EU Approves GE's Acquisition of Alstom's Energy Business -- 2nd Update

September 08 2015 - 12:58PM

Dow Jones News

By Tom Fairless

BRUSSELS-- General Electric Co. secured approval from Europe's

top antitrust authority for its acquisition of Alstom's power

business on Tuesday after agreeing to sell assets to an Italian

rival that regulators hope will become a strong new competitor in

Europe.

The European Union's approval, which follows eight months of

tough negotiations, puts GE on the brink of closing its biggest

ever deal. U.S. authorities also signaled their approval on

Tuesday, joining around 20 other global regulators that have

already given the green light.

In Brussels, regulators had pored over the deal for months amid

concerns that it would lead to higher prices in Europe for large

gas turbines. "There was a great risk of choice going down and

prices going up," Margrethe Vestager, the EU's antitrust chief,

said at a news conference.

To assuage those concerns, GE agreed to sell "central parts" of

Alstom's large gas turbines business to Ansaldo Energia of Italy,

the EU said. Those divestments, the regulator said, will allow

Ansaldo "to replicate Alstom's previous role in the market, thereby

maintaining effective competition."

Despite the asset sales, Jeff Immelt, GE's Chief Executive

Officer, said the "strategic and economic drivers of the deal" had

been preserved. He said the deal would close "as early as possible

in the fourth quarter."

When it was announced more than a year ago, GE valued the deal

at EUR12.35 billion ($13.7 billion). However, that has fallen to

around EUR8.5 billion, reflecting the impact of joint energy

ventures announced last year, changes in the deal structure, price

adjustments for the remedies and net cash at close, GE said.

Under the agreement with Brussels, GE agreed to divest Alstom's

technology for two models of large gas turbines, as well as "a

large number" of Alstom's turbine-research engineers, two test

facilities in Switzerland, and Alstom's Florida-based servicing

business.

GE already manufactures gas turbines of corresponding size to

the two Alstom models, and the company says it will retain licenses

that will enable it to compete for business servicing turbines made

by other manufacturers -- an opportunity for future earnings

growth.

The U.S. company will also divest the long-term servicing

contracts for 34 turbines that have already been installed by

Alstom. GE has said that Alstom's servicing contracts were a key

attraction of the deal, but a person close to the deal said the

divested contracts amounted to only 4% of Alstom's total installed

base.

"I am glad that we can approve this transaction, which shows

that Europe is open for business and that Europe-based technology

can thrive and attract foreign investment," Ms. Vestager said.

U.S. antitrust authorities, working in concert with Brussels,

said they would require GE to divest the Florida-based servicing

business.

The EU must sign off on the asset transfers before the deal can

go ahead, Ms. Vestager said. GE has secured a EUR300 million rebate

from Alstom for the remedies.

Steve Bolze, chief executive of GE's power business, said the

deal would be "transformative" for the company's power business,

expanding the number of installed turbines it services by 50% in a

single shot. GE will aim to achieve $3 billion of annual cost

synergies at the combined business after five years, he said.

Ted Mann contributed to this article.

Write to Tom Fairless at tom.fairless@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

September 08, 2015 12:43 ET (16:43 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

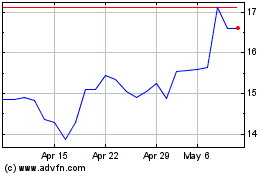

Alstom (EU:ALO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Alstom (EU:ALO)

Historical Stock Chart

From Apr 2023 to Apr 2024