TIDMDNLM

RNS Number : 5839O

Dunelm Group plc

10 February 2016

10 February 2016

Dunelm Group plc

Interim Results Announcement

Dunelm Group plc, the UK's leading homewares retailer, announces

its interim results for the 26 weeks to 2 January 2016.

Financial Highlights

FY16 FY15 +/-

H1 H1 change

------------ ------------ ----------

Sales GBP448.1m GBP406.4m + 10.3%

--------------------- ------------ ------------ ----------

Total LFL * GBP404.9m GBP387.0m +4.6%

LFL stores GBP376.9m GBP364.5m + 3.4%

Home delivery GBP28.0m GBP22.5m +24.4%

--------------------- ------------ ------------ ----------

Gross margin 50.7% 50.4% + 30 bps

EBITDA GBP88.7m GBP77.6m + 14.3%

Profit before

tax GBP75.5m GBP68.2m + 10.7%

EPS (fully diluted) 29.3p 26.4p + 11.0%

Free cash flow GBP76.7m GBP46.1m + 66.4%

* Calendar impact

Due to the 53(rd) week included in the last financial year, the

above figures include eight days of our Winter Sale, compared to

two days of Winter Sale included in the comparative period. This

has boosted LFL growth by approximately GBP10.0m (equivalent to

2.6% over the half year). These impacts will reverse in the next

quarter. Therefore, adjusting for this calendar impact, underlying

LFL performance was +2.0% for the 26 week period.

Business Highlights

-- Continued focus on three part growth strategy - growing like

for like sales, rolling out new stores, and growing our home

delivery channel - with eight core projects now in place to deliver

this

-- Solid progress in LFL store sales, underpinned by strong

performance from curtains and bedding, particularly our new Kids

range

-- On-going store portfolio expansion, with future focus now increasingly on London

-- Further strong growth in home delivery of 24.4% with growth

starting to accelerate following new web platform launch last

year

Dividends

-- Interim dividend increased by 9.1% to 6.0p per share (FY15: 5.5p per share)

-- Special distribution of 31.5p per share (totalling GBP63.9m),

in line with capital structure policy and reflecting continued

strong cash generation

John Browett, Chief Executive Officer, said:

"It is a really exciting time to be at Dunelm - a business built

on a strong foundation of exciting product and design, unrivalled

knowledge of the homewares market, a low-cost store network, great

people and investment in systems.

"Our focus remains on growing the business for the longer term.

After making good progress so far, we are continuing to work

towards our three part growth strategy and are now focused on eight

core projects that will enable us to achieve this. This will allow

us to improve our business substantially for our customers and, as

we increase both our store network around London and our online

presence, to develop Dunelm into a truly national homewares

brand.

"After a solid performance in the first half, we had a strong

sale after Christmas and we expect further good progress in the

remainder of the year."

For further information, please contact:

Dunelm Group plc 0116 2644 356

John Browett, Chief Executive

Officer

Keith Down, Chief Financial

Officer

MHP Communications 020 3128 8100

John Olsen / Simon Hockridge

/ Tom Horsman

Notes to Editors

Dunelm is market leader in the GBP11bn UK Homewares market. The

Group currently operates 157 stores, of which 151 are out-of-town

superstores and 6 are located on high streets, and an on-line

store, to be found at www.dunelm.com.

Dunelm's "Simply Value for Money" customer proposition offers

industry-leading choice of quality products at keen prices, with

high levels of availability and supported by friendly service. Core

ranges include many exclusive designs and premium brands such as

Dorma, and are supported by a frequently changing series of special

buys. The superstore format provides an average of 30,000 sq. ft.

of selling space with over 20,000 products across a broad spectrum

of categories, extending from the Group's home textiles heritage

(bedding, curtains, cushions, quilts and pillows) to a complete

Homewares offer including kitchenware and dining, lighting, wall

art, furniture and rugs. Dunelm is one of the few national

retailers to offer an authoritative selection of curtain fabrics on

the roll, and owns a specialist UK facility dedicated to producing

made-to-measure curtains.

Dunelm was founded in 1979 as a market stall business, selling

ready-made curtains. The first shop was opened in Leicester in 1984

and over the following years the business developed into a

successful chain of high street shops before expanding into broader

homewares categories following the opening of the first Dunelm

superstore in 1991.

Dunelm has been listed on the London Stock Exchange since

October 2006 (DNLM.L) and has a current market capitalisation of

approximately GBP1.7bn.

