIT:ENI)

Historical Stock Chart

From Mar 2024 to Apr 2024

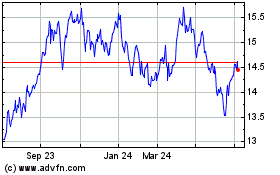

Eni (BIT:ENI)

Historical Stock Chart

From Apr 2023 to Apr 2024