TIDMDNLM

RNS Number : 6947E

Dunelm Group plc

12 February 2015

12 February 2015

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN OR INTO THE

UNITED STATES, CANADA, AUSTRALIA, NEW ZEALAND, JAPAN OR THE

REPUBLIC OF SOUTH AFRICA.

DUNELM GROUP PLC

("Dunelm" or the "Company")

POSTING OF CIRCULAR RELATING TO PROPOSED RETURN OF CAPITAL

INCLUDING NOTICE OF GENERAL MEETING ON 2 MARCH 2015

Dunelm announces today the posting of a circular (the

"Circular") to Shareholders containing details of the return of

capital of 70 pence per Ordinary Share by way of a B/C share

scheme, which was announced at the time of the Company's interim

results on 11 February 2015. The total value of the return of

capital will equate to approximately GBP142 million and will be

paid to shareholders on the register at 6.00 pm on 2 March 2015.

The return of capital is in addition to an interim dividend of 5.5

pence per share to be paid to shareholders on the register at 6.00

pm on 13 March 2015. The Circular includes notice of a General

Meeting to approve the resolution necessary to implement the

proposed return of capital, which will be held at the Dunelm Store

Support Centre, Watermead Business Park, Syston Leicestershire, LE7

1AD at 10.00 am on 2 March 2015.

Copies of the Circular will be available for inspection during

normal business hours on any weekday (public holidays excepted) at

the offices of Allen & Overy LLP, One Bishops Square, London E1

6AD and at the registered office of Dunelm from the date of the

Circular up to and including the date of the General Meeting and

will also be available for inspection for at least 15 minutes

before and during the General Meeting. A copy of the Circular will

also shortly be available on the Company's website at:

www.dunelm.com. A copy of the Circular has been submitted to the

National Storage Mechanism and will shortly be available for

inspection at: www.Hemscott.com/nsm.do.

It should be noted that no prospectus is required, in accordance

with the prospectus directive (Directive 2003/71/EC), to be

published in connection with the proposed issue of B and C

Shares.

GENERAL MEETING AND RETURN OF CAPITAL - EXPECTED TIMETABLE OF

PRINCIPAL EVENTS

Latest time and date for 10.00 am 26 February 2015

receipt of Form of Proxy

or CREST Proxy Instruction

for General Meeting

----------------------------- --------------------------

General Meeting 10.00 am 2 March 2015

----------------------------- --------------------------

Ordinary Share Record 6.00 pm 2 March 2015

Date for participation

in the Return of Capital

----------------------------- --------------------------

Latest time for receipt 4.30 pm 9 March 2015

of Election Forms from

certificated Shareholders

and TTE Instructions from

CREST holders in relation

to the Share Alternatives

----------------------------- --------------------------

B Share Dividend declared by 10 March 2015

and conversion of B Shares

in respect of which the

B Share Dividend is payable

into Deferred Shares

----------------------------- --------------------------

Purchase Offer made By 11 March 2015

----------------------------- --------------------------

Dispatch of cheques or By 24 March 2015

mandated bank accounts

or CREST accounts credited

(as appropriate) in respect

of the B Share Dividend

and the proceeds under

the Capital Option

----------------------------- --------------------------

INTERIM DIVIDEND- EXPECTED TIMETABLE OF PRINCIPAL EVENTS

Interim (ordinary) dividend 13 March 2015

record date

---------------------------- -----------------

Dispatch of cheques or by 10 April 2015

mandated bank accounts

credited (as appropriate)

in respect of the interim

ordinary dividend

---------------------------- -----------------

All times referred to are London times unless otherwise

stated.

Proposed Return of Capital to Shareholders of 70 pence per

Ordinary Share

1. Introduction

As announced on 11 February 2015 the Board is proposing to

return approximately GBP142 million of capital to Shareholders

(equivalent to 70 pence per Ordinary Share). The background to and

reasons for the Return of Capital are detailed in paragraph 2

below.

If the Return of Capital is approved at the General Meeting,

Shareholders on the register at the close of business on 2 March

2015 will be sent a payment of 70 pence per Ordinary Share by 24

March 2015.

The precise aggregate amount of the Return of Capital will

depend on the number of Ordinary Shares in issue at 6.00 pm on 2

March 2015. However, based on the number of Ordinary Shares in

issue on 11 February 2015 (202,432,085, not including 401,846

Ordinary Shares held by the Company in treasury, which will not

participate), the Return of Capital would amount to approximately

GBP142 million in total.