CHAIRMAN'S STATEMENT

Dunelm has delivered a solid performance in the first six

months, with total sales growing by 10.3% to GBP448.1m, three new

stores were opened and like for like sales growth was 3.4%. Profit

before tax increased by 10.7% to GBP75.5m. The Board has declared

an interim dividend of 6 pence per share, up 9% on last year and

broadly in line with the 11% growth in our earnings per share.

In line with our Capital Structure policy to maintain our

average net debt to EBITDA at between 0.25 times and 0.75 times the

Board has declared a Special Dividend of 31.5 pence per share,

which will be payable, together with the ordinary dividend, to

shareholders on the register on the 4th March. This Special

Dividend is supported by our strong cash performance in the period

with free cash flow increasing by 66.4% year on year to

GBP76.7m.

John Browett became Chief Executive on January 1st, having been

CEO Designate since July 2015, and is already having a substantial

positive impact on the business. As mentioned in our Annual Report,

Will Adderley continues to play an active role in the business as

Deputy Chairman. Keith Down joined as our new Chief Financial

Officer in December 2015, following the retirement of David Stead.

William Reeve and Peter Ruis have also recently joined the Board as

Non-Executive Directors.

We look forward to further good progress in the remainder of the

year.

Andy Harrison

Chairman

10 February 2016

CHIEF EXECUTIVE OFFICER'S REVIEW

The Foundation of our success

Our business is built on a strong foundation of exciting product

and design, unrivalled knowledge of the homewares market, a low

cost store network, great people and investment in systems. Our

focus continues to be on developing the business for the longer

term. We can continue to grow strongly and profitably through store

sales growth, new stores (particularly in London) and through

on-line enabled home delivery.

At our heart we are a product company through and through. We

love to design and source new lines that offer exceptional value

for money. We have a great supply base that helps us source new

product at fantastic prices and our stores have, on average, 20,000

well-chosen lines. It is a pleasure to join a company that really

understands how to find lines for whatever budget our customers

have.

Our stores and online offer continue to evolve, and we are

constantly improving the shopping trip. Historically we have

focused on range and stock density to drive sales. While this will

always be important, in our latest stores, refits and new website

we are particularly focused on making our offer easier to shop.

Most notably we have had some great breakthroughs in the last six

months on visual merchandising in key categories.

In any retail business people are a critical part of delivering

for customers. I believe this to be particularly true for Dunelm.

Perhaps this is why our stores and delivery service achieve very

high net promoter scores from our customers. We welcomed the Living

Wage increases as we had already planned to significantly increase

our pay for our store colleagues. We want to recognise the major

role they have in making Dunelm a great place to shop.

As we grow, we are also strengthening our senior team, investing

in our capability to accelerate the development of the business.

Wherever possible we promote from within our business. 80% of the

latest store manager appointments were internal promotions.

Over the years we have invested in our core systems to make our

business efficient and effective. We are focused on building the

systems around this strong IT core, which will enable us to

continue to develop without taking on significant costs as turnover

expands.

Growth Strategy

Since I joined the business we have reviewed our strategy and

whilst we continue to work towards the three part growth strategy

reported last year; growing like for like sales, rolling out new

stores and growing our home delivery channel, we have focused our

work on eight key initiatives that I believe will enable us to

achieve this. These core projects are not everything we do day to

day and do not represent all of our project work but instead focus

our effort and will be the key method by which we improve our

business substantially for our customers over the medium term.

Online

We have built our store estate for a post-internet view of UK

retailing. Our aspiration is to increase our store estate to 200

locations from the 151 superstores we have today. We cannot clearly

see what the final split of sales between stores and online will

be, however we do believe in a multi-channel world for homewares

and see online as a critical part of the shopping trip.

(MORE TO FOLLOW) Dow Jones Newswires

February 10, 2016 02:00 ET (07:00 GMT)

The web enables us to engage with customers before they leave

home, in store and when they make a final decision. It enables us

to service our customers far more effectively; whether through

offering an extended range, walking through all of the options,

tracking orders or following up appointments.

In July we launched our new website; while growth initially

slowed as we got used to a new robust platform, sales growth has

started to accelerate and we are now able to develop our offer far

more rapidly. We have lots of ideas to implement and online has

significantly expanded the reach for our great product.

