EP Global Opps Tst Portfolio Holdings as at 31 October 2017

November 17 2017 - 2:00AM

UK Regulatory

TIDMEPG

EP GLOBAL OPPORTUNITIES TRUST PLC

PORTFOLIO HOLDINGS AS AT 31 OCTOBER 2017

Rank Company Sector Country % of

Net Assets

1 Royal Dutch Shell A Oil & Gas Netherlands 4.3

2 Panasonic Consumer Goods Japan 3.9

3 Novartis Health Care Switzerland 3.5

4 AstraZeneca Health Care United Kingdom 3.1

5 BP Oil & Gas United Kingdom 2.9

6 HSBC Financials United Kingdom 2.8

7 Sumitomo Mitsui Trust Financials Japan 2.8

8 Bank Mandiri Financials Indonesia 2.7

9 Commerzbank Financials Germany 2.7

10 Baidu Technology China 2.7

11 Ubisoft Entertainment Consumer Goods France 2.7

12 Sumitomo Mitsui Financial Financials Japan 2.6

13 Sanofi Health Care France 2.5

14 Bangkok Bank * Financials Thailand 2.5

15 BNP Paribas Financials France 2.5

16 Credicorp Financials Peru 2.4

17 Edinburgh Partners Emerging

Opportunities Fund Financials Other 2.4

18 Galaxy Entertainment Consumer Services Hong Kong 2.3

19 Roche ** Health Care Switzerland 2.3

20 Tesco Consumer Services United Kingdom 2.3

21 Japan Tobacco Consumer Goods Japan 2.3

22 Mitsubishi Industrials Japan 2.3

23 Goodbaby International Consumer Goods China 2.3

24 Synchrony Financial Financials United States 2.3

25 Shanghai Fosun

Pharmaceutical H Health Care China 2.3

26 East Japan Railway Consumer Services Japan 2.2

27 DNB Financials Norway 2.2

28 PostNL Industrials Netherlands 2.2

29 Bayer Basic Materials Germany 2.2

30 Apache Oil & Gas United States 2.1

31 Total Oil & Gas France 2.1

32 Nomura Financials Japan 2.0

33 Swire Pacific A Industrials Hong Kong 2.0

34 Celgene Health Care United States 2.0

35 CK Hutchison Industrials Hong Kong 1.9

36 Telefonica Telecommunications Spain 1.9

37 Nokia Technology Finland 1.7

38 Alps Electric Industrials Japan 1.6

39 Whirlpool Consumer Goods United States 1.6

40 Gemalto Technology Netherlands 1.1

41 Edinburgh Partners Financials - United Kingdom 0.7

unlisted

Total equity investments 96.9

Cash and other net assets 3.1

Net assets 100.0

* The investment is in non-voting depositary

receipts

** The investment is in non-voting shares

GEOGRAPHICAL DISTRIBUTION

31 October 2017 % of Net assets

Europe 33.9

Japan 19.7

Asia Pacific 18.7

United Kingdom 11.8

United States 8.0

Latin America 2.4

Other 2.4

Cash and other net assets 3.1

100.0

SECTOR DISTRIBUTION

31 October 2017 % of Net

Assets

Financials 30.6

Health Care 15.7

Consumer Goods 12.8

Oil & Gas 11.4

Industrials 10.0

Consumer Services 6.8

Technology 5.5

Basic Materials 2.2

Telecommunications 1.9

Cash and other net 3.1

assets

100.0

As at 31 October 2017, the net assets of the Company were GBP147,183,000.

17 November 2017

LEI: 2138005T5CT5ITZ7ZX58

Enquiries:

Kenneth Greig

Edinburgh Partners AIFM Limited

Tel: 0131 270 3800

The Company's registered office address is:

27-31 Melville Street

Edinburgh

EH3 7JF

END

(END) Dow Jones Newswires

November 17, 2017 02:00 ET (07:00 GMT)

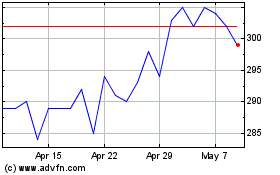

Global Opportunities (LSE:GOT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Global Opportunities (LSE:GOT)

Historical Stock Chart

From Apr 2023 to Apr 2024