Elementis PLC AGM / Interim Management Statement

April 27 2016 - 2:00AM

UK Regulatory

TIDMELM

27 April 2016

AGM / Interim Management Statement

Elementis plc (ELM.L, the "Company" or the "Group"), the Global Specialty

Chemicals Company, today issues its Interim Management Statement for the three

months ended 31 March 2016.

Commenting on the Company's performance Group Chief Executive, Paul Waterman,

said: "During my first two months at Elementis I have been impressed by the

quality of our people and the resilience of our business model. This is best

exemplified by the sustained level of contribution margins in Specialty

Products, the relative stability of the Chromium business in North America and

the Group's strong cash generation. Although some markets continue to be

challenging and we are cycling against a stronger first quarter in 2015, we are

proactively managing our margins and cost base to ensure that our performance

for the year remains in line with management expectations."

In Specialty Products, sales performance in coatings and personal care was

satisfactory, while currency and lower oilfield sales resulted in total sales

being 7 per cent below the same period last year. The following comments by

division refer to constant currency sales:

* In coatings additives, sales in North America were similar to the previous

year as sales of decorative products from the New Martinsville plant

continued to make good progress, while industrial sales remained subdued

due to the impact of the stronger dollar on consumer exports, as previously

reported. Sales in Europe were 1 per cent higher, while sales in Asia

Pacific were 1 per cent lower, following the destocking and adjustment that

took place in the Chinese economy in the second quarter of 2015. Sales to

Latin America represent 5 per cent of total coatings sales and were 9 per

cent lower than the previous year due to economic weakness in that region,

particularly in Brazil.

* In personal care, sales were 4 per cent higher than the previous period, as

the business continued to benefit from geographic expansion and new product

sales.

* Sales in oilfield drilling were broadly in line with the quarterly sales

run rate experienced in the second half of 2015, following the sharp

downturn in North American demand that took place in the early part of

2015. Consequently, sales for the current quarter were 37 per cent below

the same quarter last year.

As anticipated, Chromium sales for the first quarter were 11 per cent lower

than the previous year, as market conditions outside of North America continued

to be challenging. Although sales in North America were lower by 5 per cent,

this is largely due to order timing and sales for the first six months of the

year are expected to be in line with the same period last year. Sales outside

of North America were 19 per cent lower than the previous year, with volumes

lower by 6 per cent and pricing lower by 13 per cent.

The Group's balance sheet remains strong and is again expected to be in a net

cash position at the end of the year which, under our dividend policy, will

continue to provide shareholders with attractive returns.

ENDS

Enquiries:

Elementis + 44 (0) 207 067 2999

Paul Waterman, Chief Executive

Brian Taylorson, Finance Director

FTI Consulting + 44 (0) 203 727 1000

Deborah Scott

Matthew Cole

END

(END) Dow Jones Newswires

April 27, 2016 02:00 ET (06:00 GMT)

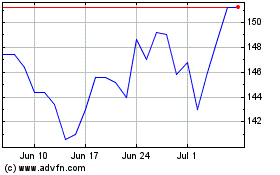

Elementis (LSE:ELM)

Historical Stock Chart

From Mar 2024 to Apr 2024

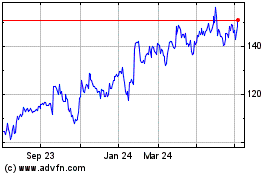

Elementis (LSE:ELM)

Historical Stock Chart

From Apr 2023 to Apr 2024