EKF Diagnostics Holdings PLC Cancellation of escrow shares PDMR dealing/buyback (5958S)

October 03 2017 - 10:44AM

UK Regulatory

TIDMEKF

RNS Number : 5958S

EKF Diagnostics Holdings PLC

03 October 2017

EKF Diagnostics Holdings plc

("EKF", the "Company")

Cancellation of escrow shares in connection with the acquisition

of Selah Genomics, Inc. ("Selah") and PDMR dealing/transaction in

own shares

EKF Diagnostics Holdings plc (AIM: EKF), the AIM listed medical

diagnostics business, announces an update to its prior announcement

on 6 November 2015 in relation to the settlement agreement reached

with the majority of the former shareholders of Selah.

Background

On 6 November 2015 the Company announced that following its

acquisition of Selah on 20 March 2014 it had entered into an

agreement with the majority of the former shareholders of Selah

(the "Majority Shareholders") under which, amongst other things,

the Majority Shareholders released to EKF certain shares in EKF

that had been issued as part of the consideration for Selah but

held in escrow (the "Escrow Shares")(the "Agreement"). The Company

subsequently announced the sale of Selah on 23 December 2015.

Cancellation

In the announcement on 6 November 2016 EKF announced its

intention to sell or cancel 5,630,032 of the shares held in the

escrow account. The remainder of the 205,561 shares in the escrow

account were to be released to those shareholders in Selah who did

not enter into the Agreement. In order to compensate EKF in respect

of these shares, the four largest Majority Shareholders also agreed

collectively to either sell 205,561 shares in EKF held by them (the

"Compensation Shares") and transfer the net proceeds of sale to EKF

or return them to the Company, free of payment, for

cancellation.

The Company will now cancel the 5,630,032 Escrow Shares (the

"Cancellation"). At the same time, the Company is also in the

process of arranging for the Compensation Shares to be transferred

to it for cancellation and it is envisaged that this will take

place over the next few weeks. Further announcements will be made

at the appropriate time.

PDMR dealing/transaction in own shares

As part of the Cancellation and the subsequent cancellation of

the Compensation Shares, EKF announces that on 3 October 2017 it

acquired 1,000,000 ordinary shares at a price of 24 pence per share

(the "Buyback") from Harwood Capital LLP ("Harwood") as investment

manager to Oryx International Growth Fund Limited ("Oryx").

Christopher Mills, the Company's Non-Executive Chairman, is a

partner and Chief Investment Officer of Harwood and a director and

shareholder in Oryx.

Following completion of the Cancellation and the Buyback Oryx's

interest is now in 39,000,000 Ordinary Shares, representing 8.52%

of the Company's issued share capital. The interests of North

Atlantic Smaller Companies Investment Trust PLC ("NAIT"), whose

investment adviser is Harwood, remains as previously disclosed in

98,000,000 Ordinary Shares, representing 21.41% of the Company's

issued share capital. Mr Mills is also a director and shareholder

in NAIT.

Given the previous level of NAIT's and Oryx's interests, the

Buyback was carried out so as to ensure that following the

Cancellation and the cancellation of the Compensation Shares, the

total indirect beneficial interest of Mr Mills remains below 30 per

cent. of the reduced share capital of the Company carrying voting

rights. Mr Mill's total indirect beneficial interest is therefore

now in 137,000,000 Ordinary Shares, representing 29.94% of the

Company's current issued share capital.

Total voting rights

Following the Cancellation and the Buyback, the Company has a

total of 458,632,749 ordinary shares in issue, of which 1,000,000

ordinary shares are held in treasury pending cancellation.

Therefore the issued share capital of the Company carrying voting

rights is 457,632,749, which may be used by shareholders as the

denominator for the calculations by which they will determine if

they are required to notify their interest in, or a change in their

interest in, the share capital of the Company under the FCA's

Disclosure and Transparency Rules.

EKF Diagnostics Holdings plc www.ekfdiagnostics.com

Christopher Mills, Non-Executive Tel: 029 2071 0570

Chairman

Julian Baines, CEO

Richard Evans, FD & COO

N+1 Singer (Nomad & Broker) Tel: 020 7496 3000

Alex Price / Shaun Dobson

Walbrook PR Limited Tel: 020 7933 8780 or ekf@walbrookpr.com

Paul McManus / Lianne Cawthorne Mob: 07980 541 893 / 07584 391 303

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

1 Details of the person discharging managerial

responsibilities / person closely associated

--- -----------------------------------------------------------------

a) Name Harwood Capital LLP, as investment

manager to Oryx International

Growth Fund Limited ("Oryx")

--- ------------------------- --------------------------------------

2 Reason for the notification

--- -----------------------------------------------------------------

a) Position/status Christopher Mills, the Company's

Non-Executive Chairman, is a partner

and Chief Investment Officer of

Harwood Capital LLP and a director

and shareholder in Oryx

--- ------------------------- --------------------------------------

b) Initial notification Initial Notification

/Amendment

--- ------------------------- --------------------------------------

3 Details of the issuer, emission allowance market

participant, auction platform, auctioneer or

auction monitor

--- -----------------------------------------------------------------

a) Name EKF Diagnostics Holdings plc

--- ------------------------- --------------------------------------

b) LEI 213800DXTF3EAUK1AR05

--- ------------------------- --------------------------------------

4 Details of the transaction(s): section to be

repeated for (i) each type of instrument; (ii)

each type of transaction; (iii) each date; and

(iv) each place where transactions have been

conducted

--- -----------------------------------------------------------------

a) Description of Ordinary shares of 1p each ("Ordinary

the financial Shares")

instrument, type

of instrument

ISIN Code: GB0031509804

Identification

code

--- ------------------------- --------------------------------------

b) Nature of the Sale of shares

transaction

--- ------------------------- --------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

--------- ----------

24p 1,000,000

--------- ----------

--- ------------------------- --------------------------------------

d) Aggregated information n/a

- Aggregated volume

- Price

--- ------------------------- --------------------------------------

e) Date of the transaction 3 October 2017

--- ------------------------- --------------------------------------

f) Place of the transaction London Stock Exchange

--- ------------------------- --------------------------------------

This information is provided by RNS

The company news service from the London Stock Exchange

END

DSHMJBITMBIMBTR

(END) Dow Jones Newswires

October 03, 2017 10:44 ET (14:44 GMT)

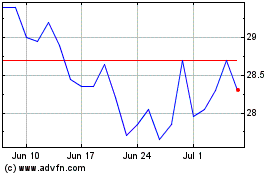

Ekf Diagnostics (LSE:EKF)

Historical Stock Chart

From Mar 2024 to Apr 2024

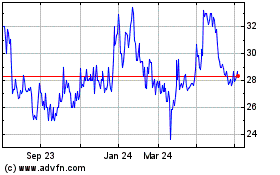

Ekf Diagnostics (LSE:EKF)

Historical Stock Chart

From Apr 2023 to Apr 2024