London

We still need around 50 stores to give us national coverage in

the UK. London and the South East provide a significant portion of

this opportunity, although we recognise that it is a challenging

market to penetrate. We are already at 8 stores in the Greater

London area and can see opportunities to increase this. Stores are

a critical way for us to build awareness around our product and

design.

Stock Management

Dunelm operates with high stock density and availability both at

the shelf-edge and online. This enables our customers to shop with

confidence knowing, for example, that when buying bed linen the

whole set is in stock.

We have carefully analysed our stock flow through the Company

and concluded that we can further improve availability whilst still

running with lower stock both in stores and in our supply chain.

This will make us more efficient which will enable us to reinvest

in the customer offer.

Store Operations

Our stores are at the heart of everything we do. We have

reviewed all activities carried out in the stores and as a result

have found several opportunities to use our colleagues more

effectively.

After a careful study we are reducing the "waste" activity in

store. This has been and will be facilitated by improving our

management of stock. Consequently we can redirect our store effort

to helping customers, which we know will drive sales.

The improvement in store operation is not just a one-off for

this year. We can see several rounds of improvement that will allow

us to reinvest in wages, make our stores more efficient and an even

better place to shop through continued investment in service.

Store Format

Our customers love our stores, but they do tell us that we could

make them easier to shop. Historically we have always focused on

range and stock density at the expense of customer space. The work

on stock is making our stores a little easier to navigate, but

there remains an opportunity to make our displays more

attractive.

We have implemented many good visual merchandising initiatives

recently; for example the Rug Bazaar we are rolling out and the

half beds we use to show bedding. However, the work on the format

will take this much further. We have incorporated elements of this

thinking in some of our stores, but this is merely an indication of

where we are travelling, not the final destination.

Made to Measure

Made to Measure is a service that differentiates us from many of

our competitors. We manufacture the majority of our curtains

ourselves and believe we offer great value for money.

We know this business can grow significantly as we improve the

efficiency and effectiveness of the operation with the aim of

increasing our overall market share. Although we have a market

leading offer we can do even better for our customers. We will

implement a new system to manage the customer order end to end and

will make the offer much easier to shop online.

Furniture

Dunelm continues to develop its furniture offer across all

channels. We are focused on readymade furniture, our value is

strong and we have grown the business significantly.

We have major opportunities to deliver even better ranges,

better in store displays and more service in our stores. Behind the

scenes we are improving stock management, delivery options and

after sales service. Customers are happy with what we deliver today

but we can do more to grow this business, recognising that it will

take some time.

The work on the supply chain over the last six months means our

total furniture sales are profitable today but increased scale will

make this a much more profitable business in the future.

Supply Chain

In the summer, as previously announced, we will double our

warehouse capacity in a purpose built facility that will enable a

lower cost logistics platform. Ultimately we will achieve greater

savings per unit as we grow.

The new facility will also enable us to further integrate our

e-commerce and direct to store distribution over time. This will

enable improved availability, productivity and cleaner realisation

of end of season clearance.

Outlook

After a solid performance in the first half, we had a strong

sale after Christmas and we expect further good progress in the

remainder of the year.

We are working hard to build an even better business for the

future. We want to improve the shopping trip for customers both in

store and online. Our work on the supply chain will provide better

service in store and to the home at lower cost. We can make

ourselves more efficient and effective in the stores and the

office. As we work through all the product ranges, including

furniture and Made to Measure, I am confident that we can find even

more ways to improve value for money for our customers.

It is a really exciting time to be at Dunelm; we have the key

infrastructure projects in place, the right team, a great heritage

and a continued focus on our product and people.

John Browett

Chief Executive Officer

10 February 2016

CHIEF FINANCIAL OFFICER'S REVIEW

Financial Performance

Sales

Total sales for the 26 weeks to 2 January 2016 were GBP448.1m

(FY15 H1: GBP406.4m), representing growth of 10.3%.

Taking our three key growth avenues in turn, sales performance

was as follows:

H1 sales Growth Growth

(GBPm) (GBPm) (%)

--------------- --------- -------- -------

LFL stores 376.9 12.4 3.4%

--------------- --------- -------- -------

Home delivery 28.0 5.5 24.4%

--------------- --------- -------- -------

Total LFL 404.9 17.9 4.6%

--------------- --------- -------- -------

Non-LFL

stores 43.2 23.8 -

--------------- --------- -------- -------

Total 448.1 41.7 10.3%

--------------- --------- -------- -------

Due to the 53(rd) week included in the last financial year, the

above figures include eight days of our Winter Sale, compared to

two days of Winter Sale included in the comparative period. This

has boosted like for like (LFL) stores growth by approximately

GBP10.0m (equivalent to 2.6% over the half year). These impacts

will reverse in the next quarter. Therefore, adjusting for this

calendar impact, underlying LFL performance was +2.0% for the 26

week period.

