TIDMELM

RNS Number : 6682M

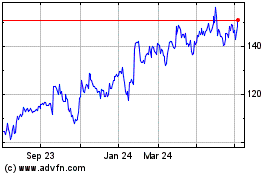

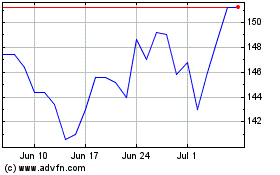

Elementis PLC

01 August 2017

1 August 2017

ELEMENTIS plc

INTERIM RESULTS FOR THE SIX MONTHSED 30 JUNE 2017

Elementis plc (ELM.L) ("Elementis", the "Company" or the

"Group"), a Global Specialty Chemicals Company, announces its

results for the six months ended 30 June 2017.

Reignite Growth strategy gaining momentum

-- Operating profit up across all three segments.

-- Group adjusted operating profit(1) up 26% with short term

favourable conditions in Surfactants and the inclusion of the

acquired SummitReheis business. Excluding these two items, the

adjusted operating profit is stable.

-- Specialty Products adjusted operating profit(1) up 18%, with

strong growth in Personal Care and Energy, and steady revenue in

Coatings.

-- Chromium gross revenue(2) up 18% with the US resilient and

stronger demand in the rest of the world. Adjusted operating

profit(1) up 3% as higher sales offset by higher maintenance costs

and lower rest of the world unit margins.

-- Surfactants boosted by favourable pricing conditions that

will not sustain in H2 and beyond. Now pursuing the potential sale

of the business.

-- SummitReheis integration on track, $3m cost synergies

underpinned and acquisition proving highly complementary - creating

a Personal Care business of scale.

-- Operating cash flow(3) up 52%.

-- Outlook unchanged - on track to grow operating profit across all three segments in 2017.

FINANCIAL SUMMARY

Six months Six months % Change

ended 30 ended 30

June 2017 June 2016

Sales $414.8m $334.1m +24%

Statutory profit for

the period $43.2m $37.4m +16%

Statutory basic earnings

per share 9.3c 8.1c +15%

Adjusted operating

profit(1) $67.6m $53.6m +26%

Profit before tax $54.1m $46.3m +17%

Diluted adjusted earnings

per share(4) 10.4c 8.8c +18%

Operating cash flow(3) $52.0m $34.3m +52%

Net (debt)/cash(5) $(313.3)m $37.5m

Interim dividend to

shareholders 2.70c 2.70c

- Restated see note 17

1 - See note 5

2 - See note 4

3 - See cash flow within Finance report

4 - See note 9

5 - See note 12

Commenting on the results, CEO, Paul Waterman said:

"The first six months of 2017 have been positive for Elementis.

Operating profit has grown across all our business segments, our

Reignite Growth strategy is showing early signs of delivery and the

integration of SummitReheis is on track.

"Trading for the Group in the first half was underpinned by

stronger sales across our end markets. In Specialty Products, we

made significant progress in Personal Care and Energy. In Coatings

we have been taking pricing action to address margin compression.

In Chromium our performance benefited from more robust demand and

we have implemented price increases in response to higher raw

material costs. In Surfactants results were exceptionally strong

due to short term favourable conditions.

"Our Reignite Growth strategy is gaining momentum. As part of

our supply chain transformation we announced the disposal of our US

colourants business and the closure of the Jersey City site. We are

also pursuing the potential sale of our Surfactants business. Our

innovation pipeline is showing promise and new product launches are

driving sales growth across business lines and geographies. New

product and capital investment processes, combined with enhanced

and standardised management information and reporting, is improving

the efficiency and effectiveness of resource allocation.

"The integration of SummitReheis, the global market leader for

anti-perspirant and deodorant actives, is progressing very well and

is on track to conclude by the end of 2017. As expected the

business has already improved the returns profile of Elementis and,

having had the opportunity to fully engage with its management

team, we are excited about the opportunities for a material

Personal Care segment that combines SummitReheis with our existing

fast growing Personal Care operations.

"Looking forward we see significant potential for Elementis as

we focus on delivery of our Reignite Growth strategy. We remain

confident in our ability to make progress in 2017 and beyond."

Enquiries

Elementis plc Tel: 020 7067 2994

James Curran, Investor Relations

FTI Consulting Tel: 020 3727 1000

Deborah Scott

Matthew Cole

-S -

Business review

CEO's report

This has been a positive start to the year for Elementis.

Operating profit has grown across all our business segments, our

Reignite Growth strategy is starting to deliver and the full

integration of SummitReheis is on track to complete by the end of

2017.

Group performance

Where we refer to adjusted performance measures (e.g. adjusted

operating profit) see note 5

Where we refer to constant currency see Finance report

Specialty Products

Specialty Products is a high quality business offering

distinctive products to customers in three different markets:

Coatings, Personal Care and Energy. Sales for the first half of

2017 were $294.5 million, compared with $238.8 million in the same

period last year, representing an increase of 26% on a constant

currency basis driven by strong volume growth and a first

contribution from SummitReheis. Unless stated otherwise, the

remainder of this commentary refers to constant currency

movements.

-- Excluding the impact of the US colourants business disposal,

Global Coatings sales rose 2% to $188.0 million, with growth in

Asia and the Americas offset by lower EMEA sales. Coatings Americas

(excluding colourants) finished 4% above last year with good North

America industrial demand and improved conditions in Latin America.

Coatings Asia improved by 3% with solid growth in our largest

market of China and improved demand in Australasia and South East

Asia. In EMEA, Coatings finished down 3% with strong performance in

Southern Europe offset by soft demand in Central Europe and the

Middle East.

-- In Personal Care, sales rose by 147% to $77.2 million, driven

by our existing operations and the initial contribution from

SummitReheis. Our existing Personal Care business grew 25% in the

period with rapid sales growth in our Bentone(R) Gels product

range, strong performance in Asia and double digit growth at the

majority of our key global accounts. SummitReheis contributed $38.1

million of sales in the period following the acquisition completion

in March 2017.

-- In Energy, customer wins and a marked increase in drilling

activity, most notably in North America, saw sales increase by 78%

to $29.3 million. Moving into the second half of the year we expect

to see an improvement on prior year results.

Adjusted operating profit for the first six months of 2017 was

$51.6 million, compared with $43.7 million in the previous year,

representing an 18% increase on a constant currency basis. Adjusted

operating margin for the period was 17.5%, down on 18.3% in the

previous period, due to raw material cost inflation in Coatings and

investment in our sales and marketing talent to support and deliver

our Reignite Growth strategy. Pricing action has been implemented

in response to raw material increases.

Chromium

Our strategy for Chromium remains focused on structurally

advantaged US assets. Gross sales in the period were $95.4 million

compared to $80.9 million in the previous year, an increase of 18%

on a constant currency basis. Strong volume growth due to increased

demand levels outside of North America was partly offset by the

exit rate of pricing from 2016.

Adjusted operating profit for the first six months of the year

was $15.8 million compared to $15.4 million in the previous year.

Operating margins declined from 19.0% to 16.6% due to a stronger

rest of the world sales mix and higher unplanned maintenance costs.

Pricing responses implemented during the first half in response to

raw material cost inflation should contribute to an improved full

year outcome versus 2016.

Surfactants

Sales in the first six months of 2017 rose significantly on the

same period last year as a result of favourable pricing conditions

that are not expected to be sustained. The adjusted operating

profit for the period was $9.1 million compared to a loss of $0.2

million in the comparable period last year.

Tax

The adjusted tax rate of 20.6% represents an increase from the

13.0% for full year 2016, reflecting geographic profit mix, one off

impacts in 2016 and the effect of funding arrangements. For the

full year 2017 we currently estimate a tax range of 21 - 23%.

