The largest U.S. mobile service provider Verizon

Communications Inc. (VZ) has made a good start to the

year, generating double-digit earnings and cash flow growth in the

first quarter of 2012.

First Quarter Review

Verizon’s first quarter adjusted earnings outpaced the Zacks

Consensus Estimate by a penny and were 8 cents above the year-ago

earnings. Revenue improved on continued strong wireless, FiOS

fiber-optic and strategic services.

Wireless revenue advanced on the back of strong data revenues

and subscriber growth. Rapid expansion of 4G Long-Term Evolution

(LTE) services and strong adoption of Google

Inc.’s (GOOG) Android smartphones led to the growth in

retail wireless subscribers. Though the slowing growth in the U.S.

mobile market led to the lower sales of Apple

Inc.’s (AAPL) iPhone, it boosted margins in the segment as

subsidies fell.

Despite the solid momentum for FiOS fiber-optic network and

strategic services, Wireline revenue dipped on lower global

wholesale and other businesses. The penetration rate of both FiOS

Internet and FiOS TV accelerated to approximately 36.4% and 32.3%,

respectively.

Coming to liquidity, Verizon’s cash balance has reached to less

than half of $14 billion and debt rose by a significant $4 billion

during the quarter.

(Read our full coverage on this earnings report: Verizon

Outperforms, Adds Users)

Guidance

Despite the ongoing efforts to expand and improve both wireless

and wireline networks, Verizon continues to focus on maximizing

free cash flow. Management expects capital efficiency (capital

expenditure-to-revenue ratio) to continue showing steady

improvements; i.e. the ratio will decline throughout the year.

Agreement of Analysts

The covering analysts have mixed views for the second quarter,

as depicted by their estimate revisions. Out of 26 analysts, 10

made positive revisions while 10 moved in the opposite direction

over the last 30 days.

However, estimates reflect a positive bias for both fiscal 2012

and 2013 over the last 30 days. For fiscal 2012, 14 analysts out of

31 made upward revisions while 10 moved in the opposite direction.

For fiscal 2013, out of the 29 covering analysts, 11 revised their

estimates downward while 5 revised theirs positively.

The analysts believe that Verizon will see improved revenue and

earnings based on both its wireless and wireline businesses.

Verizon is experiencing solid momentum in its wireless business, as

subscriber additions remains strong with a lower churn rate

(customer switch to competitor), in fact the lowest in the

industry.

The company is way ahead of its major rival AT&T

Inc. (T) and Sprint Nextel Corp. (S) in

terms of 4G deployments, which reached 230 markets covering more

than 200 million people as of April 19. Verizon expects to expand

its 4G networks to 400 markets by the end of this year and the

entire nationwide 3G footprint by mid next year.

Further, the company will continue to achieve wireless growth

and profitability with a focus on gaining share in the retail

post-paid market, increasing the penetration of smartphones, and

selling more Internet devices such as tablets.

In the Wireline business, Verizon will continue to improve

long-term profitability by increasing FiOS penetration and

strategic service offerings such as manage network, data center,

security solutions, cloud and IT infrastructure as well as

rationalizing its wireline cost structure.

However, some analysts are concerned about Verizon’s potential

spectrum deal setbacks. The company is facing stiff opposition

regarding its spectrum deals with a group of cable companies,

including Comcast Corporation

(CMCSA), Time Warner Cable Inc. (TWC) and Bright

House Networks, as well as Cox Communications Inc.

It will have an adverse impact on Verizon’s financials should

the deal fail. But if it succeeds, it might put pressure on the

balance sheet in the short term by reducing cash balances and

increasing capital expenditures before becoming accretive over the

longer term.

Magnitude — Consensus Estimate Trend

The magnitude of revisions for the second quarter remained

stable over the last 7 and 30 days at 63 cents.

The Zacks Consensus Estimate for 2012 is $2.49, unchanged over

the last 7 days but a penny higher in the last 30 days. Similarly,

the Zacks Consensus Estimate for 2012 is stable at $2.78 over the

last 7 days but a penny above in the last 30 days.

Earnings Surprises

With respect to earnings surprises, the company’s fairly good

track record is expected to continue in the coming quarters.

Verizon produced a positive average earnings surprise of 1.75% over

the last four quarters, indicating that it outpaced the Zacks

Consensus Estimate by that amount over the last year.

In the recently concluded quarter, the company surprised us by

reporting earnings 3.51% higher than what we had expected.

Neutral Recommendation

Fiscal 2012 is expected to be profitable for Verizon considering

the promises in both Wireless and Wireline businesses. Moreover,

the company aims to enhance shareholder value throughout the

year.

However, we remain skeptical about returns from the 4G wireless

and wireline FiOS networks, persistent access line losses, heavy

iPhone subsidies, hindrances in spectrum deals and intense

competition from cable companies and other alternative service

providers.

We are currently maintaining our long-term Neutral rating on

Verizon. For the short term (1–3 months), the stock retains a Zacks

#3 (Hold) Rank.

APPLE INC (AAPL): Free Stock Analysis Report

COMCAST CORP A (CMCSA): Free Stock Analysis Report

GOOGLE INC-CL A (GOOG): Free Stock Analysis Report

SPRINT NEXTEL (S): Free Stock Analysis Report

AT&T INC (T): Free Stock Analysis Report

TIME WARNER CAB (TWC): Free Stock Analysis Report

VERIZON COMM (VZ): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

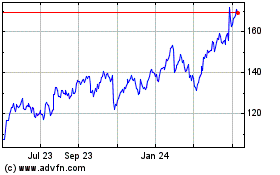

Alphabet (NASDAQ:GOOGL)

Historical Stock Chart

From Mar 2024 to Apr 2024

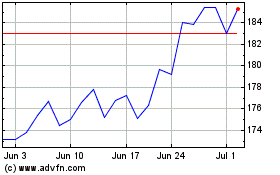

Alphabet (NASDAQ:GOOGL)

Historical Stock Chart

From Apr 2023 to Apr 2024