Edwards Lifesciences Raises 2016 View

April 26 2016 - 5:00PM

Dow Jones News

Edwards Lifesciences Corp. again raised its 2016 guidance as

strong sales of the medical device maker's nonsurgical heart valves

drove better-than-expected profit and revenue for the first

quarter.

The devices, known as transcatheter heart valves, provide an

alternative option for elderly patients who are considered at high

risk of complications in open-heart surgery. Sales of the

nonsurgical valves have continued to beat expectations despite

increased competition.

For the year, the Irvine, Calif., company again raised its

per-share earnings estimate to $2.67 and $2.77 and revenue guidance

to $2.7 and $3 billion, from its previous estimate for per-share

profit of $2.57 to $2.67 and revenue of $2.6 billion and $2.85

billion.

Edwards said the raised guidance reflects strong momentum in the

first quarter, along with expectations for an

earlier-than-anticipated expansion of access to its Sapien 3 heart

value in the U.S., as well as positive currency effects.

Earlier this month, Edwards released data indicating that its

Sapien 3 valve wasn't inferior to open heart surgery and it some

cases was better. The positive data could pave the way for a

quicker Food and Drug Administration approval for Sapien 3's use in

intermediate-risk patients, expanding access to the valves which

the U.S. regulator approved in June 2015 for high-risk

patients.

For the latest quarter, sales of Edwards's transcatheter heart

valves, which are implanted with catheter tubes inserted through

the arteries, climbed 37% to $367.8 million. According to FactSet,

analysts had expected transcatheterheart-valve sales of $340

million. Meanwhile, underlying sales of transcatheter heart valves

grew 38%.

Chairman and Chief Executive Michael A. Mussallem attributed the

improved sales to strong growth in transcatheter heart valve

procedures, as well as the U.S. launch of the Sapien 3 valve.

Over all, Edwards Lifesciences reported a profit of $143

million, or 66 cents a share, up from $123.4 million, or 56 cents a

share, a year earlier. Excluding one-time items, per-share earnings

rose to 71 cents from 57 cents. Revenue increased 18% to $697.3

million. Underlying sales, which exclude currency fluctuations and

sales-return reserve impacts—grew 20%.

The company had projected per-share earnings of 64 cents to 70

cents and revenue of $640 million to $680 million.

Surgical heart valve sales edged down 0.5% to $195.9 million,

though underlying sales improved slightly. Analysts had expected

$189 million, according to FactSet.

Critical-care product sales grew 7% to $133.6 million. Analysts

projected $125 million, according to FactSet. On an underlying

basis, segment sales rose 9.1%.

Gross margin fell to 74.1% from 77%.

For the current quarter, the company forecast per-share earnings

of 67 cents to 73 cents and sales of $700 million to $740 million.

Analysts polled by Thomson Reuters most recently forecast per-share

profit of 67 cents and revenue of $698 million.

Write to Tess Stynes at tess.stynes@wsj.com

(END) Dow Jones Newswires

April 26, 2016 16:45 ET (20:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

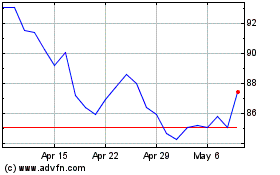

Edwards Lifesciences (NYSE:EW)

Historical Stock Chart

From Mar 2024 to Apr 2024

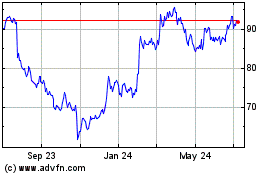

Edwards Lifesciences (NYSE:EW)

Historical Stock Chart

From Apr 2023 to Apr 2024