Balance sheet

As a result of the completion of the SummitReheis acquisition

the Group moved from a net cash position of $37.5 million to net

debt of $313.3 million, representing a net debt to adjusted EBITDA

ratio of 2.3x. As previously indicated, we expect pro-forma net

debt to adjusted EBITDA of below 2x at the year end with further

deleveraging thereafter.

The IAS 19 deficit, on the Group's post retirement benefit

plans, declined from $30.1 million at the end of 2016 to $24.1

million partly due to the benefit from good investment returns. The

UK pension plan accounts for the majority of the Group's pension

obligations.

Interim dividend

The Board is declaring an interim dividend of 2.70 cents per

share, the same as in the previous year, which will be paid on 29

September 2017, in pounds sterling at an exchange rate of

$1.3177:GBP1.00 to shareholders on the register on 8 September

2017.

Strategic progress

Though we are at an early stage of our strategic journey, since

the launch of our Reignite Growth strategy in November 2016 the

business has made considerable progress across its four key

strategic pillars.

1. Pursue the best growth opportunities

Global key account management is about accelerating how we work

and grow with our major customers. In the first six months of 2017

we implemented key account processes with our six largest Coatings

customers. This has had a positive impact on our customer

relationships and as a result Elementis is realising new business

opportunities.

In Asia the opportunity is clear: expanding our Coatings

presence, including building our decorative coatings activities in

China and beyond. We have appointed a new Managing Director in

India who will lead our business development in India and South

Asia.

In Personal Care we have a unique competitive position through

our hectorite mine. A small amount of hectorite organoclay in a

cosmetic product gives it exceptional performance, look and feel.

We believe the existing Personal Care business has major

opportunities to grow as demonstrated in the first half of the year

when it delivered constant currency growth of 25%, with notably

strong performance in Asia.

The acquisition of SummitReheis, a high quality personal care

business, is already having a positive impact on the returns

profile of Elementis. Having had the opportunity to fully engage

with its management team we are excited about the potential of

SummitReheis combined with our fast growing existing Personal Care

business, and the complementary nature of the two operations.

Integration of SummitReheis is on track for the end of 2017 and

will help transform the scale and growth prospects of our Personal

Care activities. Our cost synergies target of up to $3 million run

rate is on track.

2. Pursue supply chain transformation

Elementis has a high quality set of manufacturing sites. We are

developing advantaged sites and are progressing further investment

in Livingston, Scotland, to support global Personal Care growth and

we are planning to reposition our site in Palmital, Brazil. However

some of our plants are disadvantaged. As a result we announced in

March 2017 the disposal of our US colourants business and closure

of the Jersey City site. We are also looking to optimise our

organoclay operations in Asia and the US.

In Surfactants we are pursuing the potential sale of the

business and continue to expect resolution by early 2018.

3. Innovate for high margins and distinctiveness

Innovation is at the heart of what we do and is what our

customers expect from us. To sustain our innovation leadership

position we have introduced new pipeline management tools which

offer cross functional transparency. The integration of our

research and development functions into our customer facing teams

and alignment with our key account management initiatives is

delivering innovation that adds value for our customers.

SummitReheis also brings a new, market leading technology and

innovation opportunity to Elementis.

As a result, the quality of our innovation pipeline is improving

and we have launched several new products that are driving sales.

In Asia we launched new rheology and colour dispersant products

with roll out into further geographies expected to follow, and our

organic thixotropes are gaining momentum in both the US and

Europe.

4. Create a culture of high performance

Beyond the structural changes implemented in 2016 we have also

made several process changes in how we run the business to foster a

high performance culture. New product development and capital

investment processes mean we are now more effectively deploying

capital to the highest return opportunities. This combined with the

implementation of enhanced and standardised management information

and reporting, and clear lines of individual accountability, is

improving the efficiency and effectiveness of resource

allocation.

Outlook

Looking forward we see significant potential for Elementis. Our

management team is focused on the delivery of our Reignite Growth

strategy and we are already seeing early benefits from its

implementation. Whilst we remain very much at the early stage of

this strategic journey the first six months of the year have

reinforced the Board's confidence in the prospects for Elementis

and our expectation is for further progress in 2017 and beyond.

Management expectations for full year earnings remain

unchanged.

Finance report

Revenue for the six Revenue Effect

months of

ended 30 June 2016 restated exchange Increase Revenue

$million rates 2017 2017

$million $million $million

Specialty Products 238.8 (4.2) 59.9 294.5

Chromium 80.9 - 14.5 95.4

Surfactants 21.8 (0.6) 10.2 31.4

Inter-segment (7.4) - 0.9 (6.5)

---------------------- --------------- ---------- ----------- -----------

334.1 (4.8) 85.5 414.8

--------------------- --------------- ---------- ----------- -----------

Adjusted operating Adjusted

profit for the six operating

months ended 30 June profit*

2016

restated

$million

----------- ---------- ------------ -----------

Effect

of Increase/

Adjusted

operating

exchange (decrease) profit*

rates 2017 2017

$million $million $million

--------------------- --- ----------- ---------- ------------ -----------

Specialty Products 43.7 (0.1) 8.0 51.6

Chromium 15.4 - 0.4 15.8

Surfactants (0.2) (0.2) 9.5 9.1

Central costs (5.3) 0.3 (3.9) (8.9)

-------------------------- ----------- ---------- ------------ -----------

53.6 - 14.0 67.6

------------------------- ----------- ---------- ------------ -----------

* See note 5

Group results

Group sales for the first six months of 2017 was $414.8 million,

compared to $334.1 million in the same period last year,

representing an increase of 24%, or 26% excluding currency

movements. Whilst much of the additional sales came from the

SummitReheis acquisition increased sales in Chromium outside of

North America, Surfactants and Personal Care and Energy in

Specialty Products contributed to the improvement. Group adjusted

operating profit was $67.6 million, compared to $53.6 million in

the same period last year, which is an increase of 26%, and the

same percentage excluding currency movements. Increased operating

profit was primarily the result of the addition of SummitReheis to

the Group, adding $6.0 million in the period since acquisition to

30 June 2017, and the result of favourable pricing conditions in

Surfactants.

The Group continues to enter into hedging transactions in order

to reduce the impact of currency movements on earnings. In 2017

these transactions added a gain of $0.1 million (2016: cost of $1.8

million) to the Specialty Products business.

Central costs

Central costs are costs that are not identifiable as expenses of

a particular business and comprise the Board of Directors and

corporate offices in the UK and US. Adjusted costs for the first

half of 2017 were higher at $8.9 million, compared to $5.3 million

in the same period last year due to building of capability to

support and deliver our Reignite Growth strategy.

Adjusting items

In calculating the profitability measures by which management

assesses the performance of the Group a number of items are

excluded from operating profit as reported in accordance with IFRS.

The Board believes that the adjusted measures assist shareholders

in better understanding the underlying performance of the

business.

