ETF Issuer Solutions Welcomes Industry Newcomers

November 18 2014 - 9:00AM

ETFDB

Innovation has long been one of the driving forces behind the

expansion of the exchange-traded universe. Most recently,

innovation has struck the industry in the form of a comprehensive

platform designed to help investment managers bring their

strategies to market: enter ETF Issuer Solutions. We recently

talked with the president of ETF Issuer Solutions, William

Smalley, who shared his firm’s story, their objective,

and insights surrounding the industry as a whole [see also

Recent ETFdb Interviews].

ETF Database (ETFdb): What was the inspiration behind

creating ETF Issuer Solutions?

William Smalley (WS): The genesis of the ETFis platform

came from our perspective as product managers at emerging ETF

sponsors. We found that the barriers to entry, both in terms of

product origination and distribution penetration, were daunting and

expensive. We formed ETFis in 2012 to address the challenges that

all new entrants to the space will face.

The ETF industry “grew up” quickly and, frankly, a little

haphazardly. The infrastructure for such a rapidly expanding space

struggled to keep pace with product innovation and tremendous AUM

growth. Much of the technology, operations, and distribution

support were serviced by legacy mutual fund infrastructure and

processes. We felt there was significant demand for a

comprehensive, ETF-specific services model that allows emerging

product issuers to focus on what really matters: strong performance

and effective distribution [see also 7 Charts to Put the ETF

Industry in Perspective].

ETFdb: Who is ETFis targeted towards? Why does it make

sense for them to utilize this platform?

WS: The ETFis

platform does not necessarily target a particular type of ETF

issuer – we have the regulatory framework and operational

infrastructure to support both index-based and actively managed

ETFs. That said, we see the biggest demand for the platform from

middle market hedge funds, CTAs, and investment advisors who are

seeking to efficiently launch a retail version of their flagship

strategies in an effort to cast a wider net without having to make

a significant investment in internal headcount and regulatory

permissions.

WS: The ETFis

platform does not necessarily target a particular type of ETF

issuer – we have the regulatory framework and operational

infrastructure to support both index-based and actively managed

ETFs. That said, we see the biggest demand for the platform from

middle market hedge funds, CTAs, and investment advisors who are

seeking to efficiently launch a retail version of their flagship

strategies in an effort to cast a wider net without having to make

a significant investment in internal headcount and regulatory

permissions.

Coincidentally, we believe the biggest opportunity for new AUM

growth is in alternative strategies. The “liquid alts” movement has

not yet made its way to ETFs – we are positioning the ETFis

platform as the destination for sophisticated ETFs managed by

specialists in particular asset classes or strategies [see

Alternatives ETF List].

ETFdb: There are some critics who think that ETFs have gone

too far from their initial intention of offering broad-based

exposure to buy-and-hold investors. What’s your take on the

innovation in the ETF industry over the last several years?

WS: We had a period between 2007 and 2009 where ETF product

innovation was focused more on trading vehicles rather than longer

term portfolio tools. The recent wave of smart beta and

actively-managed ETFs are tailored to more closely meet the needs

of the buy and hold investor rather than the day trader. Such

products can be more complex than broad-based beta ETFs, and

typically have somewhat higher management fees, but they have been

successful in raising AUM because they fulfill needs within

portfolios that may be unmet by broad-based ETFs. We continue to be

bullish on these products in large part because they have real

appeal to buy and hold investors of all shapes and sizes.

ETFdb: What are some of the trends you are seeing as far as

what kinds of products are quick to gain momentum? Can exotic ETFs

compete with “proven strategies” in the same space for assets?

WS: Gauging “quick momentum” for new products is very

difficult. The notion that listing an ETF with a great strategy or

index behind it will lead to instant adoption is a fallacy in 2014.

Active/alternative ETFs may not directly “compete” with more

established and less complex ETFs; rather, we often look to garner

market share outside of existing ETF assets – be it hedge funds,

mutual funds, closed end funds, etc. with comparable investment

objectives. These ETFs fall somewhere in between SPY and higher fee

pooled vehicles [see The Cheapest ETF for Every Investment

Objective].

ETFdb: What do you expect in terms of ETF adoption going

forward? What types of investors have been slow to adopt or are

potentially major beneficiaries of embracing ETFs?

WS: We expect increased usage across nearly every channel.

We are paying particular attention to the shifting dynamic in the

investment advisory space – from the transactional brokerage

business to the fee-based wealth advisory model. The rise of the

“ETF Strategist” is no coincidence, in our view. Perhaps the

biggest barriers to fall are in the defined contribution and

insurance channels, though we expect that to come slowly over the

next decade. Those are especially intriguing possibilities to us

because we believe technology solutions will help catalyze adoption

and make distribution ubiquitous and highly scalable.

The Bottom Line

The ETF industry has undeniably democratized the investment

process. However, from an issuer’s perspective, this landscape

remains riddled with nuances; more specifically, the hurdles

associated with starting as well as running an exchange-traded

fund can be quite intimidating. As such, ETF Issuer Solutions

continues to push the innovation envelope forward as it strives to

bring forth compelling strategies and products that might otherwise

not get the attention they deserve.

Follow me on Twitter @SBojinov

[For more ETF analysis, make sure to

sign up for our free ETF newsletter]

Disclosure: No positions at time of

writing.

Click here to read the original article on ETFdb.com.

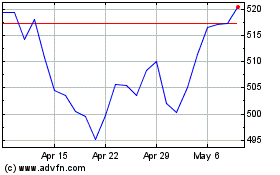

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Mar 2024 to Apr 2024

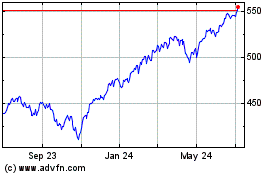

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Apr 2023 to Apr 2024