FRANKFURT—A top European Central Bank official cautioned that

investors shouldn't assume the bank will aggressively beef up its

stimulus next month, saying that no decision has been made and that

all options are on the table.

"Sometimes I think people in the financial markets have to brush

up on their English lessons to understand when we say nothing yet

has been decided for March," ECB Executive Board member Yves Mersch

said in an interview with The Wall Street Journal. "It is not our

communication which is flawed, it is the hype that is being

provoked by people with vested interests."

Mr. Mersch's comments follow a series of speeches by ECB

President Mario Draghi underlining the bank's readiness to boost

its stimulus next month to combat stubbornly low inflation, and

underscore the challenge faced by central bankers as they seek to

guide markets with their words, but maintain policy flexibility to

adapt to changing circumstances.

Mr. Mersch said the ECB "will obviously reconsider" its slate of

stimulus programs at its next scheduled meeting March 10, in light

of new economic forecasts that are likely to show weakening

inflation. "Everything is on the table," he said.

He also pointed to "a lot of positive developments" in the

eurozone economy and a rebound in oil prices, and said investors

were misjudging the impact of the ECB's addition to its stimulus at

its meeting in December. Stock markets are only about 10% below

their record highs, which "is not exactly a crash," he said.

"If you would look at what we communicate, I think this is quite

clear. The situation has changed since December, we will re-examine

and reassess and possibly, if needed, also correct," said Mr.

Mersch, former governor of Luxembourg's central bank, and the

longest-serving member of the ECB's 25-member governing.

At a punchy news conference in January, Mr. Draghi surprised

investors with a pledge to "review and possibly reconsider" the

ECB's stimulus at its March meeting, and not to "give up" in the

face of ultralow inflation.

Markets reacted positively to what they interpreted as a strong

signal that additional stimulus was imminent, sending eurozone

share and bond prices higher and weakening the euro.

Mr. Mersch's comments suggested the ECB believes investors may

not have given the bank's December stimulus measures sufficient

credit. These included a reduction in the already negative deposit

rate, a six-month extension of the quantitative-easing program, and

a decision to reinvest principle payments on the bonds it holds.

Investors were disappointed by the package, driving stocks lower

and the euro higher against the dollar.

"Some of our measures that we have decided in December will last

until 2019," said Mr. Mersch, noting that the additional bond

buying stimulus in December totaled about €680 billion.

A number of bank economists have recently raised their

expectations for the ECB's March meeting. Berenberg, J.P. Morgan

and Royal Bank of Scotland now expect the ECB to increase its

monthly bond purchases by at least €10 billion from €60 billion

currently, and to cut its deposit rate—now at minus -0.3%—by at

least a further 0.1 percentage point.

Mr. Draghi has done little to damp investors' hopes. In a speech

in Strasbourg on Monday, he warned that inflation was " tangibly

weaker" than the bank had expected in December, and reiterated the

need to "review and possibly reconsider" the ECB's stimulus in

March.

Mr. Mersch said the annual rate of inflation—which was 0.4% in

January—would probably turn negative between spring and early

summer. "This brings us into a zone of discomfort," he said.

The debate taking place within the ECB is whether to treat this

as a temporary response to the sharp drop in oil prices, which

could be looked through, or whether it might feed through into

wages and other prices.

Jens Weidmann, the President of Germany's central bank, the

Deutsche Bundesbank, parked himself firmly in the former camp last

week, warning that the ECB shouldn't fixate on current inflation

rates "like a rabbit staring at a snake."

Mr. Mersch appeared to sympathize with that position, pointing

to positive developments in the eurozone economy, including the

drop in oil prices, which gives companies added leeway in making

new investments or repairing their balance sheets. Indeed, he said

that the bulk of the risks facing the economy are from abroad,

including growth concerns in China and other emerging markets.

"If we only had the domestic economy, I would not say that the

downside risks have increased. From the domestic point of view, we

might be at neutral."

Mr. Mersch, who has been on the ECB's Governing Council since

the late 1990s, said the past two decades taught him humility when

it comes to fine-tuning the economy.

"I still perceive central banks as being able to have a

longer-term view of the situation, and it is quite important to

continue to have such an actor in the economy and society," he

said.

Write to Tom Fairless at tom.fairless@wsj.com and Brian

Blackstone at brian.blackstone@wsj.com

(END) Dow Jones Newswires

February 02, 2016 13:35 ET (18:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

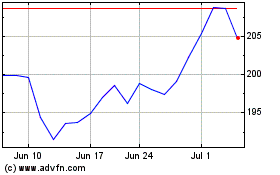

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Mar 2024 to Apr 2024

JP Morgan Chase (NYSE:JPM)

Historical Stock Chart

From Apr 2023 to Apr 2024