2016 2016

------------

Six months Year

ended ended

30 June 31 December

restated restated

2017 $million $million

Six months

ended

30 June

$million

------------------------------ ------------ ----------- ------------

Reported operating profit 60.4 48.7 84.5

------------------------------ ------------ ----------- ------------

Adjusting items:

Acquisition costs 6.0 - 0.8

Restructuring 0.7 1.7 3.0

Business review 0.9 1.9 2.4

Amortisation of intangibles

arising on acquisition 3.1 1.3 2.7

Colourants disposal and (3.5) - -

Jersey City site closure

Other - - 3.5

------------------------------ ------------ ----------- ------------

Net adjusting items 7.2 4.9 12.4

------------------------------ ------------ ----------- ------------

Adjusted operating profit 67.6 53.6 96.9

------------------------------ ------------ ----------- ------------

Acquisition costs primarily relate to the fees for legal and

advisory work incurred in the acquisition of SummitReheis. In the

first half of 2016 a business review was undertaken by a third

party to support development of the long term strategy and internal

transformation for Elementis. The one time cost of this exercise

was $1.9m however subsequent costs have been incurred for delivery

of this transformation. In previous years Elementis has not

adjusted operating profit for the amortisation of intangibles

arising on acquisition. Following the acquisition of SummitReheis,

the Directors reviewed this policy and concluded that excluding

such a charge from the operating profit will provide readers of the

accounts with a better understanding of the Group's results on its

operating activities and, as such, this charge is now included

within adjusting items. In March 2017 Elementis announced the sale

of its US Colourants business to Chromaflo Technology Corp, and

closure of the Jersey City site. The net profit on this disposal

and closure was $3.5 million and, given the one time nature of the

transaction, has been treated as an adjusting item.

Other expenses

Other expenses are administration costs incurred and paid by the

Group's pension schemes, which relate primarily to former employees

of legacy businesses, and were $1.4 million in the period compared

to $0.8 million in the previous year.

Net finance costs

30 June 30 June

2017 2016

$million $million

----------------------------- --------- ---------

Finance income 0.1 0.1

Finance cost of borrowings (4.3) (0.6)

----------------------------- --------- ---------

(4.2) (0.5)

Net pension finance expense (0.1) (0.4)

Discount on provisions (0.6) (0.7)

----------------------------- --------- ---------

Net Finance costs (4.9) (1.6)

----------------------------- --------- ---------

Net finance costs for the first six months of the year were $3.3

million higher at $4.9 million. Net interest costs were higher than

the same period last year at $4.2 million and consist mostly of

interest on the Group's increased borrowings following the

acquisition of SummitReheis. Net pension finance costs in the

period were $0.3 million lower at $0.1 million, in line with the

decline in the Group's net IAS 19 pension deficit. Discount on

provisions relates to the time value cost of certain environmental

provisions, which are calculated on a discounted cash flow basis.

The charge for the period was slightly lower than the same period

last year due to a reduction in the discount rate at the end of

2016.

Tax

The provision for tax on profits after adjusting items was $12.7

million, or 20.6%, in the first half of 2017 (2016: $10.3 million ,

or 20.1% ) and is based on the probable tax payable in those

jurisdictions where taxable profits arise and deferred tax

provisions where these are applicable. The estimated rate for the

full year is 21% - 23% including $1.0 million of prior year

adjustments. The rate is sensitive to the mix of profits from

different jurisdictions. The inclusion of a tax credit of $1.8m on

adjusting items results in a reported tax charge for the period of

$10.9 million (2016: $8.9 million ).

Earnings per share

Basic and diluted adjusted earnings per share for the first half

of 2017, calculated on the adjusted earnings of $48.6 million

(2016: $40.9 million ), were 10.5 cents and 10.4 cents respectively

compared to 8.8 cents and 8.8 cents respectively in the same period

last year.

Cash flow

Cash flow is summarised below:

30 June 2016

restated

-------------

30 June 2017 $million

$million

------------------------------------------- ------------- -------------

Profit before interest, tax, depreciation

and

amortisation (EBITDA) 77.6 62.7

Change in working capital (9.7) (11.1)

Capital expenditure (14.9) (15.7)

Other (1.0) (1.6)

------------------------------------------- ------------- -------------

Operating cash flow 52.0 34.3

Pension deficit payments (6.5) (3.1)

Interest and tax (7.3) (3.2)

Other (2.1) 0.1

------------------------------------------- ------------- -------------

Free cash flow 36.1 28.1

Dividends (65.3) (63.7)

Acquisitions (361.2) -

Currency fluctuations (0.4) (0.9)

------------------------------------------- ------------- -------------

Movement in net cash (390.8) (36.5)

Net cash at start of period 77.5 74.0

------------------------------------------- ------------- -------------

Net (debt)/cash at end of period (313.3) 37.5

------------------------------------------- ------------- -------------

Net cash expended in the first six months of 2017 of $390.8

million includes a net outflow of $361.2 million for SummitReheis

(purchase price of $360.0 million for the business and $10.3

million for working capital less $9.1 million of cash acquired with

the business). Excluding this item, net cash expended was $6.9

million lower than the same period last year, at $29.6 million.

Operating cash flow in the period rose from $34.3 million to

$52.0 million driven by earnings growth and reduced working capital

outflow. EBITDA in the period was $14.9 million higher, in line

with the changes in operating profit and increased depreciation and

amortisation following the SummitReheis acquisition, while working

capital outflows were $1.4 million lower than the same period last

year. This reduction in working capital flows was largely a result

of lower inventories of chrome ore at 30 June 2017 compared to 30

June 2016 and increased creditor days outstanding within Specialty

Products.

Capital expenditure in the period was $0.8 million lower than

the previous year at $14.9 million. Of this, spending in Specialty

Products was $9.0 million, compared to $7.1 million in the previous

year, and included growth investments in product expansions in the

UK and investments in health and safety in Asia Pacific and Europe.

Capital spending for the year as a whole is expected to be

approximately $40 million (2016: $35.3 million).

Pension deficit payments in the period were $3.4 million higher

than the previous year, at $6.5 million, as a deficit funding

payment relating to 2016 was deferred from December 2016 to January

2017. Total contributions for the year as a whole are expected to

be below $10.0 million as a result of progressive improvements in

the UK plan deficit. Interest and tax payments in the period were

$4.1 million higher than the previous year, mostly due to interest

on the Group's increased borrowings following the acquisition of

SummitReheis.

Dividend payments were $65.3 million compared to $63.7 million

in the first six months of 2016, with the increase being the result

of an increase in the special dividend for 2016, as announced in

March 2017. Overall, the Group had a net debt position on its

balance sheet of $313.3 million at the end of the period.

Working capital

Working capital days 30 June

restated

2016

----------

30 June 31 December

2017 2016

---------------------------- -------- ---------- ------------

Inventory 99 109 97

----------------------------- -------- ---------- ------------

Debtors 49 47 44

----------------------------- -------- ---------- ------------

Creditors 65 62 64

----------------------------- -------- ---------- ------------

Average working capital to

sales (%) 19.9 24.4 22.1

----------------------------- -------- ---------- ------------

Total working capital for the Group was $19.6 million higher at

the end of June 2017 than at the same time last year primarily due

to an additional $32.1 million on the acquisition of SummitReheis

offset by reductions in inventories. Creditor days showed a minor

increase at 65 days, compared to 62 days last year, somewhat

offsetting a minor worsening in debtor days from 47 days to 49

days. Inventory levels were $5.0 million higher compared to the end

of June 2016 with much of the increase due to SummitReheis offset

by reductions in chrome ore inventory. Average working capital

levels as a percentage of sales have declined steadily over the 12

month period from 24.4% to 19.9% due to this improvement in

inventory management.

Balance sheet

30 June

2016

restated

-------------

30 June 2017 $million

$million

------------------------------- ------------- ----------

Property, plant and equipment 241.3 213.7

Other net assets 701.1 373.1

Net (debt)/cash (313.3) 37.5

------------------------------- ------------- ----------

Equity 629.1 624.3

------------------------------- ------------- ----------

Property, plant and equipment increased by $27.6 million

compared to the previous period end due to $18.8 million being

acquired on the acquisition of SummitReheis and net capital

spending of $34.0 million exceeding depreciation of $26.2 million.

The remainder of the movement is due to the impact of FX

movements.

