EUROPE MARKETS: European Stocks End In The Red As Doubts Grow About Trump Agenda

May 18 2017 - 12:46PM

Dow Jones News

By Carla Mozee and Victor Reklaitis, MarketWatch

Fiat shares fall on prospect of U.S. civil suit

European stocks dropped Thursday, retreating for a second

session as continuing U.S. political turmoil cast doubt on whether

President Donald Trump's pro-economic growth policies will become

reality.

The Stoxx Europe 600 index ) lost 0.5% to end at 389.19. The

move builds on Wednesday's slide of 1.2%, which marked the

benchmark's biggest one-day percentage loss since late September

and followed Tuesday's flat finish.

Investors on Wednesday began fleeing assets perceived as risky,

such as stocks, after a report that Trump had asked James Comey,

then director of the Federal Bureau of Investigation, to halt a

probe into links between Trump's associates and Russian officials

(http://www.marketwatch.com/story/us-stock-futures-under-pressure-amid-fresh-concerns-over-trump-2017-05-17).

In the U.S. on Wednesday, the S&P 500 index and the Dow Jones

Industrial Average logged their worst declines since Sept. 9. The

two American stock gauges were rebounding somewhat

(http://www.marketwatch.com/story/fragile-start-ahead-for-us-stocks-as-political-concerns-weigh-heavy-2017-05-18)

on Thursday.

Read:Here's how impeachment works--and why Trump is safe for now

(http://www.marketwatch.com/story/heres-how-impeachment-works---and-why-trump-is-safe-for-now-2017-05-17)

"With optimism rapidly diminishing over Trump's proposed fiscal

spending and his administration coming under increasing pressure,

the Trump rally seems to be a theme of the past," said FXTM

research analyst Lukman Otunuga, in a note.

"Stock markets may be in store for further punishment moving

forward, as political turmoil in the US and ongoing geopolitical

tensions are adding to the mounting uncertainty over Trump," he

said.

European bank shares were struggling on concerns the Trump

administration won't be able to push through looser regulations for

the financial industry. The Stoxx Europe 600 Bank flopped down

0.8%.

Pressure on shares of European exporters also came from strength

in the euro, which this week rose above $1.11 for the first time

since November. The shared currency on Thursday bought $1.1131,

compared with $1.1159 late Wednesday.

Individual indexes: Germany's DAX 30 , which has notched record

closing highs in recent sessions, fell 0.3% to end at

12,590.06.

In London, the FTSE 100 dropped 0.9% to 7,436.42. The index came

under further pressure as the pound rose above $1.30 for the first

time since September, after U.K. retail sales burst past

expectations.

Check out:The pound looks set for 'significant further upside'

now that it's regained $1.30

(http://www.marketwatch.com/story/the-pound-looks-set-for-significant-further-upside-now-that-its-regained-130-2017-05-18)

France's CAC 40 declined 0.5% to finish at 5,289.73.

Stock movers: Fiat Chrysler Automobiles NV (FCA.MI) shares fell

3.1% after reports that the U.S. Justice Department plans to file a

civil lawsuit

(http://www.marketwatch.com/story/fiat-chryslers-stock-falls-5-after-report-of-possible-doj-suit-2017-05-18)

against the auto maker over excess diesel emissions, if no

agreement is reached.

Altice NV (ATC.AE) shares lost 1.5%. The Dutch telecom broke

European Union rules by carrying out its acquisition of PT Portugal

before notifying or getting approval from regulators, the EU's

competition watchdog said in a statement Thursday.

(http://www.marketwatch.com/story/altices-stock-falls-after-eu-cries-foul-on-pt-portugal-buyout-2017-05-18)

Economic data: France's unemployment rate dropped to 9.6%, a

five-year low

(http://www.marketwatch.com/story/french-unemployment-rate-falls-to-5-year-low-2017-05-18),

as the job market improved for young people.

U.K. retail sales rebounded

(http://www.marketwatch.com/story/uk-retail-sales-rebound-overshoot-expectations-2017-05-18)

in April, following a steep quarterly decline in the first three

months of the year. Retail sales grew by 2.3% on the month,

significantly more than the 1.5% growth seen in a Wall Street

Journal poll.

(END) Dow Jones Newswires

May 18, 2017 12:31 ET (16:31 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

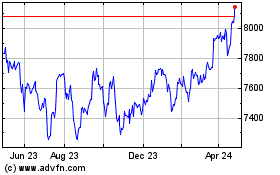

FTSE 100

Index Chart

From Mar 2024 to Apr 2024

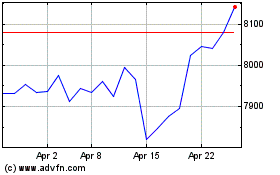

FTSE 100

Index Chart

From Apr 2023 to Apr 2024