Having adjusted for the beneficial calendar impact, performance

in the period reflected:

-- Good performance in curtains and bedding, particularly our

new Kids range. We also saw good growth in our rugs and utility

departments;

-- Ongoing store portfolio expansion, with three new superstores

opened and one major refit completed; and

-- Continuing growth of our on-line business, including a +24.4%

increase in home delivery sales.

Gross margin

Gross margin for the half year increased by 30 basis points

(bps) to 50.7% (FY15 H1: 50.4%). This included the impact of Winter

Sale as described above, which is estimated to have depressed

margin growth by -10bps over the half year. Underlying margin

improved due to a small increase in direct sourcing, (increasing to

19.4% from 19.0% in the comparative period) better buying and less

promotional clearance.

Operating costs

Operating costs for the period were GBP151.4m, an increase of

GBP13.7m (10.0%) year on year. The main drivers of this increase

were:

-- IT capability - we continue to recognise the importance of IT

in our business, not only investing in the new web platform but

also the scale and capability of our IT function;

-- Store portfolio growth - we opened three new stores

increasing selling space by 2.1% in the first half of the year;

-- Multi-channel fulfilment - we continue to invest in our home

delivery service, and the value of this business rose by 24%

compared to the previous year;

-- Dunelm At Home - we finalised the roll-out of our in-home

consultation service adding another 10 stores;

-- Stoke 2 transition - we have invested around GBP0.3m in

transition costs relating to the new warehouse which is due to open

in the second half of the year;

-- Stores - we continue to invest in customer service and in our

workforce through higher wage increases. We anticipate that these

incremental costs will be offset by productivity benefits over

time;

-- Investment in board and executive team - we have

significantly invested in senior management capability as we look

to develop the business further; and

-- Property - we saw a one-off benefit of GBP0.7m in the first

half relating to the reassignment of an onerous lease

Profit and Earnings per Share

Operating profit for the period was GBP75.6m (FY15 H1:

GBP67.1m), an increase of GBP8.5m (12.7%). Operating profit margin

was 16.9%, 40bps higher than FY15 H1 due to the increase in gross

margin and the benefit of the Winter Sale brought forward into the

first half of the year.

Earnings before interest, tax, depreciation and amortisation

(EBITDA) rose by 14.3% to GBP88.7m (FY15 H1: GBP77.6m). On a last

twelve months basis, EBITDA was GBP155.2m (FY15 H1: GBP142.3m). The

EBITDA margin achieved was 19.8% (FY15 H1: 19.1%)

(MORE TO FOLLOW) Dow Jones Newswires

February 10, 2016 02:00 ET (07:00 GMT)

There was a net loss of GBP0.1m (FY15 H1: GBP1.1 gain) on

financial items in the period. Interest payable and amortisation of

arrangement fees relating to the Group's revolving credit facility

of GBP0.8m (FY15 H1: nil) were offset by gains of GBP0.6m (FY15 H1:

GBP0.7m) resulting from foreign exchange differences on the

translation of dollar denominated assets and liabilities along with

interest earned on cash deposits of GBP0.1m (FY15 H1: GBP0.4m).

Profit before tax (PBT) grew by 10.7% to GBP75.5m (FY15 H1:

GBP68.2m). Profit after tax of GBP59.5m (FY15 H1: GBP53.5m)

reflects the projected full year effective tax rate of 21.2% (FY15

H1: 21.5%). The effective rate has reduced compared with last year

primarily due to the lowering of the headline rate of corporation

tax offset by depreciation charged on non-qualifying capital

expenditure.

Fully diluted earnings per share were 29.3p (FY15 H1: 26.4p), an

increase of 11.0%.

Cash generation

Dunelm continues to deliver strong cash returns. In the period,

the group generated GBP96.8m (FY15 H1: GBP58.7m) of net cash from

operating activities, an increase of 64.9%. This includes some

benefit of seasonality, which is expected to reverse in the second

half of the financial year.

