EDC Moves to Become Private Company

October 08 2015 - 9:10AM

Dow Jones News

LONDON—Russia's largest onshore oil driller is moving to become

a private company in another sign of the toll a prolonged price

slump is taking on the oil-services industry.

Eurasia Drilling Co. said Thursday that unnamed managers and

"core shareholders" had made an undisclosed offer to take the

company private, as it faces a challenging Russian economy,

uncertainty from the effects of Western sanctions and geopolitics,

and oil prices that nearly halved in the past year.

EDC said the offer was $10 a share, which would value the

company at about $1.5 billion. The executives and shareholders

already own much of the company and would buy shares worth about

$430 million.

An independent committee tasked with considering the offer said

Thursday it hadn't made a decision. EDC shares fell in London

trading.

EDC had hoped selling a stake for $1.7 billion to Schlumberger,

the largest oil-services company in the world, would help it ride

out a period of industry turmoil. But Schlumberger last month

walked away after waiting more than six months for Russian

antimonopoly officials' approval.

That forced EDC to switch gears. The company said a plan to

change the business "would best be achieved by taking the company

private, so it can sustain itself through the expected and long,

difficult market conditions."

"Given all these challenges, the management of EDC believe they

require maximum flexibility to manage the business, which is best

facilitated by being a private company," EDC's statement said.

A person close to the situation said taking the company private

would reduce costs involved with being a publicly listed company,

such as salaries for board members and expenses related to holding

board meetings.

EDC is listed in Moscow with a secondary listing in London.

The move comes amid a tumultuous period for EDC.

Last week, EDC reported a more-than halving in revenues and a

sharp drop in profit this year after one of its biggest Russian

customers scaled back drilling efforts amid the slump in oil

prices.

Western governments have targeted parts of the Russian oil

industry over the situation in Ukraine. The sanctions have slowed

activity in some areas, such as onshore shale oil drilling and

offshore Arctic oil exploration, and limited finance options for

some projects.

In January, Schlumberger had offered to buy a 45% stake in EDC,

with an option to buy the rest of the company at a later date. The

offer was accepted by EDC and originally expected to close by the

end of March. But the deal got bogged down over concerns in Moscow

that EDC's activities could be affected if Western sanctions

against Russia were tightened.

EDC operates the largest fleet of onshore drilling in Russia and

is vital to operations at the country's oil fields. Russia is

highly dependent on oil and gas, the sales of which account for

around half of its federal budget. The country recently reported

production of 10.74 million barrels a day in September, a

post-Soviet record.

Other large oil-services companies have been forced to make

major changes as energy firms squeeze them for cheaper contracts.

Halliburton Co. and Baker Hughes Inc., two of the world's biggest

services firms, are merging, while Schlumberger has laid off tens

of thousands of workers.

Write to Selina Williams at selina.williams@wsj.com and Alex

MacDonald at alex.macdonald@wsj.com

Access Investor Kit for "Eurasia Drilling Co. Ltd."

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=US29843U2024

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 08, 2015 08:55 ET (12:55 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

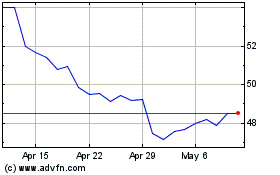

Schlumberger (NYSE:SLB)

Historical Stock Chart

From Mar 2024 to Apr 2024

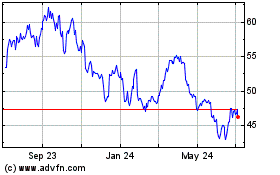

Schlumberger (NYSE:SLB)

Historical Stock Chart

From Apr 2023 to Apr 2024