Other net assets increased by $328.0 million due to $342.4

million on the acquisition of SummitReheis but also due to working

capital reductions (excluding balances acquired with the

SummitReheis acquisition) of $13.7 million, net tax liabilities

increasing by $8.0 million, a net reduction in pensions and

provisions liabilities of $2.1 million and increases in valuation

of goodwill and other intangibles of $5.2 million due to the impact

of FX revaluation.

Equity increased by $4.8 million as a result of profit for the

intervening period of $73.9 million offset by dividends paid of

$77.8 million, actuarial losses net of tax of $2.8 million and

positive exchange movements of $9.1 million.

The main dollar currency exchange rates as at 30 June 2017 and

average rates in the period were:

2017 2017 2016 2016

30 June Average 30 June Average

---------- -------- -------- -------- --------

Sterling 0.77 0.79 0.75 0.69

---------- -------- -------- -------- --------

Euro 0.88 0.93 0.90 0.90

---------- -------- -------- -------- --------

Pensions and post retirement plans

UK US Other Total

$million $million $million $million

--------------------------------- --------- --------- --------- ---------

Movement in net deficit

Net asset/(deficit) in

schemes at 1 January

2017 4.3 (29.4) (5.0) (30.1)

Deficit acquired on acquisition

of SummitReheis - - (4.3) (4.3)

Current service cost (0.3) (0.1) (0.4) (0.8)

Contributions 7.1 0.2 0.1 7.4

Administration costs (0.8) (0.2) (0.1) (1.1)

Net interest expense 0.1 (0.5) (0.1) (0.5)

Actuarial gain 0.9 4.5 - 5.4

Currency translation

differences 0.6 - (0.7) (0.1)

--------------------------------- --------- --------- --------- ---------

Net asset/(deficit) in

schemes at 30 June 2017 11.9 (25.5) (10.5) (24.1)

--------------------------------- --------- --------- --------- ---------

During the period the deficit, under IAS 19, on the Group's

pension and post retirement medical plans improved by $6.0 million

to $24.1 million. During the first six months of 2017 the UK

scheme, which represent 83% of total liabilities, had an annualised

return of 5% (2016: 25%), while the liabilities increased by 4%

(2016: increased by 22%) on the same basis. The US schemes, which

represent the majority of the remainder of liabilities, also had an

annualised return of 16% which was well above the liability growth

of 7%. The net impact is represented by the actuarial gain of $5.4

million (2016: $4.3 million) shown in the above table.

Contributions in the period totalled $7.4 million (2016: $3.8

million) and were mostly made to the UK plan. Included in this

amount was $0.8 million (2016: $0.7 million) to fund current

service costs and $6.6 million (2016: $3.1 million) for deficit

reduction. Deficit contributions are higher than for the same

period last year as a deficit funding payment relating to 2016 was

deferred from December 2016 to January 2017

Cautionary statement

The Elementis plc interim results announcement for the half year

ended 30 June 2017, which comprises the CEO's report, Finance

report and the Directors' responsibility statement (which taken

together constitute the Interim management report) and the interim

financial statements and accompanying notes (incorporating a

Condensed consolidated balance sheet at 30 June 2017, Condensed

consolidated income statement, Condensed consolidated statement of

comprehensive income, Condensed consolidated cash flow statement

and Condensed consolidated statement of changes in equity, each for

the six months ended 30 June 2017) (altogether 'Half yearly

financial report'), contains information which viewers or readers

might consider to be forward looking statements relating to or in

respect of the financial condition, results, operations or

businesses of Elementis plc. Any such statements involve risk and

uncertainty because they relate to future events and circumstances.

There are many factors that could cause actual results or

developments to differ materially from those expressed or implied

by any such forward looking statements. Nothing in this Half yearly

financial report should be construed as a profit forecast.

Related party transactions

There were no material related party transactions entered into

during the first half of the year and there have been no material

changes to the related party transactions disclosed in the

Company's 2016 Annual report and accounts on page 107.

Directors' responsibility statement

A full list of the Directors can be found on the Elementis

corporate website at: www.elementisplc.com.

The Directors confirm that to the best of their knowledge:

-- The condensed set of financial statements set out in this

half-yearly financial report has been prepared in accordance with

IAS 34 Interim Financial Reporting as adopted by the EU.

-- The condensed set of consolidated financial statements, which

has been prepared in accordance with the applicable set of

accounting standards, gives a true and fair view of the assets,

liabilities, financial position and profit or loss of the issuer,

or the undertakings included in the consolidation as a whole as

required by DTR 4.2.4R; and

-- The interim management report contained in this half-yearly

financial report includes a fair review of the information required

by:

o DTR 4.2.7R of the Disclosure and Transparency Rules, being an

indication of the important events that have occurred during the

first six months of the financial year and their impact on the

condensed set of financial statements; and a description of the

principal risks and uncertainties for the remaining six months of

the year.

o DTR 4.2.8R of the Disclosure and Transparency Rules, being

related party transactions that have taken place in the first six

months of the current financial year and that have materially

affected the financial position or performance of the entity during

that period; and any changes in related party transactions

described in the 2016 Annual report and accounts that could have a

material effect on the financial position or performance of the

entity during the first six months of the current financial

year.

Approved by the Board on 1 August 2017 and signed on its behalf

by:

Paul Waterman Ralph Hewins

CEO CFO

1 August 2017 1 August 2017

INDEPENT REVIEW REPORT TO ELEMENTIS PLC

We have been engaged by the Company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 30 June 2017 which comprises the condensed

consolidated income statement, the condensed consolidated statement

of comprehensive income, the condensed consolidated balance sheet,

the condensed consolidated statement of changes in equity, the

condensed consolidated cash flow statement and related notes 1 to

17. We have read the other information contained in the half-yearly

financial report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the condensed set of financial statements.

This report is made solely to the Company in accordance with

International Standard on Review Engagements (UK and Ireland) 2410

"Review of Interim Financial Information Performed by the

Independent Auditor of the Entity" issued by the Auditing Practices

Board. Our work has been undertaken so that we might state to the

company those matters we are required to state to it in an

independent review report and for no other purpose. To the fullest

extent permitted by law, we do not accept or assume responsibility

to anyone other than the Company, for our review work, for this

report, or for the conclusions we have formed.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the Directors. The Directors are responsible

for preparing the half-yearly financial report in accordance with

the Disclosure and Transparency Rules of the United Kingdom's

Financial Conduct Authority.

As disclosed in note 2, the annual financial statements of the

Group are prepared in accordance with IFRSs as adopted by the

European Union. The condensed set of financial statements included

in this half-yearly financial report has been prepared in

accordance with International Accounting Standard 34 "Interim

Financial Reporting" as adopted by the European Union.

Our responsibility

Our responsibility is to express to the Company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410 "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity" issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making inquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK) and consequently does not enable us to obtain

assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not

express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

June 2017 is not prepared, in all material respects, in accordance

with International Accounting Standard 34 as adopted by the

European Union and the Disclosure and Transparency Rules of the

United Kingdom's Financial Conduct Authority.