The purpose of this announcement is to provide you with

information relating to the Return of Capital and to explain the

reasons for it and why the Board considers it to be in the best

interests of Dunelm and Shareholders as a whole.

The Return of Capital requires the approval of Shareholders

which will be sought at the General Meeting to be held on 2 March

2015.

2. Background to and reasons for the Return of

Capital

Dunelm has consistently generated significant

cashflow and has built up material cash balances

in recent years. Dunelm returned GBP42.2 million

of surplus cash to its shareholders in 2010, GBP65.8

million in 2012 and GBP50.7 million in 2013, and

has continued to generate further cash balances

since then in the ordinary course of its trading

activities. In the financial year ended 28 June

2014, the Group's average net cash position was

GBP48.3 million, with net cleared funds at the

end of the period being GBP46.8 million. During

the half year ended 27 December 2014, daily average

cleared funds across the half year amounted to

GBP49.4m, with net cleared funds at the end of

the half year of GBP61.4 million. In the absence

of the proposed Return of Capital the Board would

expect the Group's positive cash position to continue

to increase further.

The Board has also reviewed its policy on capital

structure and dividends. The original policy was

established at the time of the floatation of the

Company and in the Board's opinion has ceased

to reflect the scale of the business and its consistent

track record of cash generation over many years.

Accordingly, the Board has determined that, henceforward,

the Group will operate with a modest amount of

leverage such that net debt, measured as daily

average liquid funds over the most recent six

month period, should fall within the range of

0.25 to 0.75 times last 12 months EBITDA. Furthermore,

the Board intends that ordinary dividend cover

should in future be between 2.0 and 2.5 times

on a full year basis. The Board currently anticipates

holding cover towards the middle of this range.

In order to fund the intended ongoing debt, the

Group has entered into an arrangement with a syndicate

of three major banks for the provision of a GBP150

million revolving credit facility, expiring on

9 February 2020.

Reflecting these policies the Company will pay

an interim dividend of 5.5 pence per share (a

10 per cent. increase year on year) payable on

10 April 2015 to Shareholders on the register

at 13 March 2015, and the Board proposes, subject

to Shareholder approval, to make a Return of Capital

to Shareholders on the terms set out in the Circular.

3. Summary of the proposals

The Board is mindful of the fact that it has a

range of institutional, corporate and individual

shareholders and, as such, proposes a flexible

mechanism by which the capital is returned. As

with the return of capital in 2012, and having

considered the available options, the Board is

proposing that the Return of Capital is effected

via a B/C share scheme under which Shareholders

will receive a bonus issue of a newly created

class of shares, either B Shares or C Shares,

pro-rata to their holding of Ordinary Shares.

This method of return has been chosen as it allows

Shareholders (save for certain Overseas Shareholders)

to be treated equally irrespective of the size

of their investment in Dunelm and gives each such

Shareholder flexibility to elect to receive all

or part of the Return of Capital in a dividend

form, if preferred. Whichever alternative is chosen,

the Return of Capital will amount to 70 pence

per Ordinary Share and, based upon the number

of Ordinary Shares in issue (excluding any Ordinary

Shares held by Dunelm in treasury, which will

not participate in the Return of Capital), the

Return of Capital will total approximately GBP142

million.

4. Return of Capital

4.1 B Shares/C Shares

Under the Return of Capital, Shareholders will

receive a bonus issue of:

One B Share or One C Share for each Ordinary Share

held on the Ordinary Share Record Date.

At the closing middle-market price of 929.5 pence

per Ordinary Share on 11 February 2015 (being

the latest practicable date prior to the publication

of the Circular), the proposed Return of Capital

to Shareholders represents approximately 7.55

per cent. of Dunelm's market capitalisation at

that date and 70 pence per Ordinary Share.

4.2 Share Alternatives

Under the B/C Share Scheme, Shareholders (other

than certain Overseas Shareholders) will have

the following alternatives. The two alternatives

will each have different UK tax consequences.

Shareholders who are in any doubt as to their

tax position should consult an appropriate professional

adviser.

In the event that a Shareholder fails to make

a valid election for one or more of the alternatives,

such Shareholder will be deemed (unless the Company

determines otherwise) to have elected for the

Income Option in respect of his entire holding.

Except in the case of an Overseas Shareholder

in a Restricted Territory, a Shareholder may elect

to receive any one of, or a combination of, the

two Share Alternatives set out below. The Capital

Option is not available to Overseas Shareholders

in Restricted Territories who are only entitled

to elect for the Income Option.

