Electrolux to Pay $175 Million for Failed GE Deal

December 09 2015 - 3:20PM

Dow Jones News

STOCKHOLM—Electrolux AB's failed ambition to acquire General

Electric Co.'s appliance business came at a price: The Swedish firm

said Wednesday it would pay the $175 million break-up fee demanded

by the U.S. company.

The charge, compounded with the botched promise of creating a

white-goods giant capable of rivaling with Chinese leaders and

Whirlpool Corp. of the U.S., might also cost Keith McLoughlin his

job as Electrolux chief executive, analysts said.

"Electrolux has put a lot of time, money and prestige into this

deal," said Mattias Eriksson, chief strategist at Nordea. "As the

company goes back to the drawing board it might be a natural time

to switch chief executive."

Mr. McLoughlin didn't respond to requests seeking comment.

According to a company spokesman, he has said he was "fully

committed to continue in (his) role."

GE's decision at the start of the week to abandon a $3.3 billion

agreement to sell its appliance business to Electrolux has tossed

the Swedish company 15 months backward, when it was trying to solve

a delicate equation: How to counter the onslaught of Chinese and

South Korean appliance manufacturers on its traditional Western

markets while conquering positions in Asia.

A big expansion in the U.S., where Electrolux has a 20% market

share, could prove difficult after the U.S. Justice Department

challenged the proposed transaction with GE in court, sending a

message that it wants more competition, not consolidation.

When the deal collapsed on Monday, a lawyer for the Justice

Department said it would have been "bad for the millions of

consumers who buy cooking appliances every year. Electrolux and

General Electric could not overcome that reality at trial."

Mr. McLoughlin said Monday he was confident Electrolux could

expand in emerging markets.

But the CEO has presided over several failed attempts to

increase Electrolux's sales in China. In 2013 he ended a strategy

to compete head-on with local rivals for cheap home appliances,

instead launching an effort to move the Electrolux brand upmarket

in the country. But the new approach hasn't fared better than the

previous one, the company says.

Electrolux generates 18% of its 112 billion Swedish krona ($13.9

billion) in annual sales from Latin America and 8% from the Asia

and Pacific region. That remains far off its long stated goal of

generating half of its sales from emerging markets.

The U.S. flop is a setback for Mr. McLoughlin, a graduate of the

U.S. Military Academy at West Point, who had announced the proposed

deal—the largest ever for Electrolux—with much fanfare in September

2014.

"This is an historic moment and important strategic move for the

Electrolux Group, which takes our company to a new level in terms

of global reach and market coverage," he said at the time.

Throughout the review process, however, Mr. McLoughlin appears

to have underestimated the antitrust obstacle posed by the Justice

Department, saying repeatedly he was confident Electrolux could

secure the purchase with minor concessions.

Mr. McLoughlin's appearance in the Washington court handling the

case on Nov. 19 caused confusion. Days after the CEO testified that

a combination of Electrolux and GE's appliance businesses wouldn't

hinder competition, providing details on product-offering

developments by competitors to support his claim, lawyers for the

Swedish company said Mr. McLoughlin had made incorrect statements

which he wanted to retract.

Mr. McLoughlin has survived several controversies in Sweden.

Upon taking the CEO job in January 2011, he was criticized in

Swedish media for collecting the country's biggest executive

paycheck. More recently, the Swedish press questioned his choice of

moving into a luxurious hotel after terminating the lease on his

Stockholm house.

Despite the failed deal with GE, Mr. McLoughlin continues to

enjoy support from Electrolux's biggest shareholder, Investor AB,

the investment vehicle of the prominent Swedish Wallenberg

family.

Investor, however, said it was expecting a new roadmap from the

CEO.

"Now we have to look forward and find other ways to develop the

company," said Stefan Stern, a spokesman at Investor.

An Electrolux union delegate in Sweden, Viveca

Brinkenfeldt-Lever, said employees had been disappointed to see GE

pulling the plug on the proposed deal without waiting for the

outcome of the antitrust trial initiated by the Department of

Justice.

On Mr. McLoughlin, she said: "He has our full support."

Write to Christina Zander at christina.zander@wsj.com

(END) Dow Jones Newswires

December 09, 2015 15:05 ET (20:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

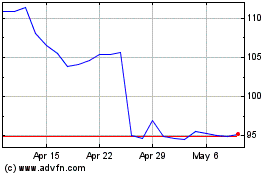

Whirlpool (NYSE:WHR)

Historical Stock Chart

From Mar 2024 to Apr 2024

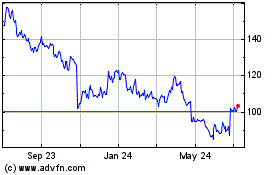

Whirlpool (NYSE:WHR)

Historical Stock Chart

From Apr 2023 to Apr 2024