FRANKFURT—The European Central Bank is expected to leave its

€1.8 trillion stimulus unchanged at its policy meeting on Thursday

despite a potential economic slowdown in the euro area in the wake

of Britain's vote to leave the European Union.

ECB President Mario Draghi has identified Brexit as a key risk

that could shave up to 0.5 percentage points off eurozoneÂ

economic growth over three years. Early survey data published

Tuesday shows German investors are very concerned about the

fallout.

But after years of monetary stimulus, economists say the ECB and

other central banks are running out of policy options. Last week,

the Bank of England surprised investors by postponing any response

to Brexit until August.

"The ECB is more and more short of ammunition," said Franck

Dixmier, Global Head of Fixed Income at Allianz Global Investors.

"They will have to …use [it] only in exceptional

circumstances."

Most economists expect Mr. Draghi to use his news conference on

Thursday to reassure investors of the ECB's ability to bolster the

economy again if needed. Many think the ECB president will signal

fresh stimulus is coming in September, when economic forecasts will

be available that factor in the impact of the U.K. vote.

"It's critical for the ECB to convince investors that it can act

again," Mr. Dixmier said.

The fallout from Brexit on the euro area remains unclear. An

initial bout of financial-market volatility has subsided. European

stock markets largely recovered from a sharp fall and yields on

10-year German government bonds returned toward zero. The euro has

risen sharply against the pound but fallen against the dollar.

Yet vulnerability lingers. Shares of Italy's largest banks

plunged by roughly 20% and haven't fully recovered. Italian

officials are negotiating with EU authorities over a possible €40

billion capital injection for the banks. The latest batch of EU

stress test results, due to be published on July 29, could reveal

further weaknesses in the sector.

Such problems "cannot be fully ignored by the ECB" when

designing its monetary policy, said Gilles Moec, an economist with

Bank of America Merrill Lynch in London.

Meanwhile the first eurozone indicator to be published since the

U.K. referendum—the ZEW index of German investor sentiment— slumped

to nearly a four-year low on Tuesday. ZEW President Achim Wambach

blamed Brexit.

The European Commission, the EU's executive arm, warned Tuesday

that the U.K. referendum would likely reduce the eurozone's gross

domestic product by up to 0.5% by 2017, due to heightened

uncertainty, and knock up to 0.25 percentage points off

inflation.

The ECB's challenge is that it has already done much to support

the eurozone economy. It has twice boosted monetary stimulus since

December, accelerated its bond purchases to €80 billion a month,

slashed interest rates further below zero and launched new

four-year loans for banks.

Despite that, eurozone inflation was just 0.1% in June, far

below the ECB's target of just below 2%. Top ECB officials have

urged investors to wait for the full impact of the bank's recent

policy measures to unfold.

"There's not a huge amount they can do of a new nature," said

Tim Graf, head of macro strategy for Europe at State Street Global

Markets. "On the [interest] rates side they're probably out of

options."

The ECB cut its deposit rateâ "charged for storing funds with

the central bankâ "to minus 0.4% in March, an all-time low.

Investors expect a further small cut in coming months.

But most economists argue that interest rates can't fall much

further. Europe's banks complain that negative interest rates

undermine profits and could lead to higher loan costs.

The other main stimulus tool is the ECB's bond-purchase program,

known as quantitative easing, which is currently due to expire in

March. With inflation so low, many economists expect it to be

extended soon, probably until September next year.

Any extension would raise fresh questions about whether the ECB

can continue to find enough bonds to buy—particularly German bunds,

whose yields have come under further pressure since the Brexit

vote. Under the rules of the program, the ECB only buys bonds that

yield more than its deposit rate of minus 0.4%.

"The main focus for markets [on Thursday] is if [Mr. Draghi]

comments pre-emptively on the scarcity of bonds," said Thushka

Maharaj, global market strategist at JP Morgan Asset Management in

London. "The ECB should start hitting constraints early next

year."

At their last meeting, policymakers noted market concerns about

bond scarcity, but said the purchases had been proceeding smoothly

so far, according to the minutes. To extend it much further,

though, economists say the ECB would need to change its design,

perhaps by increasing the bond issue limit, currently 33%, or

buying bonds that yield less than its deposit rate.

With the ECB's options limited, Mr. Draghi is likely to renew

his calls on governments to step in and spend money to support

growth.

"At this stage I think ECB policy is more a stabilizer for the

market rather than a stimulus in its own right," Ms. Maharaj

said.

Write to Tom Fairless at tom.fairless@wsj.com

(END) Dow Jones Newswires

July 19, 2016 09:35 ET (13:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

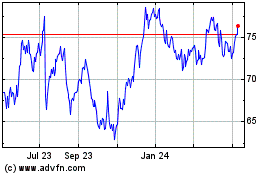

State Street (NYSE:STT)

Historical Stock Chart

From Mar 2024 to Apr 2024

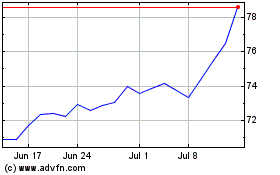

State Street (NYSE:STT)

Historical Stock Chart

From Apr 2023 to Apr 2024