If a Shareholder does not properly complete and

return the Election Form or if they are a CREST

holder and do not send a valid TTE Instruction,

unless the Company determines otherwise, they

will be deemed to have elected for the Income

Option in respect of all of their entitlement.

Alternative 1: Income Option

Shareholders who choose this alternative (or are

deemed to have chosen this alternative) will receive

one B Share for each corresponding Ordinary Share

held at the Ordinary Share Record Date. Shareholders

will receive a single dividend of 70 pence per

B Share in respect of those B Shares. A Shareholder's

aggregate entitlement will be rounded down to

the nearest penny. It is expected that this will

be declared by 10 March 2015. Following the declaration

of the B Share Dividend, the B Shares will be

automatically converted into Deferred Shares.

The Deferred Shares will not be listed, and will

carry extremely limited rights as Shareholders

will have already received a cash pay-out in relation

to those shares. It is intended that the Deferred

Shares will be purchased by UBS under the Purchase

Offer and subsequently purchased from UBS by the

Company, in each case for an aggregate sum of

1 penny, and cancelled.

It is expected that the B Share Dividend will

be treated as income for United Kingdom tax purposes.

It is also expected that Shareholders who choose

(or are deemed to have chosen) this alternative

will have their cheques dispatched or mandated

bank accounts credited (as appropriate) by 24

March 2015.

Alternative 2: Capital Option

Shareholders who choose this alternative will

receive one C Share for each corresponding Ordinary

Share held at the Ordinary Share Record Date.

It is intended that such C Shares will be purchased

by UBS as principal under the Purchase Offer by

11 March 2015 for 70 pence per C Share, free and

clear from all dealing expenses and commissions,

with the proceeds of such sale being sent to relevant

Shareholders by 24 March 2015 and it is intended

that any such C Shares purchased by UBS would

in turn be purchased from UBS by the Company and

then cancelled.

It is expected that the proceeds from this sale

will be treated as capital for United Kingdom

tax purposes.

The making of the Purchase Offer is subject to

certain conditions and Shareholders' attention

is drawn to paragraph 2 of Part 10 of the Circular,

where the Purchase Offer Deed is summarised.

It is also expected that Shareholders who choose

this alternative will have their cheques dispatched

or CREST accounts credited (as appropriate) by

24 March 2015.

4.3 Information Relating to the B Shares, C Shares

and Deferred Shares

None of the B Shares, C Shares or Deferred Shares

will be admitted to the Official List or to trading

on the London Stock Exchange's main market for

listed securities, nor will the B Shares, C Shares

or Deferred Shares be listed or admitted to trading

on any other recognised investment exchange.

The B Shares, C Shares and Deferred Shares will

have limited rights. The rights and restrictions

attached to the B Shares, C Shares and Deferred

Shares are set out more fully in Parts 5, 6 and

7 of the Circular respectively.

5. General Meeting

Shareholder approval is being sought for the proposed

Return of Capital.

A General Meeting has been convened for 10.00

am on 2 March 2015 for this purpose, notice of

which, together with a Form of Proxy to be used

in connection with the General Meeting, will be

sent out with the Circular.

The General Meeting is being convened on not less

than 14 days' clear notice, in accordance with

the Company's articles of association and the

authority granted by the Shareholders at the Company's

last annual general meeting, to ensure that the

Return of Capital is effected as soon as possible.

6. Summary explanation of the Resolution to be

put to the General Meeting

The Return of Capital is conditional upon the

Resolution being passed. The Resolution is a special

resolution and will be passed if at least 75 per

cent. of the votes cast are in favour.

The Resolution proposes to:

* authorise the Directors to:

(i) capitalise a sum not exceeding GBP2,028.34

standing to the credit of the Company's share

premium account to pay up in full the B Shares

and C Shares; and

(ii) allot and issue B Shares and C Shares up

to an aggregate nominal amount of GBP2,028.34

to Shareholders on the basis of one B Share or

one C Share for each Ordinary Share held at 6.00

pm on 2 March 2015. The authority granted to the

Directors will expire on the earlier of the conclusion

of the next annual general meeting of the Company

after the passing of this Resolution and 31 December

2015; and

(iii) carry out any other act necessary in relation

to the Return of Capital; and

* approve the terms of the Option Agreement to be

entered into between the Company and UBS described in

paragraph 2 of Part 10 of the Circular; and

* adopt new articles of association that incorporate

the terms of the B Shares and C Shares and the

Deferred Shares.

