EU Set To Block Hutchison Deal for O2 -- WSJ

May 04 2016 - 3:04AM

Dow Jones News

By Natalia Drozdiak and Valentina Pop

BRUSSELS -- The European Commission is set to torpedo CK

Hutchison Holdings Ltd.'s planned deal to buy British mobile

operator O2 for around $14 billion, two people familiar with the

matter said, as EU regulators take a hardened approach toward

telecom consolidation.

European Union commissioners are scheduled to approve the

decision by the bloc's antitrust watchdog on Wednesday, the people

said, after the companies failed to assuage regulator's concerns

the deal would lead to higher prices and less choice for U.K.

consumers.

The item is on the agenda for the weekly meeting of the 28 EU

commissioners, where the decision is usually a formality.

The commission and the companies declined to comment.

The purchase of Telefónica SA's O2 by Hong Kong-based CK

Hutchison would have combined the U.K.'s second-largest mobile

operator with Three U.K., the fourth-largest operator and CK

Hutchison's existing British carrier. The acquisition, announced in

2015, would have more than tripled Three's U.K. subscribers to 34

million and created the country's biggest mobile operator.

Margrethe Vestager, the EU's antitrust chief, has taken a tough

stance against telecoms mergers in the region, particularly in

cases where deals reduce the number of mobile-telecom operators in

a given country from four to three, as would be the case in the

U.K. deal. The first such deal to be reviewed under Ms. Vestager's

watch, in Denmark, was abandoned last year following resistance

from Brussels.

The commission's expected decision in the U.K. deal reinforces

the EU's course for future telecom merger reviews, including its

probe into CK Hutchison's plans in Italy to merge its 3 Italia

business with Russian telecom company VimpelCom Ltd.'s Wind Group

-- another so-called "four-to-three" merger.

"It seems to be a key turning point because of what happened in

Denmark last year," said Adrian Baschnonga, a telecoms analyst with

Ernst & Young. "A lot of the industry thinks that the European

attitude toward consolidation is hardening."

Mobile operators say mergers, and the price increases that may

come with them, are necessary so that they can build better

networks, especially since consumers are using more data as they

watch more videos on smartphones.

CK Hutchison, the flagship company of Hong Kong tycoon Li

Ka-shing, and Spain's Telefónica in early March submitted

commitments to the EU to help push the deal through, but the EU's

antitrust body has deemed them insufficient.

The companies offered to sell fractional ownership stakes in

their U.K. mobile network to competitors, allowing them access to

the network as well as additional rights, such as influence in

network investment decisions.

CK Hutchison also said it would freeze prices for customers for

five years, though EU antitrust regulators can't accept such a

pledge as a formal commitment since the remedies need to be

structural, such as creating a new mobile network operator.

The Hong Kong-based company, which in recent years has been

buying and merging with other mobile carriers in Europe in a bid to

cement itself as one of the bloc's top wireless providers, can

appeal the commission's decision in the U.K. case.

Telefónica executives said last week that they were leaving open

the possibility that EU regulators would block the sale of its U.K.

unit to CK Hutchison. They highlighted the unit's strong

performance in the first quarter of this year, which they said

opens up various possibilities -- such as finding another buyer or

keeping the unit -- if the deal does fall through.

"We have many options" if the deal with Hutchison doesn't go

through, Ángel Vilá, Telefónica's chief strategy and finance

officer, said during a presentation to analysts on Friday.

Telefónica Chairman José María Álvarez-Pallete also said Friday

that a legal analysis of the transaction would allow the deal to

clear all regulatory reviews and that if the sale were killed, it

would be for "political reasons."

With the U.K. set to vote June 23 on whether to remain in the

EU, some lawyers say that may have added to the pressure on the

commission to decide against the deal, in favor of the British

regulators.

Both the U.K.'s Competition and Markets Authority and its

communications regulator Ofcom have v oiced their concerns about

the deal, saying it would kill competition and innovation, and lead

to higher prices for British consumers.

--Stu Woo in London and Jeannette Neumann in Madrid contributed

to this article.

Write to Natalia Drozdiak at natalia.drozdiak@wsj.com and

Valentina Pop at valentina.pop@wsj.com

(END) Dow Jones Newswires

May 04, 2016 02:49 ET (06:49 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

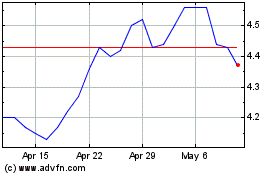

Telefonica (NYSE:TEF)

Historical Stock Chart

From Mar 2024 to Apr 2024

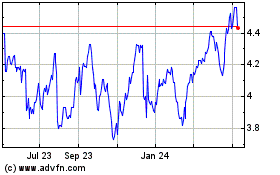

Telefonica (NYSE:TEF)

Historical Stock Chart

From Apr 2023 to Apr 2024