EU Extends Deadline for U.K. Mobile Phone Merger Review

November 06 2015 - 10:38AM

Dow Jones News

By Tom Fairless

BRUSSELS--Europe's top antitrust regulator has extended by a

month its deadline for reviewing Telefonica SA's $14 billion sale

of British cellphone operator O2, a week after opening a full-blown

investigation into the deal.

The move by the European Commission is common in complex

mergers, and aims to give the parties more time to convince

regulators that the deal is unproblematic, or discuss potential

remedies, such as asset sales.

In a statement published on its website, the commission said it

had extended the deadline for the review by 20 working days, to

April 18, 2016. The regulator has until that date to investigate

the proposed acquisition and to decide whether to approve it, or

ask the companies for concessions to ease its concerns. If it fails

to reach an agreement on how to bring the acquisition in line with

EU competition rules, the commission can also decide to block the

merger.

The commission opened an in-depth investigation last Friday,

warning that the sale of O2 to Hong Kong tycoon Li Ka-shing's CK

Hutchison Holdings Ltd. would create the largest mobile-network

operator in the U.K., potentially removing an important

competitor.

Britain's telecom regulator Ofcom also expressed misgivings

about the merger, warning in a statement that it could lead to

higher prices and reduced customer choice.

Natalia Drozdiak contributed to this article.

Write to Tom Fairless at tom.fairless@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 06, 2015 10:23 ET (15:23 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

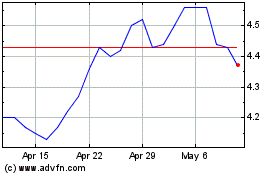

Telefonica (NYSE:TEF)

Historical Stock Chart

From Mar 2024 to Apr 2024

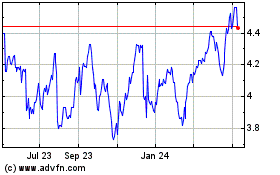

Telefonica (NYSE:TEF)

Historical Stock Chart

From Apr 2023 to Apr 2024