By Sarah Kent and Justin Scheck

Several big oil companies have fallen into unlikely alignment

with environmental groups calling for new taxes on air polluters

like coal-burning power plants. One key reason: Those taxes are

probably good for their natural-gas businesses.visu

Energy giants including Royal Dutch Shell PLC and BP PLC hope a

so-called carbon tax--which would force companies to pay for their

emissions and likely increase oil producers' costs--also would

increase demand for natural gas, an increasingly significant part

of their output.

The companies are part of a collection of business interests,

environmental activists and economists that have urged negotiators

meeting at a U.N. climate-change summit in Paris over the next two

weeks to consider potential carbon pricing policies as a tool to

curb emissions. Such programs could open new markets in China and

elsewhere for gas to displace coal.

Most carbon-tax plans being discussed wouldn't much affect

transportation fuels that oil companies already sell, says the

Organization for Economic Cooperation and Development. Automobile

fuel is already heavily taxed in much of the world, while

coal-heavy power production often isn't.

"Coal," BP's chief economist, Spencer Dale, said in an October

speech, "is likely to be more affected by future climate policies

than either oil or gas."

The embrace of carbon taxes demonstrates how some oil companies

now see a business opportunity as efforts to enact climate-change

policies gain momentum. While not entirely new, oil companies have

become more vocal in their support for carbon taxes in recent

years.

Oil companies including BP, Shell and France's Total SA joined

forces in recent months to push for action on climate change,

calling for taxes to encourage the use of cleaner-burning gas over

coal. BP has said switching just 1% of world-wide power production

to gas from coal would have an equivalent emissions reduction as

increasing renewable-energy generation by 11%. Exxon Mobil Corp.

isn't part of the coalition, but in recent years it has expressed

support for a carbon tax, provided it is offset by tax reductions

elsewhere.

Their support for a carbon tax carries relatively little risk,

says Kurt Van Dender, the head of the tax and environment unit for

the Organization for Economic Cooperation and Development, a group

of first-world countries that includes the U.S. and Western

European nations.

Around 80% of carbon emissions in the U.S. and Europe come from

power plants and big industrial sources that largely use coal, he

said.

"The relative increase [in costs] will be much higher for these

non-oil types of energy," he said.

Coal producers say any financial incentives to reduce CO2

emissions should be directed toward the development of carbon

capture-and-storage, or CCS, technologies that force emissions into

underground reservoirs.

"Market mechanisms, including carbon pricing, should not impose

punitive costs but should instead provide revenues that can be

directed toward the deployment of low-emission technology,

including CCS," said a spokeswoman for the World Coal Association,

an advocacy group for coal producers.

Positioning "coal as the villain and gas as the solution" isn't

a productive long-term approach to curbing climate change, said

Daniel Litvin, managing director of Critical Resource, a

London-based resource-extraction consultancy. Shifting to natural

gas from coal is "pretty far off the major transformation that's

needed," he said. On Wednesday, his group said oil companies should

focus more on alternative energy and energy efficiency.

A global carbon tax is unlikely to emerge from the U.N. climate

summit, but any international commitment to reducing emissions

likely will result in individual countries implementing their own

version of pricing carbon.

The pro-carbon-tax talk hasn't taken oil companies out of the

sights of environmental groups and policy makers who want to reduce

fossil-fuel use. Shell this year faced protests in the U.S. for its

exploration of the Arctic offshore Alaska, which environmental

groups said could lead to pollution. Shell said it had taken all

necessary precautions but pulled out of the project in September

when drilling results were disappointing.

In November, the New York attorney general's office confirmed it

sent Exxon a subpoena for information on the company's research on

and response to climate change going back decades. The request

followed stories by InsideClimate News that detailed Exxon's 1970s

research into climate change and later support for groups that

questioned climate science. Exxon has said it didn't do anything

wrong.

Many environmentalists say the companies' support for a carbon

price won't be sufficient to prevent global temperatures rising by

dangerous amounts in the coming decades.

Greenpeace campaigner Charlie Kronick said he supports raising

the cost of fossil fuels, but he says a carbon tax alone isn't

enough to curb global warming, and could benefit the companies that

sell fossil fuels. It "absolutely will not do what we need to do,

which is dramatically reduce fossil fuels," he said.

Some oil companies, particularly in the U.S., remain suspicious

of regulation and taxes overall. In a speech in October in London,

Exxon Chief Executive Rex Tillerson pointedly noted that the U.S.

had curbed emissions with an increase in natural-gas usage for

electricity "in the absence of a comprehensive cost-of-carbon

policy."

Oil companies also oppose policies that would force a fast

switch to more reliance on renewable energy, saying the world's

energy needs are so great that fossil fuels will remain a part of

the picture for decades.

The carbon-tax push isn't oil companies' first foray into

promoting more environmentally friendly energy alternatives. In the

1990s, for instance, Shell and BP invested in solar energy and

other renewable sources, but they have scaled back many of those

investments, scrapping some altogether. A Shell spokesman said the

company is continuing with a "multibillion-dollar" investment in

biofuels.

Shell has produced more gas than oil on an annual basis since

2009. BP expects natural gas to make up about 60% of its total

production by the end of the decade and nearly 50% of Exxon's

production last year was gas.

Write to Sarah Kent at sarah.kent@wsj.com and Justin Scheck at

justin.scheck@wsj.com

Access Investor Kit for "BP plc"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=GB0007980591

Access Investor Kit for "Royal Dutch Shell PLC"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=GB00B03MLX29

Access Investor Kit for "Royal Dutch Shell PLC"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=GB00B03MM408

Access Investor Kit for "BP plc"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US0556221044

Access Investor Kit for "EXXON MOBIL CORP"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US30231G1022

Access Investor Kit for "Royal Dutch Shell PLC"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US7802591070

Access Investor Kit for "Royal Dutch Shell PLC"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US7802592060

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 30, 2015 21:32 ET (02:32 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

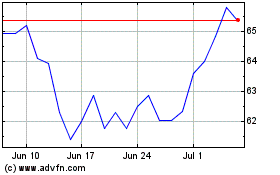

TotalEnergies (EU:TTE)

Historical Stock Chart

From Mar 2024 to Apr 2024

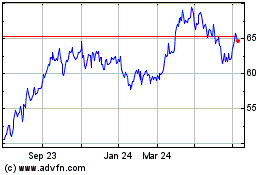

TotalEnergies (EU:TTE)

Historical Stock Chart

From Apr 2023 to Apr 2024