Deloitte LLP

Statutory Auditor

London, United Kingdom

1 August 2017

Condensed consolidated income statement

for the six months ended 30 June 2017

2016

2017 Six months 2016

Six months ended Year

ended 30 June ended

30 June restated 31 December

Note $million $million $million

-------------------- ----- ------------ ------------ -------------

Revenue 4 414.8 334.1 659.5

Cost of sales (259.2) (209.6) (420.5)

---------------------- ----- ------------ ------------ -------------

Gross profit 155.6 124.5 239.0

Distribution costs (50.2) (39.5) (80.0)

Administrative

expenses (53.5) (36.3) (74.5)

Income on sale 8.5 - -

of business

Operating profit 4 60.4 48.7 84.5

Other expenses (1.4) (0.8) (1.4)

Finance income 6 0.1 0.1 0.1

Finance costs 7 (5.0) (1.7) (7.7)

---------------------- ----- ------------ ------------ -------------

Profit before

income tax 4 54.1 46.3 75.5

---------------------- ----- ------------ ------------ -------------

Tax 8 (10.9) (8.9) (7.4)

---------------------- ----- ------------ ------------ -------------

Profit for the

period 43.2 37.4 68.1

---------------------- ----- ------------ ------------ -------------

Attributable to

equity holders

of the parent 43.2 37.4 68.1

---------------------- ----- ------------ ------------ -------------

Earnings per share

Basic (cents) 9 9.3 8.1 14.7

---------------------- ----- ------------ ------------ -------------

Diluted (cents) 9 9.2 8.0 14.6

---------------------- ----- ------------ ------------ -------------

Condensed consolidated statement of comprehensive income

for the six months ended 30 June 2017

2016

2017 Six months 2016

Six months ended Year

ended 30 June ended

30 June resated 31 December

$million $million $million

------------------------------------- ------------ ------------ -------------

Profit for the period 43.2 37.4 68.1

------------------------------------- ------------ ------------ -------------

Other comprehensive income:

Items that will not be reclassified

subsequently to profit or

loss:

Actuarial gain/(loss) on pension

and other post retirement

schemes 5.4 4.3 (2.6)

Deferred tax associated with

pension and other post retirement

schemes 0.1 0.9 (0.5)

------------------------------------- ------------ ------------ -------------

5.5 5.2 (3.1)

Items that may be reclassified

subsequently to profit or

loss:

Exchange differences on translation

of foreign operations 9.7 (6.4) (16.5)

Effective portion of change

in fair value of net investment

hedges 10.3 (1.3) (1.4)

Effective portion of changes

in fair value of cash flow

hedges (1.0) (2.9) (0.3)

Fair value of cash flow hedges

transferred to income statement 0.3 0.9 0.9

Exchange differences on translation

of share options reserves - - (0.7)

19.3 (9.7) (18.0)

------------------------------------- ------------ ------------ -------------

Other comprehensive income,

net of tax 24.8 (4.5) (21.1)

------------------------------------- ------------ ------------ -------------

Total comprehensive income

for the period 68.0 32.9 47.0

------------------------------------- ------------ ------------ -------------

Attributable to:

------------------------------------- ------------ ------------ -------------

Equity holders of the parent 68.0 32.9 47.0

------------------------------------- ------------ ------------ -------------

Total comprehensive income

for the period 68.0 32.9 47.0

------------------------------------- ------------ ------------ -------------

Condensed consolidated balance sheet

at 30 June 2017

2016

---------- -------------

30 June

resated

2017 $million 2016

30 June 31 December

$million $million

------------------------------- --- ---------- --------- -------------

Non-current assets

Goodwill and other intangible

assets 697.8 364.5 359.9

Property, plant and equipment 241.3 213.7 217.3

ACT recoverable 18.0 26.4 23.0

Deferred tax assets 14.7 13.9 16.1

Total non-current assets 971.8 618.5 616.3

------------------------------------ ---------- --------- -------------

Current assets

Inventories 139.8 134.8 121.3

Trade and other receivables 150.2 109.2 96.0

Current tax asset 13.5 - -

Cash and cash equivalents 74.6 56.3 82.6

------------------------------------ ---------- --------- -------------

Total current assets 378.1 300.3 299.9

------------------------------------ ---------- --------- -------------

Total assets 1,349.9 918.8 916.2

------------------------------------ ---------- --------- -------------

Current liabilities

Bank overdrafts and loans (6.5) (3.7) (5.0)

Trade and other payables (128.4) (97.9) (98.9)

Derivatives (0.3) (3.2) (0.4)

Current tax liabilities (6.4) (3.3) (6.7)

Provisions (10.5) (9.3) (9.5)

------------------------------------ ---------- --------- -------------

Total current liabilities (152.1) (117.4) (120.5)

------------------------------------ ---------- --------- -------------

Non-current liabilities

Loans and borrowings (381.4) (15.1) (0.1)

Employee retirement benefits (24.1) (24.6) (30.1)

Deferred tax liabilities (135.0) (111.2) (108.7)

Provisions (28.2) (26.2) (29.7)

Total non-current liabilities (568.7) (177.1) (168.6)

------------------------------------ ---------- --------- -------------

Total liabilities (720.8) (294.5) (289.1)

------------------------------------ ---------- --------- -------------

Net assets 629.1 624.3 627.1

------------------------------------ ---------- --------- -------------

Equity

Share capital 44.4 44.4 44.4

Share premium 21.2 20.7 20.9

Other reserves 95.9 84.5 75.2

Retained earnings 467.6 474.7 486.6

------------------------------------ ---------- --------- -------------

Equity attributable to equity

holders of the parent 629.1 624.3 627.1

Total equity and reserves 629.1 624.3 627.1

------------------------------------ ---------- --------- -------------

Condensed consolidated cash flow statement

for the six months ended 30 June 2017

2016

---------- -------------

Six

months

ended

30 June

restated

2017 $million

Six 2016

months Year

ended ended

30 June 31 December

$million $million

------------------------------------ ---------- ---------- -------------

Operating activities:

Profit for the period 43.2 37.4 68.1

Adjustments for:

Other expenses 1.4 0.8 1.4

Finance income (0.1) (0.1) (0.1)

Finance costs 4.9 1.7 7.7

Tax 10.9 8.9 7.4

Depreciation and amortisation 17.3 13.9 28.0

Decrease in provisions (2.4) (2.8) (3.5)

Pension contributions net

of current service cost (6.5) (3.1) (4.7)

Share based payments 1.4 1.2 2.6

Operating cash flows before

movements in working capital 70.1 57.9 106.9

Decrease/(increase) in inventories 2.1 (9.2) 1.7

Increase in trade and other

receivables (23.4) (19.9) (9.6)

Increase in trade and other

payables 11.6 18.2 22.5

------------------------------------- ---------- ---------- -------------

Cash generated by operations 60.4 47.0 121.5

Income taxes paid (4.2) (2.8) (2.7)

Interest paid (3.2) (0.5) (0.9)

------------------------------------- ---------- ---------- -------------

Net cash flow from operating

activities 53.0 43.7 117.9

------------------------------------- ---------- ---------- -------------

Investing activities:

Interest received 0.1 0.1 0.1

Disposal of property, plant

and equipment 0.2 0.1 0.3

Purchase of property, plant

and equipment (14.7) (14.4) (34.0)

Purchase of business (361.2) - -

Acquisition of intangibles (0.4) (1.4) (1.6)

------------------------------------- ---------- ---------- -------------

Net cash flow from investing

activities (376.0) (15.6) (35.2)

------------------------------------- ---------- ---------- -------------

Financing activities:

Issue of shares 0.3 0.5 0.7

Dividends paid (65.3) (63.7) (76.2)

Purchase of shares by the

ESOT (2.4) (0.4) (0.9)

Increase in borrowings 380.0 13.7 -

------------------------------------- ---------- ---------- -------------

Net cash used in financing

activities 312.6 (49.9) (76.4)

------------------------------------- ---------- ---------- -------------

Net increase/(decrease) in

cash and cash equivalents (10.4) (21.8) 6.3

Cash and cash equivalents

at beginning of period 82.6 79.1 79.1

Foreign exchange on cash

and cash equivalents 2.3 (1.0) (2.8)

