EU to Probe Deutsche Bö rse, London Stock Exchange Merger

September 28 2016 - 10:40AM

Dow Jones News

BRUSSELS—The European Union's antitrust regulator on Wednesday

opened a full-blown investigation into the proposed merger of

Deutsche Bö rse AG and London Stock Exchange Group PLC, citing

concerns the deal would reduce competition in a number of financial

markets.

The European Commission said it was concerned about the deal's

impact in clearing, derivatives, repurchasing agreements, German

stocks and exchange-traded products adding that the merger would

"by far" create the largest European-exchange operator.

"Financial markets provide an essential function for the

European economy. We must ensure that market participants continue

to have access to financial market infrastructure on competitive

terms," EU antitrust chief Margrethe Vestager said.

In-depth merger reviews by the EU are common in large, complex

deals. The commission has until Feb. 13 next year to reach a

decision, though the deadline could be extended.

In response to the commission's announcement, the LSE said it

would try to head off some competition concerns by exploring the

potential sale of LCH SA. It said any sale of the unit would be

subject to the merger with Deutsche Bö rse going ahead.

In a separate statement Deutsche Bö rse said it noted the

review.

Write to Natalia Drozdiak at natalia.drozdiak@wsj.com

(END) Dow Jones Newswires

September 28, 2016 10:25 ET (14:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

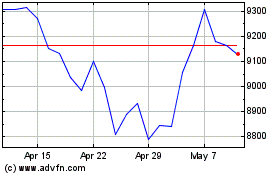

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Mar 2024 to Apr 2024

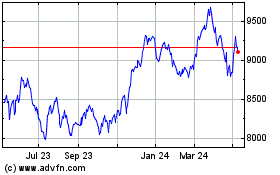

London Stock Exchange (LSE:LSEG)

Historical Stock Chart

From Apr 2023 to Apr 2024