EU to Block U.K. Hutchison-Telefonica Merger

May 03 2016 - 7:10AM

Dow Jones News

BRUSSELS—The European Commission is set to torpedo CK Hutchison

Holdings Ltd.'s planned $14 billion takeover of Telefonica SA's

British cellphone operator O2, two people familiar with the matter

said.

The EU's 28 commissioners are scheduled to approve the decision

by the bloc's antitrust watchdog on Wednesday, the people said,

after the companies failed to assuage the regulator's concerns the

deal would lead to higher prices and less choice for U.K.

consumers.

European Union antitrust chief Margrethe Vestager has taken aÂ

tough stance against telecoms mergers in the region, particularly

in cases where deals reduce the number of mobile-telecom operators

in a given country from four to three, as would be the case in the

U.K. deal.

The commission's decision in the U.K. deal reinforces the EU's

course for future telecom merger reviews, including its probe into

Hutchison's plans in Italy to merge its 3 Italia business with

Russian telecom firm VimpelCom Ltd.'s Wind Group—another so-called

"four-to-three" merger.

In the U.K., the purchase of Telefonica's British mobile

operator by Hong Kong tycoon Li Ka-shing's Hutchison would have

combined O2, the country's second-largest mobile operator and Three

U.K, Britain's fourth-largest operator. The acquisition, announced

in 2015, would have more than tripled Three's U.K. subscribers to

34 million and would create the country's biggest mobile

operator.

Write to Natalia Drozdiak at natalia.drozdiak@wsj.com and

Valentina Pop at valentina.pop@wsj.com

(END) Dow Jones Newswires

May 03, 2016 06:55 ET (10:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

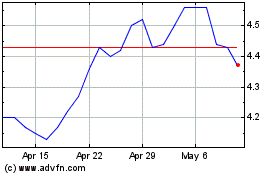

Telefonica (NYSE:TEF)

Historical Stock Chart

From Mar 2024 to Apr 2024

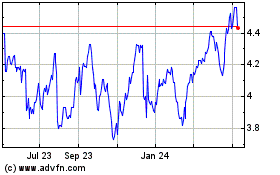

Telefonica (NYSE:TEF)

Historical Stock Chart

From Apr 2023 to Apr 2024