------------------------------------- ---------- ---------- -------------

Cash and cash equivalents

at end of period 74.5 56.3 82.6

------------------------------------- ---------- ---------- -------------

Condensed consolidated statement of changes in equity

for the six months ended 30 June 2017

Share capital Share premium Translation Hedging Other Retained Total

reserve reserve reserves earnings equity

$million $million $million $million $million $million $million

--------------- -------------- -------------- -------------- -------------- ---------- -------------- ---------

At 1 January

2017 44.4 20.9 (79.9) (7.3) 162.4 486.6 627.1

Profit for

the period - - - 43.2 43.2

Other

comprehensive

income:

Exchange

differences - - 20.0 - - - 20.0

Movement in

cash flow

hedges - - - (0.7) - - (0.7)

Actuarial

gain on

pension

scheme - - - - - 5.4 5.4

Deferred tax

adjustment

on pension

scheme

deficit - - - - - 0.1 0.1

Transactions

with owners:

Issue of

shares - 0.3 - - - - 0.3

Purchase of

shares - - - - - (2.4) (2.4)

Share based

payments - - - - 1.4 - 1.4

Dividends

paid - - - - - (65.3) (65.3)

At 30 June

2017 44.4 21.2 (59.9) (8.0) 163.8 467.6 629.1

--------------- -------------- -------------- -------------- -------------- ---------- -------------- ---------

Translation Retained

Share reserve Hedging Other earnings

capital Share premium restated reserve reserves restated Total equity

$million $million $million $million $million $million $million

--------------- ------------- -------------- ------------- ------------- ---------- ------------- -------------

At 1 January

2016 44.4 20.2 (62.0) (7.9) 162.9 496.2 653.8

Profit for

the period - - - - - 37.4 37.4

Other

comprehensive

income:

Exchange

differences - - (7.7) - - - (7.7)

Movement in

cash flow

hedges - - - (2.0) - - (2.0)

Actuarial

gain on

pension

scheme - - - - - 4.3 4.3

Deferred tax

adjustment

on pension

scheme

deficit - - - - - 0.9 0.9

Transactions

with owners:

Issue of

shares - 0.5 - - - - 0.5

Purchase of

shares - - - - - (0.4) (0.4)

Share based

payments - - - - 1.2 - 1.2

Dividends

paid - - - - - (63.7) (63.7)

At 30 June

2016 44.4 20.7 (69.7) (9.9) 164.1 474.7 624.3

--------------- ------------- -------------- ------------- ------------- ---------- ------------- -------------

Notes to the interim financial statements for the six months

ended 30 June 2017

1 General Information

Elementis plc (the 'Company') and its subsidiaries (together,

the 'Group') manufactures specialty chemicals. The Group has

operations in the US, UK, Netherlands, Brazil, Germany, China,

Taiwan, Malaysia and India. The Company is a limited liability

company incorporated and domiciled in England, UK and is listed on

the London Stock Exchange.

2 Accounting policies

Basis of preparation

This condensed set of financial statements (also referred to as

'interim financial statements' in this announcement) has been

prepared in accordance with IAS 34 Interim Financial Reporting as

adopted by the EU.

As required by the Disclosure and Transparency Rules of the

Financial Services Authority, the condensed set of financial

statements has been prepared applying the accounting policies and

presentation that were applied in the preparation of the Company's

published consolidated financial statements for the year ended 31

December 2016, except when new or revised accounting standards have

been applied.

The preparation of these interim financial statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of income, expense, assets and liabilities. The significant

estimates and judgements made by management were consistent with

those applied to the consolidated financial statements for the year

ended 31 December 2016.

The information for the year ended 31 December 2016 does not

constitute statutory accounts as defined in section 434 of the

Companies Act 2006. A copy of the statutory accounts for that year

has been delivered to the Registrar of Companies. The auditor's

report on those accounts was not qualified, did not include a

reference to any matters to which the auditors drew attention by

way of emphasis without qualifying the report and did not contain

statements under section 498(2) or (3) of the Companies Act

2006.

3 Going concern

The Directors have assessed the Group as a going concern, having

given consideration to its business plans and financial forecasts,

as well as to the risks and material uncertainties to the Group's

trading performance arising therefrom. The Group is in a net debt

position at the end of 30 June 2017 of $313.3 million but has

facilities available in excess of $100 million.

The Directors are satisfied that, after considering all of the

above, the Group has adequate resources to remain in operational

existence for the foreseeable future, that it is appropriate for

the Group to adopt the going concern basis of accounting in

preparing these interim financial statements, and that there are no

material uncertainties to the ability of the Group and Company to

continue to do so over a period of at least twelve months from the

date of approval of the interim financial statements.

4 Segment reporting

For management purposes the Group is currently organised into

three operating divisions - Specialty Products, Surfactants and

Chromium. Principal activities are as follows:

Specialty Products - production of rheological additives and

compounded products.

Surfactants - production of surface active ingredients.

Chromium - production of chromium chemicals.

Six months ended Six months ended Year ended

30 June 2017 30 June 2016 31 December

2016

Gross Inter-segment External

Gross Inter-segment External restated restated restated Gross Inter-segment External

$million $million $million $million $million $million $million $million $million

------------- --------- -------------- --------- --------- -------------- --------- --------- -------------- ---------

Revenue

Specialty

Products 294.5 - 294.5 238.8 - 238.8 460.4 - 460.4

Surfactants 31.4 (0.1) 31.3 21.8 (0.1) 21.7 43.1 (0.2) 42.9

Chromium 95.4 (6.4) 89.0 80.9 (7.3) 73.6 168.8 (12.6) 156.2

------------- --------- -------------- --------- --------- -------------- --------- --------- -------------- ---------

421.3 (6.5) 414.8 341.5 (7.4) 334.1 672.3 (12.8) 659.5

------------- --------- -------------- --------- --------- -------------- --------- --------- -------------- ---------

All revenues relate to the sale of goods

2016 2016

------------

Six months Year

ended ended

30 June 31 December

restated restated

2017

Six months

ended

30 June

$million $million $million

-------------------- ------------ ----------- ------------

Operating profit

Specialty Products 52.1 41.4 77.5

Surfactants 9.1 (0.2) (0.9)

Chromium 15.7 15.4 23.6

Central costs (16.5) (7.9) (15.7)

-------------------- ------------ ----------- ------------

Operating profit 60.4 48.7 84.5

-------------------- ------------ ----------- ------------

Other expenses (1.4) (0.8) (1.4)

Finance income 0.1 0.1 0.1

Finance costs (5.0) (1.7) (7.7)

-------------------- ------------ ----------- ------------

Profit before tax 54.1 46.3 75.5

-------------------- ------------ ----------- ------------

5 Adjusting items and alternative performance measures

In calculating the profitability measures by which management

assesses the performance of the Group a number of items are

excluded from operating profit as reported in accordance with IFRS.

The Board believes that the adjusted measures assist shareholders

in better understanding the underlying performance of the

business.