Period end working capital decreased by GBP20.5m. (FY15 H1:

GBP5.1m increase). The majority of this movement relates to an

improvement in stock and inventories of GBP14.7m which reflects

better stock control and the impact of the Winter Sale being

brought forward. We expect that the majority of this working

capital benefit will continue in the second half of the year.

Capital investment was GBP20.0m in the period (FY15 H1:

GBP12.6m). Spend in the period included the purchase of the Fogarty

brand (GBP4.8m), investment in the new distribution centre (GBP2.5m

of a GBP12m total expected investment), and investment in new and

existing stores (GBP9.5m). Free cash flow was GBP76.7m (FY15 H1:

GBP46.1m), representing 102% of PBT (FY15 H1: 68%).

Capital Policy

During FY15, the Board adopted a new policy on capital

structure, targeting an average net debt level (excluding lease

obligations and short-term fluctuations in working capital) of

between 0.25× and 0.75× historical EBITDA. This policy provides the

flexibility to continue to invest in the Group's growth strategy

and to take advantage of investment opportunities as and when they

arise, for example freehold property acquisitions. Furthermore, the

board intends that ordinary dividend cover should in future be

between 2.0x and 2.5x on a full year basis.

Reflecting these policies, we will pay a regular interim

dividend of 6p per share (totalling GBP12.2m, a 9% increase year on

year) and a special distribution of 31.5p per share (totalling

GBP63.9m) to shareholders on the register at 4 March 2016. Both

payments are expected to be made on 24 March 2016.

The Board will consider further special distributions in the

future if average debt over a period consistently falls below the

minimum target level of 0.25x EBITDA, subject to known and

anticipated investments plans at the time.

Banking Agreements and Net Debt

The Group has in place a GBP150m syndicated Revolving Credit

Facility (RCF) which expires on 9 February 2020. The terms of the

RCF are consistent with normal practice and include covenants in

respect of leverage (net debt to be no greater than 2.5× EBITDA)

and fixed charge cover (EBITDA to be no less than 1.5× fixed

charges), both of which were met comfortably as at 2 January

2016.

In addition the Group maintains GBP20m of uncommitted overdraft

facilities with two syndicate partner banks.

Net debt at 2 January 2016 was GBP29.4m compared with net debt

of GBP73.6m at 4 July 2015. Daily average net debt (facilities

drawn plus cash at bank) was GBP47.5m. This falls within our target

range of net debt.

Principal Risks and Uncertainties

There are a number of potential risks and uncertainties which

could have a material impact on the Group's performance over the

remaining six months of the financial year and beyond, and could

cause actual results to differ materially from expected and

historical results. The Board considers that the majority of

significant risks and uncertainties remain as published in the

Annual Report for the year ended 4 July 2015. These comprise:

-- Damage to brand reputation through product and service quality

-- Loss of market share through increased competition

-- Prosecution and other regulatory action as a result of

failure to comply with legislative or regulatory requirements

-- Disruption to key IT systems from a major incident, including a cyber-attack

-- Fluctuations in commodity prices

-- Access to sites for store chain expansion

-- Loss of a key part of our infrastructure

-- Unforeseen financing requirements or treasury exposures

-- Loss of key personnel

A detailed explanation of these risks can be found on pages 24

to 28 of the 2015 Annual Report which is available at

www.dunelm.com.

Keith Down

Chief Financial Officer

10 February 2016

CONSOLIDATED INCOME STATEMENT (UNAUDITED)

For the 26 weeks ended 2 January 2016

26 weeks 26 weeks 53 weeks

ended ended ended

2 January 27 December 4 July

Note 2016 2014 2015

GBP'000 GBP'000 GBP'000

----------- ------------- ----------

Revenue 5 448,078 406,372 835,805

Cost of sales (221,021) (201,571) (424,649)

------------------------------------ ----- ----------- ------------- ----------

Gross profit 227,057 204,801 411,156

Operating costs (151,422) (137,688) (288,672)

------------------------------------ ----- ----------- ------------- ----------

Operating profit 75,635 67,113 122,484

Financial income 691 1,061 811

Financial expenses (833) - (673)

------------------------------------ ----- ----------- ------------- ----------

Profit before taxation 75,493 68,174 122,622

Taxation 6 (16,005) (14,657) (26,551)

