Edwards Lifesciences Revenue Rises 8.6%, 2016 Outlook Raised

February 02 2016 - 4:50PM

Dow Jones News

Edwards Lifesciences Corp. said its fourth-quarter revenue rose

8.6% on continued strong sales growth for the medical-device

maker's nonsurgical heart valves.

The medical-device maker also raised its 2016 outlook and

projected fourth-quarter results mostly above analysts' views.

The Irvine, Calif., company reported revenue of $671.1 million

compared with $618 million a year earlier. Edwards expected revenue

of $620 million to $660 million. However, on an underlying basis,

which excludes currency impacts and sales-return reserve impacts,

sales improved 15%.

The company has continued to post better-than-expected sales of

its nonsurgical heart valves, despite increased competition. The

devices, known as transcatheter heart valves, provide an

alternative option for elderly patients who are considered at high

risk of complications in open-heart surgery. Edwards recently

received Food and Drug Administration approval to study the safety

and effectiveness of the company's Sapien 3 valve in lower-risk

patients. If the study ultimately leads to U.S. regulatory

approval, Edwards will be able to market the heart valves to a

broader group of patients.

For 2016, the company raised its per-share earnings estimate to

$2.57 to $2.67 and revenue of $2.6 billion and $2.85 billion,

compared with its previous estimate for per-share profit of $2.30

to $2.40 and revenue of $2.5 billion to $2.75 billion. The guidance

reflects Edwards raising its transcatheter heart valve sales

estimate by $100 million to between $1.3 billion and $1.5

billion.

For the first quarter, the company forecast per-share earnings

of 64 cents to 70 cents and revenue of $640 million to $680

million. Analysts polled by Thomson Reuters expected per-share

profit of 59 cents and revenue of $643 million.

For the latest quarter, sales of Edwards's transcatheter heart

valves, which are implanted with catheter tubes inserted through

the arteries, increased 25% to $334.3 million. According to

FactSet, analysts had expected transcatheter heart-valve sales of

$319 million. Meanwhile, underlying sales of transcatheter heart

valves climbed 32%.

Edwards's fourth-quarter per-share results reflect the company's

2-for-1 stock split completed in December, Edwards's second stock

split since going public in April of 2000. Companies typically make

such moves to make their stocks more attractive to a broader range

of investors. Though investors hold more shares under such stock

splits, their relative stakes in the companies typically aren't

affected.

Over all, Edwards reported a profit of $140.7 million, or 64

cents a share, up from $109.2 million, or 50 cents a share, a year

earlier. Excluding acquisition-related charges and other items,

per-share earnings rose to 63 cents from 53 cents. Analysts polled

by Thomson Reuters expected 62 cents.

Gross margin fell to 73.8% from 74%, driven by higher

manufacturing costs.

Surgical heart valve sales rose 4.8% to $196.2 million. Analysts

expected $196 million, according to FactSet. Segment sales

increased slightly on an underlying basis.

Critical-care product sales dropped 2.6% to $140.6 million.

Analysts projected $136 million, according to FactSet. On an

underlying basis, segment sales improved by 3.6%.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

February 02, 2016 16:35 ET (21:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

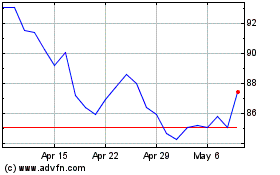

Edwards Lifesciences (NYSE:EW)

Historical Stock Chart

From Mar 2024 to Apr 2024

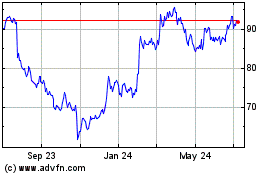

Edwards Lifesciences (NYSE:EW)

Historical Stock Chart

From Apr 2023 to Apr 2024