2016 2016

------------

Six months Year

ended ended

30 June 31 December

restated restated

2017

Six months

ended

30 June

$million $million $million

------------------------------ ------------ ----------- ------------

Reported operating profit 60.4 48.7 84.5

------------------------------ ------------ ----------- ------------

Adjusting items:

Acquisition costs 6.0 - 0.8

Restructuring 0.7 1.7 3.0

Business review 0.9 1.9 2.4

Amortisation of intangibles

arising on acquisition 3.1 1.3 2.7

Colourants disposal and (3.5) - -

Jersey City site closure

Other - - 3.5

------------------------------ ------------ ----------- ------------

Net adjusting items 7.2 4.9 12.4

------------------------------ ------------ ----------- ------------

Adjusted operating profit 67.6 53.6 96.9

------------------------------ ------------ ----------- ------------

2016 2016

------------

Six months Year

ended ended

30 June 31 December

restated restated

2017 $million $million

Six months

ended

30 June

$million

---------------------------- ------------ ----------- ------------

Adjusted operating profit

Specialty Products 51.6 43.7 81.5

Surfactants 9.1 (0.2) (0.6)

Chromium 15.8 15.4 27.1

Central costs (8.9) (5.3) (11.1)

---------------------------- ------------ ----------- ------------

Adjusted operating profit 67.6 53.6 96.9

Other expenses (1.4) (0.8) (1.4)

Finance income 0.1 0.1 0.1

Finance costs (5.0) (1.7) (7.7)

---------------------------- ------------ ----------- ------------

Adjusted profit before tax 61.3 51.2 87.9

---------------------------- ------------ ----------- ------------

Adjusted operating margin is the ratio of Adjusted operating

profit to sales.

Contribution margin is defined as sales less all variable costs,

divided by sales, expressed as a percentage and is unaffected by

the adjusting items recorded above.

The adjusted tax rate is defined as the provision for tax on

profits after adjusting items, divided by the adjusted profit

before income tax.

EBITDA is defined as Operating profit excluding the charge for

depreciation and amortisation. Adjusted EBITDA is defined as the

Operating profit after adjusting items (except where those

adjusting items relate to interest, depreciation or amortisation)

excluding the charge for depreciation and amortisation.

Acquisition costs primarily relate to the fees for legal and

advisory work incurred in the acquisition of SummitReheis. In the

first half of 2016 a business review was undertaken by a third

party to support development of the long term strategy and internal

transformation for Elementis. The one time cost of this exercise

was $1.9m however subsequent costs have been incurred for delivery

of this transformation. In previous years Elementis has not

adjusted operating profit for the amortisation of intangibles

arising on acquisition. Following the acquisition of SummitReheis,

the Directors reviewed this policy and concluded that excluding

such a charge from the operating profit will provide readers of the

accounts with a better understanding of the Group's results on its

operating activities and, as such, this charge is now included

within adjusting items. In March 2017 Elementis announced the sale

of its US Colourants business to Chromaflo Technology Corp, and

closure of the Jersey City site. The net profit on this disposal

and closure was $3.5 million and, given the one time nature of the

transaction, has been treated as an adjusting item.

6 Finance income

2017 2016 2016

Six months Six months Year

ended ended ended

30 June 30 June 31 December

$million $million $million

--------------------------- ----------- ----------- ------------

Interest on bank deposits 0.1 0.1 0.1

--------------------------- ----------- ----------- ------------

7 Finance costs

2017 2016 2016

Six months Six months Year

ended ended ended

30 June 30 June 31 December

$million $million $million

----------------------------------- ----------- ----------- ------------

Interest on bank loans 4.3 0.6 0.8

Unwind of discount on provisions 0.6 0.7 1.4

Increase in environmental

provisions due to change in

discount rate - - 4.5

Pension and other post-retirement

liabilities 0.1 0.4 1.0

----------------------------------- ----------- ----------- ------------

5.0 1.7 7.7

----------------------------------- ----------- ----------- ------------

8 Tax

The provision for tax on profits of $10.9 million, or 20.1%

(2016: $8.9 million , or 19.2% ) is based on the probable tax

charge in those jurisdictions where profits arise. Within this

figure is a tax credit of $1.8m in respect of adjusting items.

9 Earnings per share

2016 2016

Six months Year

------------

ended ended

30 June 31 December

restated restated

2017

Six months

ended

30 June

$million $million $million

------------------------------------- ------------ ------------ -----------------

Earnings for the purposes of

basic earnings per share 43.2 37.4 68.1

Adjusting items net of tax 5.4 3.5 12.4

------------------------------------- ------------ ------------ -----------------

Adjusted earnings 48.6 40.9 80.5

------------------------------------- ------------ ------------ -----------------

Number(m) Number(m) Number(m)

------------------------------------- ------------ ------------ -----------------

Weighted average number of shares

for the purposes of basic earnings

per share 463.6 463.1 462.8

Effect of dilutive share options 5.4 2.6 3.9

------------------------------------- ------------ ------------ -----------------

Weighted average number of shares

for the purposes of diluted

earnings per share 469.0 465.7 466.7

------------------------------------- ------------ ------------ -----------------

2016 2016

2017 Six months Year

Six months ended ended

ended 30 June 31 December

30 June restated restated

cents cents cents

------------------------------ ------------ ------------ -------------

Earnings per share:

Basic 9.3 8.1 14.7

------------------------------ ------------ ------------ -------------

Diluted 9.2 8.0 14.6

------------------------------ ------------ ------------ -------------

Adjusted earnings per share:

------------------------------ ------------ ------------ -------------

Basic 10.5 8.8 17.4

------------------------------ ------------ ------------ -------------

Diluted 10.4 8.8 17.2

------------------------------ ------------ ------------ -------------

10 Dividends

The following dividends were declared and paid by the Group:

2017

Six 2016 2016

months Six months Year

ended ended ended

30 June 30 June 31 December

$million $million $million

----------------------------------- --------- ------------ -----------------

Dividends paid on ordinary shares 65.3 63.7 76.2

----------------------------------- --------- ------------ -----------------

An interim dividend of 2.70 cents per share (2016: 2.70 cents)

has been declared by the Board of Directors and will be paid on 29

September 2017 to shareholders on the register at 8 September 2017.

The interim dividend will be paid in sterling at an exchange rate

of $1.3177:GBP1.00.

11 Pension

Valuations for IAS 19 purposes were conducted as of 30 June

2017. The Group is reporting a deficit on its combined retirement

benefit obligations of $24.1 million at the end of June 2017,

compared to balances of $24.6 million at the same time last year

and $30.1 million at the end of December 2016. Additional

commentary is included in the Finance report.

12 Movement in net cash/(borrowings)

2017 2016 2016

Six Six

months months Year

ended ended ended

30 June 30 June 31 December

$million $million $million

----------------------------------- --------- --------- ------------

Change in net cash/(borrowings)

resulting from cash flows

(Decrease)/increase in cash and

cash equivalents (10.4) (21.8) 6.3

(Increase)/decrease in borrowings (380.0) (13.7) -

----------------------------------- --------- --------- ------------

(390.4) (35.5) 6.3

Currency translation differences (0.4) (1.0) (2.8)

----------------------------------- --------- --------- ------------

(Decrease)/increase in net cash (390.8) (36.5) 3.5

Net cash at beginning of period 77.5 74.0 74.0

----------------------------------- --------- --------- ------------

Net (debt)/cash at end of period (313.3) 37.5 77.5

----------------------------------- --------- --------- ------------

13 Principal risks and uncertainties

The Group has policies, processes and systems in place to help

identify, evaluate and manage risks at all levels throughout the

organisation. Certain key risks, because of their size, likelihood

and/or severity, are reviewed regularly by the senior leadership

team and the Board, to ensure that appropriate action is taken to

eliminate, reduce or mitigate, wherever practicable, significant

risks that can lead to financial loss, harm to reputation, business

failure or which threaten the safety of our employees.

