EUROPE MARKETS: European Stocks Face 6th Day Of Losses As Euro Marches Higher

November 14 2017 - 6:19AM

Dow Jones News

By Carla Mozee, MarketWatch

Shared currency rises on back of stronger-than-expected German

GDP reading

Major European stock indexes slipped Tuesday, with the regional

benchmark headed for a sixth straight loss, as the euro hit its

highest level in three weeks on the back of stronger-than-expected

German economic growth figures.

What markets are doing: In Frankfurt, the DAX 30 index fell

fractionally to 13,068.61, and France's CAC 40 gave up 0.1% to

5,338.72.

But the U.K.'s FTSE 100 was higher by 0.1% at 7,424.84, and

Spain's IBEX held up 0.1% at 10,054.00.

Looking at the pan-European benchmark, the Stoxx Europe 600 was

off 0.2% at 385.34. The move came as Swiss shares as measured by

the SMI edged down 0.1% to 9,153.03. Monday's decline marked the

longest run of losses since late May.

The euro traded at $1.1716, rising from $1.1669 late Monday in

New York. Against the pound, the shared currency fetched GBP0.8948,

up from GBP0.8843 on Friday.

What's driving markets: The euro climbed above $1.1700 against

the dollar for the first time since Oct. 26, according to FactSet

data. That puts the euro up by roughly 0.6% on a week-to-data

basis.

Strength in the euro puts pressure on shares of European

exporters, as it makes their products more expensive for holders of

other currencies. On the German index, shares of Adidas AG (ADS.XE)

shed 0.2% and Volkswagen AG (VOW.XE) (VOW.XE) lost 0.3%.

Investors bumped up the euro after Destatis said Germany's gross

domestic product rose by 3.3% in the third quarter

(http://www.marketwatch.com/story/german-gdp-grows-33-outstripping-forecasts-2017-11-14),

outstripping expectations for 2.4% growth. Germany is Europe's

largest economy.

What strategists are saying: "Stock markets have seen tentative

buying this morning, as they look to recover from a tough few days.

However, with the central banking cabal of Yellen, Kuroda, Draghi

and Carney to speak today, it is not surprising to see the main

indices mostly tread water so far," said Chris Beauchamp, chief

market analyst at IG, in a note.

"Germany's economic success story goes on and on and on," said

ING chief economist Carsten Brzeski, noting it "remains the

high-flyer of the eurozone."

"Looking ahead, there is very little reason to fear a sudden end

to the current performance. In fact, today's drivers of the economy

should also be tomorrow's drivers of the economy. Low interest

rates should further support activity in the construction sector,

boost private consumption and contribute to the ongoing investment

upswing," Brzeski said in a note.

Central bankers were also in focus, as European Central Bank

President Mario Draghi, Bank of England Gov. Mark Carney, Federal

Reserve Chairwoman Janet Yellen and Bank of Japan Gov. Haruhiko

Kuroda appeared on a panel Tuesday morning in Brussels.

The leaders of the four global heavyweights of central banks

were sharing their views on communicating with investors and the

markets at a moderated discussion at the European Central Bank's

headquarters.

Stock movers: Infineon Technologies AG (IFX.XE) shares jumped

5.4% on the DAX 30. The chip maker's net profit for the fourth

quarter fell 22%

(http://www.marketwatch.com/story/infineon-net-profit-down-22-on-weaker-dollar-2017-11-14)

as the company faced a strong headwind from dollar

depreciation.

Henkel AG & Co. (HEN.XE) shares dropped 3.4% after the

company said third-quarter net profit fell to 564 million euros

(http://www.marketwatch.com/story/henkel-profit-falls-on-fx-effects-raises-forecast-2017-11-14)($657.4

million) from EUR576 million a year ago. The maker of Dial soap and

Purex laundry detergent raised its forecast for adjusted

earnings.

Tesco shares (TSCO.LN) climbed 5.1% after the U.K. Competition

and Markets Authority provisionally cleared a merger between the

supermarket chain and wholesaler Booker Group (BOK.LN) . Booker's

shares , which trade off the FTSE 100, climbed 5.2%.

Vodafone (VOD.LN) (VOD.LN) jumped 5.2% after the mobile

telecommuncations company raised its outlook for fiscal 2018

(http://www.marketwatch.com/story/vodafone-pretax-profit-up-55-lifts-2018-outlook-2017-11-14),

with pretax profit for the first half rising 55%

year-over-year.

Economic data: U.K. inflation came in at 3% in October

(http://www.marketwatch.com/story/uk-inflation-stays-at-5-year-high-of-3-2017-11-14),

slightly below expectations for a 3.1% print.

(END) Dow Jones Newswires

November 14, 2017 06:04 ET (11:04 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

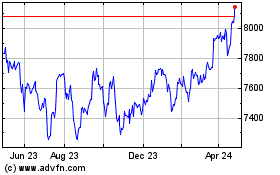

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

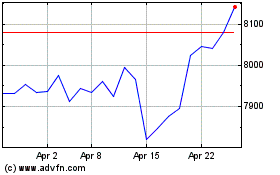

FTSE 100

Index Chart

From Apr 2023 to Apr 2024