------------------------------------

Profit for the period attributable

to owners of the parent 59,488 53,517 96,071

------------------------------------ ----- ----------- ------------- ----------

Earnings per Ordinary Share

- basic 8 29.4p 26.5p 47.5p

Earnings per Ordinary Share

- diluted 8 29.3p 26.4p 47.3p

------------------------------------ ----- ----------- ------------- ----------

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME (UNAUDITED)

For the 26 weeks ended 2 January 2016

26 weeks 26 weeks 53 weeks

ended ended ended

2 January 27 December 4 July

2016 2014 2015

GBP'000 GBP'000 GBP'000

----------- ------------- ---------

Profit for the period 59,488 53,517 96,071

Other comprehensive income/(expense):

Items that may be subsequently

reclassified to profit or loss:

Movement in fair value of cash

flow hedges 2,318 4,565 905

Transfers of cash flow hedges

to cost of sales 498 529 1,706

Deferred tax on hedging movements (538) (1,019) (522)

Other comprehensive income for

the period, net of tax 2,278 4,075 2,089

---------------------------------------- ----------- ------------- ---------

Total comprehensive income for the

period attributable to owners of

the parent 61,766 57,592 98,160

---------------------------------------- ----------- ------------- ---------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION (UNAUDITED)

As at 2 January 2016

Note 2 January 27 December 4 July

2016 2014 2015

GBP'000 GBP'000 GBP'000

---------------------------------- ----- ---------- ------------ ----------

Non-current assets

Intangible assets 10 17,636 11,298 13,124

Property, plant and equipment 10 162,047 152,910 158,946

Deferred tax asset 1,153 1,582 1,897

Total non-current assets 180,836 165,790 173,967

---------------------------------- ----- ---------- ------------ ----------

Current assets

Inventories 118,374 135,326 133,118

Trade and other receivables 16,953 20,295 17,962

Cash and cash equivalents 39,590 38,312 16,197

Derivative financial instruments 2,777 2,196 -

Total current assets 177,694 196,129 167,277

(MORE TO FOLLOW) Dow Jones Newswires

February 10, 2016 02:00 ET (07:00 GMT)

---------------------------------- ----- ---------- ------------ ----------

Total assets 358,530 361,919 341,244

---------------------------------- ----- ---------- ------------ ----------

Current liabilities

Trade and other payables (95,649) (85,059) (88,102)

Liability for current tax (15,443) (13,649) (12,495)

Derivative financial instruments - - (308)

Total current liabilities (111,092) (98,708) (100,905)

---------------------------------- ----- ---------- ------------ ----------

Non-current liabilities

Bank loans 11 (69,008) - (89,840)

Trade and other payables (40,962) (43,546) (42,376)

Provisions for liabilities (1,925) (3,416) (3,055)

Total non-current liabilities (111,895) (46,962) (135,271)

---------------------------------- ----- ---------- ------------ ----------

Total liabilities (222,987) (145,670) (236,176)

---------------------------------- ----- ---------- ------------ ----------

Net assets 135,543 216,249 105,068

---------------------------------- ----- ---------- ------------ ----------

Equity

Issued share capital 2,028 2,028 2,028

Share premium 1,624 1,624 1,624

Capital redemption reserve 43,157 43,157 43,157

Hedging reserve 2,048 1,756 (230)

Retained earnings 86,686 167,684 58,489

Total equity attributable to

equity holders of the Parent 135,543 216,249 105,068

---------------------------------- ----- ---------- ------------ ----------

CONSOLIDATED STATEMENT OF CASH FLOWS (UNAUDITED)

For the 26 weeks ended 2 January 2016

Note 26 weeks 26 weeks 53 weeks

ended ended ended

2 January 27 December 4 July

2016 2014 2015

GBP'000 GBP'000 GBP'000

--------------------------------------- ----- ----------- ------------- ----------

Profit before taxation 75,493 68,174 122,622

Adjustment for net financing

costs 142 (1,061) (138)

----------- ------------- ----------

Operating profit 75,635 67,113 122,484

Depreciation and amortisation 10 12,354 10,509 21,436

Impairment losses on non-current

assets 10 - - 109

Loss on disposal of non-current

assets 10 684 5 102

----------- ------------- ----------

Operating cash flows before

movements in working capital 88,673 77,627 144,131

Decrease/(increase) in inventories 14,744 (19,798) (17,590)

