Edwards Lifesciences Crafts 52-Week High - Analyst Blog

May 14 2014 - 4:00PM

Zacks

Shares of Edwards

Lifesciences Corp. (EW) hit a new 52-week high of $86.52

on May 13, eventually closing at $86.11. The closing share price

represents an extraordinary one-year return of 20.3% and a

year-to-date return of 30.6%. Average volume of shares traded over

the last three months was 1,237K.

This Zacks Rank #3 (Hold) company

has a market cap of $9.08 billion with long-term earnings growth

expectations of 15.2%.

Growth Drivers

Edwards Lifesciences delivered

mixed first-quarter 2014 results with a bottom-line beat and a

top-line miss.

However, for all good reasons, the

company has managed to be in the news since the beginning of 2014.

Edwards Lifesciences kick-started the year with the receipt of CE

mark for its SAPIEN 3 in January and SAPIEN XT in February followed

by the INTUITY Elite Valve System winning the same in April.The

company is also positive on the expected U.S. Food and Drug

Administration (FDA) sanction of the Sapien XT valve by the second

quarter of this year.

In addition, enrollment of 1,000

intermediate risk patients in the U.S. SAPIEN 3 trial is on track

and is expected to be completed by the end of this year. Till date,

the company has launched many new products, demonstrated strong

clinical data and made significant progress on several key

developments indicating sustainable future growth.

Outside the U.S., Transcatheter

Heart Valves (THV) sales grew 33% in the last reported quarter,

driven by exceptionally strong growth in Europe and the ongoing

rollout of SAPIEN XT in Japan. Edwards expects the positive

procedural growth trends in Europe to further strengthen this

year.

With the favorable court ruling

against Medtronic Inc. (MDT) announced in April

2014 and next-generation transcatheter valve SAPIEN XT in the

company's pipeline, Edwards Lifesciences is well positioned to

continue dominating and consolidating its foothold in the U.S.

transcatheter aortic heart valve market.

Other Stocks to

Consider

Better-ranked medical instruments

stocks that are worth a look include Masimo

Corporation (MASI) and Accuray

Incorporated (ARAY). All of these three stocks carry a

Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

ACCURAY INC (ARAY): Free Stock Analysis Report

EDWARDS LIFESCI (EW): Free Stock Analysis Report

MASIMO CORP (MASI): Free Stock Analysis Report

MEDTRONIC (MDT): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

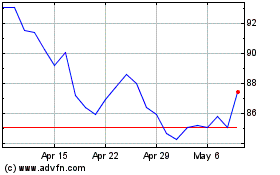

Edwards Lifesciences (NYSE:EW)

Historical Stock Chart

From Mar 2024 to Apr 2024

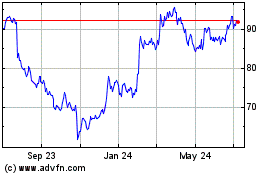

Edwards Lifesciences (NYSE:EW)

Historical Stock Chart

From Apr 2023 to Apr 2024