EU to Approve GE-Alstom Deal

September 07 2015 - 8:50PM

Dow Jones News

BRUSSELS—The European Union is set to approve General Electric

Co.'s $17 billion acquisition of Alstom SA's power business on

Tuesday, two people familiar with the matter said, putting the U.S.

industrial giant a step closer to clinching its biggest ever

deal.

The EU's green light will put an end to nearly eight months of

wrangling with the U.S. company, which has sought to convince

regulators that the deal won't lead to higher prices for gas

turbines in Europe.

The purchase by an American company of a crown jewel of French

industry was politically charged from the start. Germany's Siemens

AG was pulled into the contest early on by French officials seeking

a European buyer for Alstom. But Paris subsequently changed tack

and lobbied Brussels to approve the deal, said a person familiar

with the matter.

GE eventually offered concessions to Brussels that satisfied the

regulators' concerns. The EU's executive arm is expected to

formally approve the deal at a meeting in Strasbourg, France, on

Tuesday, the people said.

The final major hurdle to the merger—approval from U.S.

antitrust authorities—is also likely to be cleared as early as

Tuesday, one of the people said.

It wasn't immediately clear what conditions would be applied. GE

Chief Executive Jeff Immelt said in May he was willing to sell off

intellectual property to secure regulatory approval, but

concessions around the French company's service business weren't an

option.

The Alstom deal is central to Mr. Immelt's multiyear effort to

reposition GE, returning focus to its industrial business units as

it exits the lending business. After the Alstom acquisition and the

sell-off of GE Capital is complete, GE says it will generate 90% of

its profits from industrial business and just 10% from financial

services. As recently as the financial crisis, lending generated as

much as half of GE's annual earnings.

The deadline for the EU's investigation has been extended

several times, and by more than two months, as GE sought to

convince regulators that their initial concerns were misplaced.

The repeated delays stirred up memories of an earlier proposed

GE deal that foundered at the hands of regulators in Brussels—its

failed $45 billion takeover of Honeywell Inc., which the EU blocked

in 2001 after U.S. regulators had given the go-ahead.

When it came to the Alstom deal, the U.S. company pushed back

strongly against Brussels' concerns. GE argued that heavy-duty gas

turbines are sold in a global market by four competing companies,

including Siemens and Mitsubishi Hitachi Power Systems, and that

only 5% of demand is in Europe.

But the EU said only two strong competitors would remain after

the merger.

In June, the EU sent GE a formal list of concerns relating to

the proposed deal. Only then did GE relent, saying in July that it

had proposed concessions that preserved "the economic and strategic

value of the deal."

The U.S. company has complained repeatedly about the length of

the investigation, which it said was hurting Alstom by causing

uncertainty for employees and customers. Experts said GE could have

come forward sooner with an offer to sell parts of the business in

order to allay the regulators' concerns.

The Alstom deal proved difficult and costly to complete for GE.

Over the nearly 18 months in which the American company sought

approval from various European regulators, GE has repeatedly

reassured investors that the rationale for the purchase is secure.

The company says the installed base of steam turbines it will

receive from Alstom will boost its footprint in emerging markets

even as GE wrings out cost savings by consolidating Alstom's

industrial footprint and its own.

GE is focusing on its heavy industrial roots, like its

businesses making jet engines, locomotives, power turbines and

medical scanners. Mr. Immelt is also trying to sell GE's appliance

business, as the company looks to shed lower-margin, slow-growing

pieces of the company.

Still, Wall Street has remained cool to the deal, with many

analysts who cover GE saying their clients remain indifferent at

best.

People familiar with the company's thinking say that Mr. Immelt

has long felt GE held a crucial trump card as regulators sought

deeper concessions. Without a buyer like GE, Alstom was poised to

fall into even more dire financial straits. Finding a way to secure

the sale to GE will also mean that job guarantees for French

employees of Alstom, and a pledge by GE to add jobs in the country,

will remain in force.

For Mr. Immelt, one piece of his "pivot" is preserved by the EU

decision. What remains, once the deal is closed, is the work of

integrating Alstom into GE, a project Mr. Immelt told investors

early this year would be the most important facing the company this

year, and in the coming years, too. Meanwhile, the company

continues to sell off units of GE Capital, aiming to part with the

bulk of what was until recently a $500 billion banking business by

the end of next year.

Write to Tom Fairless at tom.fairless@wsj.com and Ted Mann at

ted.mann@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 07, 2015 20:35 ET (00:35 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

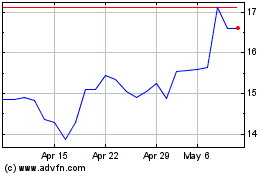

Alstom (EU:ALO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alstom (EU:ALO)

Historical Stock Chart

From Apr 2023 to Apr 2024