If the Resolution is not passed at the General

Meeting, the Return of Capital will not proceed

and any Election Forms received by Equiniti will

lapse and shall have no effect.

The Return of Capital will have no effect on the

number of Ordinary Shares held by any Shareholder

and accordingly on the voting share capital of

the Company. As a result, the provisions of Rule

9 of the Takeover Code do not apply to the Return

of Capital and no approval is being sought from

Shareholders for a waiver of these provisions

in the context of the Return of Capital.

7. United Kingdom taxation in relation to the

Return of Capital

A tax liability may arise for Shareholders resident

in the UK (for tax purposes) in respect of the

capital and/or income received under the Return

of Capital depending upon a Shareholder's individual

circumstances. A guide to certain UK tax consequences

of the Return of Capital under current UK law

for United Kingdom Shareholders is set out in

the Circular.

8. Overseas Shareholders

The attention of those Shareholders who are not

resident in the United Kingdom or who are citizens,

residents or nationals of other countries is drawn

to the information set out in paragraph 6 of Part

3 of the Circular.

In particular, Overseas Shareholders should note

that, by making a valid election for the Capital

Option, such Shareholders will be deemed to represent,

warrant, undertake and/or agree (as applicable)

in the terms set out in paragraph 6 of Part 3

of the Circular. Furthermore, Overseas Shareholders

with a registered address in a Restricted Territory

will be deemed to have elected for the Income

Option in respect of all of their B/C Share Entitlement.

The tax consequences of the B/C Share Scheme may

vary for Overseas Shareholders and, accordingly,

Overseas Shareholders should consult their own

independent professional adviser without delay.

9. Share Option Schemes

Holders of options under the Share Option Schemes

are not the beneficial owners of Ordinary Shares

and so will not be entitled to participate in

the Return of Capital.

In previous returns of capital, no adjustments

have been made to options. However, in view of

the size of the Return of Capital on this occasion

it is intended that appropriate adjustments will

be made to options outstanding under the Share

Option Schemes in accordance with the rules of

the relevant scheme, in order to maintain the

holders' economic position following the completion

of the Return of Capital. Details of the adjustments

will be sent to holders of options under the Share

Option Schemes in due course.

10. Interim announcement and no significant change For information purposes, Shareholders' attention

is drawn to the announcement of the interim results

of the Company for the period to 27 December

2014 which was published on 11 February 2015

and which can be found at www.dunelm.com.

The Directors are not aware of any significant

change in the financial or trading position of

the Group since the date of the announcement

of the interim results

11. Action to be taken

General meeting

A Form of Proxy for use at the General Meeting

will be sent to Shareholders with the Circular.

Whether or not the Shareholder intends to be present

at the meeting, they are requested to complete,

sign and return the Form of Proxy to Equiniti

Limited, Aspect House, Spencer Road, Lancing,

West Sussex BN99 6DA, as soon as possible but

in any event so as to be received no later than

10.00 am on 26 February 2015.

Shareholders who hold their Ordinary Shares in

CREST may appoint a proxy by completing and transmitting

a CREST Proxy Instruction to Equiniti so that

it is received no later than 10.00 am on 26 February

2015.

Completion and return of the Form of Proxy or

the transmission of a CREST Proxy Instruction

will not preclude Shareholders from attending

and voting in person at the General Meeting should

they so wish.

B/C Share Scheme

The Circular contains instructions on the completion

of the Election Form sent to Shareholders with

the Circular if their shares are in certificated

form, or if their shares are held in uncertificated

form (that is in CREST), how to make their election

through CREST. The Election Form must be received

or the TTE Instruction must be sent through CREST

as soon as possible but in any event so as to

be received no later than 4.30pm on Monday 9 March

2015.

13. Recommendation

In the opinion of the Board, which has received

financial advice from UBS, the Return of Capital

and the Resolution to be proposed at the General

Meeting are in the best interests of Shareholders

as a whole. In providing advice to the Directors,

UBS has relied upon the Directors' commercial

assessment of the Return of Capital.

Accordingly the Board unanimously recommends that

you vote in favour of the Resolution to be proposed

at the General Meeting as the Directors intend

to do in respect of their beneficial holdings

amounting to 63,005,738 Ordinary Shares in aggregate,

representing approximately 31.1 per cent. of the

current voting share capital of Dunelm.

14. Shareholders' elections

The Board makes no recommendation to Shareholders

in relation to elections for the B/C Share Scheme

itself. Shareholders need to take their own decision

in this regard and are recommended to consult

their own independent professional adviser.