The following is a summary of the principal risks faced by the

Group that could impact the second half of the year: (i) uncertain

global economic conditions and competitive pressures in the

marketplace (including from currency movement); (ii) business

interruption as a result of a major event (e.g. operations/HSE, IT,

transport or workplace incident caused by process/system failure,

human error, terrorist incident or by fire, storm and/or flood), or

a natural catastrophe (e.g. hurricane and/or pandemic); (iii)

business interruption as a result of supply chain failure of key

raw materials and/or third party service provision (e.g.

infrastructure, transport or IT failure); (iv) increasing

regulatory and product stewardship challenges; (v) major regulatory

enforcement action, litigation and/or other claims arising from

products and/or historical and ongoing operations; (vi) talent

management and succession planning: failure to attract, manage,

develop and/or retain key talent; (vii) cyber security incident:

systems security breach and loss of network connectivity and

integrity, and/or loss of business and personal data; (viii)

industrial espionage, workplace security and loss/theft of

intellectual property; (ix) disruptive technology advances: failure

to identify and mitigate the threat posed by new or imitation

technology; and (x) changes in international tax policy. A full

description of these risks and the mitigating actions taken by the

Company can be found in the 2016 Annual report and accounts on

pages 17 to 21.

14 Financial risk management

The Group has exposure to the following financial risks:

-- credit risk;

-- liquidity risk; and

-- market risk.

The Board of Directors has overall responsibility for the

establishment and oversight of the Group's risk management

framework. The Group's risk management policies are established to

identify and analyse the risks faced by the Group, to set

appropriate risk limits and controls, and to monitor risks and

adherence to limits. Risk management policies and systems are

reviewed regularly to reflect changes in market conditions and the

Group's activities. The Group's Audit Committee, assisted by

Internal Audit, oversees how management monitors compliance with

the Group's risk management policies and procedures and reviews the

adequacy of the risk management framework in relation to the risks

faced by the Group. These interim financial statements do not

include all the financial risk management information and

disclosures that are required in the Annual report and accounts and

should be read in conjunction with the financial statements for the

year ended 31 December 2016. The Group's risk management policies

have not changed since the year end.

The Group measures fair values in respect of financial

instruments in accordance with IFRS 13, using the following fair

value hierarchy that reflects the significance of the inputs used

in making the measurements:

Level 1: Quoted market price (unadjusted) in an active market

for an identical instrument.

Level 2: Valuation techniques based on observable inputs, either

directly or indirectly.

Level 3: Valuation techniques using significant unobservable

inputs.

The Group categorises its trade and other receivables and

payables, excluding derivatives, within level 3 and all other

financial instruments, including cash, loans and derivatives within

level 1. At both 30 June 2017 and 31 December 2016 there was no

difference between the carrying value and fair value of financial

instruments.

15 Contingent liabilities

As is the case with other chemical companies, the Group

occasionally receives notices of litigation relating to regulatory

and legal matters. A provision is recognised when the Group

believes it has a present legal or constructive obligation as a

result of a past event, and it is probable that an outflow of

economic benefits will be required to settle the obligation. Where

it is deemed that an obligation is merely possible and that the

probability of a material outflow is not remote, the Group would

disclose a contingent liability. No contingent liability was

considered to be reportable at 30 June 2017.

16 Acquisition

On 24 March 2017 the Group acquired 100% of the equity, which

gives control, of SummitReheis for a cash consideration of $370.3m.

Further acquisition related costs to 30 June 2017 of $6.0 million

have been included within administrative expenses in the income

statement but also reflected within adjusting items (note 5).

SummitReheis is a high quality, high margin specialty chemicals

platform that produces a range of critical active ingredients and

materials tailored for use in personal care, pharmaceutical and

dental products. SummitReheis' anti-perspirant actives business

(more than 60% of its sales) is the global leader in the

manufacture and sale of active ingredients for anti-perspirants and

has long standing relationships with key consumer product companies

across the Americas, Europe and Asia.

IFRS 3 "Business Combinations" (revised 2008) requires the

assets acquired to be initially recorded at fair value at the date

of acquisition. Any such fair value adjustments are provisional and

will be finalised within twelve months of the acquisition date. Any

resulting changes in the fair values may have an impact on the

depreciation from the date of acquisition and will be recorded in

the financial statements. An assessment of the fair value of the

assets and liabilities is being performed and will form the basis

of the valuation to be included in the year end accounts.

The acquisition had the following effect on the Group's assets

and liabilities:

Book value

acquisition

$million

------------------------------- ------------

Intangible assets 75.0

Property, plant and equipment 18.8

Inventories 17.7

Trade and other receivables 27.0

Trade and other payables (12.6)

Cash and cash equivalents 9.1

Provisions (0.5)

Employee retirement benefits (4.3)

Corporation tax 14.1

Deferred tax (27.1)

--------------------------------- ------------

117.2

Goodwill 253.1

Consideration paid, satisfied

in cash 370.3

Cash acquired (9.1)

--------------------------------- ------------

Net cash outflow 361.2

--------------------------------- ------------

No preliminary assessment of intangible assets and the Property

Plant and Equipment (PPE) valuation had been completed at the date

of these condensed financial statements as such the Book Value of

the acquired assets has been used in completion of these

statements. When the final valuation work is concluded, an

adjustment in PPE and intangible assets values, and a corresponding

adjustment in goodwill is anticipated. None of the goodwill is

deductable for tax purposes.

In the first half of 2017 the acquisition contributed $38.1m to

the Group's revenue and $6.0m to the adjusted operating profit.

The estimated contribution of SummitReheis to the results of the

Group had the acquisition been made on 1 January 2017 is as

follows:

2017

Six months

ended

30 June

$million

--------------------------- -----------

Revenue 67.0

----------------------------- -----------

Adjusted operating profit 10.0

----------------------------- -----------

17 Prior year restatement

During 2016 the Directors considered the detailed criteria for

the recognition of revenue from the sale of goods set out in IAS 18

Revenue and, in particular, when the Group had transferred the

significant risks and rewards of ownership of the goods. Following

further assessment of the terms of shipment, the Directors have

concluded that international shipments should not be recognised

within revenue until they reach the destination port, as they

believe that this more accurately reflects the commercial substance

of the transaction in that risks and rewards of ownership pass to

the customer at this point. Due to this change in the accounting

policy, the prior year comparatives have therefore been restated to

provide comparable information.

The financial statement line items impacted have been set out

below.

Consolidated income statement

June June June

2016 2016 Adjusting 2016

Adjusted

reported restatement restated items restated

$million $million $million $million $million

---------------------- --------- --------------- -------------- ------------ -------------------

Revenue 334.0 0.1 334.1 - 334.1

Cost of sales (211.1) 1.5 (209.6) - (209.6)

---------------------- --------- --------------- -------------- ------------ -------------------

Gross profit 122.9 1.6 124.5 - 124.5

Operating profit 47.1 1.6 48.7 4.9 53.6

---------------------- --------- --------------- -------------- ------------ -------------------

Profit before income

tax 44.7 1.6 46.3 4.9 51.2

Tax charge (8.3) (0.6) (8.9) (1.4) (10.3)

Profit for the year 36.4 1.0 37.4 3.5 40.9

---------------------- --------- --------------- -------------- ------------ -------------------

2016

2016 Adjusting restated

restated items adjusted

$million $million $million

---------------------- -------------- ------------ -------------------

Revenue 659.5 - 659.5

Cost of sales (420.5) - (420.5)

------------------------ -------------- ------------ -------------------

Gross profit 239.0 - 239.0

Operating profit 84.5 12.4 96.9

------------------------ -------------- ------------ -------------------

Profit before income

tax 75.5 16.9 92.4

Tax charge (7.4) (4.6) (12.0)

Profit for the year 68.1 12.3 80.4

------------------------ -------------- ------------ -------------------

Consolidated statement of comprehensive income

June June

2016 2016

reported Restatement restated

$million $million $million

---------------------------- ------------------------------ ------------ ---------

Profit for the year 36.4 1.0 37.4