EKF Diagnostics Holdings PLC Update (8764Z)

March 20 2017 - 3:01AM

UK Regulatory

TIDMEKF

RNS Number : 8764Z

EKF Diagnostics Holdings PLC

20 March 2017

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 (MAR).

EKF Diagnostics Holdings plc

("EKF", the "Company")

Update

EKF Diagnostics Holdings plc (AIM: EKF), the AIM listed

point-of-care business, announces the following update for

shareholders.

The Directors are currently evaluating plans under which they

would split the Company into two separate companies based on the

business divisions, namely Point of Care and Lab Diagnostics.

Whilst both these business divisions are valuable in their own

right, the Directors consider that separating the companies out

represents a better route for shareholders and one under which they

are more likely to achieve a fair reflection of the value of each

separate business.

However, based on tax advice received by the Company, it is the

Directors' understanding that US federal income tax chargeable on

any gain associated with the divestiture of the business could be

significant. In order to mitigate these potentially adverse tax

effects, the distribution needs to qualify as a 'tax-free spinoff'.

There are numerous requirements in order to achieve this treatment,

including that no acquisition of 50% or more of the shares in

either the Company (i.e. the business that remains following the

divestiture) or the newly separated company may take place within

two years of the separation. Accordingly, the articles of

association of the two separate companies would be amended so as to

include a prohibition of the sale of 50% or more of the shares in

the companies without the consent of their directors.

The implementation of the above proposal is envisaged to include

a cancellation of the Company's shares from trading on AIM

following which it is the Directors current intention to seek a

listing of the shares of both companies on a market to be

determined.

The Directors are sympathetic to individual investors'

requirements and therefore in order to provide those shareholders

that do not wish to wait for the completion of the restructuring

and subsequent potential sale of the two businesses with an exit,

the Company is evaluating the possibility of a share buyback offer

to shareholders. This share buyback offer would, if completed, be

prior to the commencement of the separation and would be at a price

of 21.5p per share.

There can of course be no guarantee that the above proposals,

including any share buyback, will be capable of being completed in

the manner currently anticipated. Further announcements will be

made at the appropriate time

EKF Diagnostics Holdings plc www.ekfdiagnostics.com

Christopher Mills, Non-Executive Tel: 029 2071 0570

Chairman

Julian Baines, CEO

Richard Evans, FD & COO

N+1 Singer (Nomad & Broker) Tel: 020 7496 3000

Alex Price / Shaun Dobson

Walbrook PR Limited Tel: 020 7933 8780 or ekf@walbrookpr.com

Paul McManus / Lianne Cawthorne Mob: 07980 541 893 / 07584 391 303

This information is provided by RNS

The company news service from the London Stock Exchange

END

UPDGCGDXRXBBGRC

(END) Dow Jones Newswires

March 20, 2017 03:01 ET (07:01 GMT)

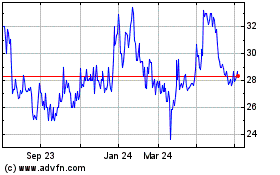

Ekf Diagnostics (LSE:EKF)

Historical Stock Chart

From Mar 2024 to Apr 2024

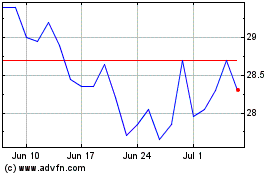

Ekf Diagnostics (LSE:EKF)

Historical Stock Chart

From Apr 2023 to Apr 2024