Terms used in this announcement shall have the

meanings given to them in the Circular and are

incorporated into this announcement by reference.

For further information, please contact:

Dunelm Group plc

Will Adderley, Chief

Executive

David Stead, Finance

Director 0116 2644 356

MHP Communications

John Olsen

Simon Hockridge

Naomi Lane 020 3128 8100

Equiniti Shareholder 0871 384 2919 (from inside

helpline the UK)

+44 121 415 0263 (from outside

the UK)

Shareholder helpline available between the hours

of 8.30 am and 5.30 pm Monday to Friday (except

UK public holidays). Please note that calls to

the helpline may be recorded or monitored. Calls

to 0871 384 2919 cost 8 pence per minute (excluding

VAT) plus network extras. Different charges may

apply to calls from mobile telephone. Calls from

outside the UK will be charged at applicable

international rates.

Please note that for legal reasons the Shareholder

helpline will only be able to provide information

contained in this announcement, the Circular

and the Election Form and will be unable to give

advice on the merits of the B/C Share Scheme,

the Share Alternatives or to provide financial,

legal or tax advice.

This announcement does not constitute an offer

to sell or the solicitation of an offer to buy

any security, nor the solicitation of any vote

or approval in any jurisdiction, nor shall there

be any sale, issuance or transfer of the securities

referred to in any jurisdiction in contravention

of applicable law.

No application will be made to the UK Listing

Authority or to the London Stock Exchange for

any of the B Shares, C Shares or Deferred Shares

to be admitted to the Official List or to trading

on the London Stock Exchange's main market for

listed securities, nor will the B Shares or the

C Shares or the Deferred Shares be admitted to

trading on any other recognised investment exchange.

None of the B Shares, the C Shares or the Deferred

Shares have been or will be registered under

the US Securities Act or the state securities

laws of the United States and none of them may

be offered or sold in the United States unless

pursuant to a transaction which has been registered

under the US Securities Act and/or relevant state

securities laws or which is not subject to the

registration requirements of the US Securities

Act or such laws, either because of an exemption

therefrom or otherwise.

None of the B Shares, the C Shares or the Deferred

Shares or this announcement or the Circular has

been approved, disapproved or otherwise recommended

by any US federal or state securities commission

or other regulatory authority or any non-US securities

commission or regulatory authority nor have any

such authorities confirmed the accuracy or determined

the adequacy of this announcement or the Circular.

Any representation to the contrary is a criminal

offence in the United States.

This announcement includes forward-looking statements

concerning the Group. Forward-looking statements

are based on current expectations and projections

about future events. These forward-looking statements

are subject to risks, uncertainties and assumptions

about the Group. The Group undertakes no obligation

to update publicly or revise any forward-looking

statements, whether as a result of new information,

future events or otherwise save to the extent

required in accordance with the Company's continuing

obligations under the Listing Rules, the Disclosure

and Transparency Rules, applicable laws and regulations.

UBS Limited is authorised by the Prudential Regulation

Authority and regulated by the Financial Conduct

Authority and the Prudential Regulation Authority

and is acting as financial adviser to Dunelm

in connection with the Return of Capital and

for no one else and will not be responsible to

anyone other than Dunelm (whether or not a recipient

of this announcement or the Circular) for providing

the protections afforded to clients of UBS Limited

nor for providing advice in relation to the proposals

described in this announcement or the Circular

or any other matter referred to in this announcement

or the Circular. Persons other than Dunelm are

recommended to seek their own financial and professional

advice.

Apart from the responsibilities and liabilities,

if any, which may be imposed on UBS Limited by

the FSMA or the regulatory regime established

thereunder, UBS Limited accepts no responsibility

or liability whatsoever for the contents of this

announcement or the Circular or for any other

statement made or purported to be made in connection

with the Company, the proposed Return of Capital

or the Resolutions. UBS Limited accordingly disclaims

all and any responsibility or liability whether

arising in tort, contract or otherwise (save

as referred to above) which it might otherwise

have in respect of this announcement, the Circular

or any such statement.

This announcement has been issued by, and is the sole

responsibility of, the Company.

Name of authorised Company official responsible for making this

notification:

Dawn Durrant, Company Secretary

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCFFLLFELFEBBB

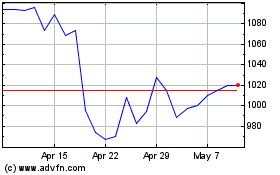

Dunelm (LSE:DNLM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dunelm (LSE:DNLM)

Historical Stock Chart

From Apr 2023 to Apr 2024