Decrease/(increase) in receivables 1,002 (771) 1,505

Increase in payables 4,717 15,463 16,236

----------- ------------- ----------

Net movement in working capital 20,463 (5,106) 151

Share-based payments expense 595 (439) 250

----------- ------------- ----------

109,731 72,082 144,532

Interest received 64 273 522

Tax paid (13,043) (13,630) (26,859)

----------- ------------- ----------

Net cash generated from operating

activities 96,752 58,725 118,195

Cash flows from investing activities

Proceeds on disposal of property,

plant and equipment - - 3

Acquisition of property, plant

and equipment (13,315) (9,616) (25,362)

Acquisition of intangible assets (6,723) (2,980) (5,884)

--------------------------------------- ----- ----------- ------------- ----------

Net cash used in investing activities (20,038) (12,596) (31,243)

Cash flows from financing activities

Proceeds from re-issue of treasury

shares 703 22 810

Net (repayments)/drawdowns on

revolving credit facility 11 (21,000) - 91,000

Loan transaction costs 11 - - (1,295)

Interest paid (992) - (148)

Ordinary dividends paid (32,397) (30,322) (41,458)

Special distributions to shareholders - - (141,727)

--------------------------------------- ----- ----------- ------------- ----------

Net cash flows used in financing

activities (53,686) (30,300) (92,818)

--------------------------------------- ----- ----------- ------------- ----------

Net decrease in cash and cash

equivalents 23,028 15,829 (5,866)

Foreign exchange revaluations 365 743 323

Cash and cash equivalents at

the beginning of the period 16,197 21,740 21,740

Cash and cash equivalents at

the end of the period 39,590 38,312 16,197

--------------------------------------- ----- ----------- ------------- ----------

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY (UNAUDITED)

For the 26 weeks ended 2 January 2016

Issued Capital

share Share redemption Hedging Retained Total

Note capital premium reserve reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------- ----- --------- --------- ------------ --------- ---------- ----------

As at 4 July 2015 2,028 1,624 43,157 (230) 58,489 105,068

-------------------------- ----- --------- --------- ------------ --------- ---------- ----------

Profit for the period - - - - 59,488 59,488

Movement in fair value

of cash flow hedges - - - 2,318 - 2,318

Transfers to cost of

sales - - - 498 - 498

Deferred tax on hedging

movements - - - (538) - (538)

-------------------------- ----- --------- --------- ------------ --------- ---------- ----------

Total comprehensive

income for the period - - - 2,278 59,488 61,766

Issue of treasury shares - - - - 703 703

Share based payments - - - - 595 595

Deferred tax on share

based payments - - - - (258) (258)

Current corporation

tax on share options

exercised 6 - - - - 66 66

Ordinary dividends paid 9 - - - - (32,397) (32,397)

-------------------------- ----- --------- --------- ------------ --------- ---------- ----------

Total transactions with

owners, recorded directly

in equity - - - - (31,291) (31,291)

--------- --------- ------------ --------- ---------- ----------

As at 2 Jan 2016 2,028 1,624 43,157 2,048 86,686 135,543

-------------------------- ----- --------- --------- ------------ --------- ---------- ----------

As at 28 June 2014 2,028 1,624 43,157 (2,319) 145,247 189,737

Profit for the period - - - - 53,517 53,517

Movement in fair value

of cash flow hedges - - - 4,565 - 4,565

Transfers to cost of

sales - - - 529 - 529

Deferred tax on hedging

movements - - - (1,019) - (1,019)

-------------------------- ----- --------- --------- ------------ --------- ---------- ----------

Total comprehensive

(MORE TO FOLLOW) Dow Jones Newswires

February 10, 2016 02:00 ET (07:00 GMT)

income for the period - - - 4,075 53,517 57,592

Issue of treasury shares - - - - 22 22

Share based payments - - - - (439) (439)

Deferred tax on share

based payments - - - - 133 133

Current corporation

tax on share options

exercised 6 - - - - (474) (474)

Ordinary dividends paid 9 - - - - (30,322) (30,322)

-------------------------- ----- --------- --------- ------------ --------- ---------- ----------

Total transactions with

owners, recorded directly

in equity - - - - (31,080) (31,080)

--------------------------------- --------- --------- ------------ --------- ---------- ----------

As at 27 December 2014 2,028 1,624 43,157 1,756 167,684 216,249

-------------------------- ----- --------- --------- ------------ --------- ---------- ----------

As at 28 June 2014 2,028 1,624 43,157 (2,319) 145,247 189,737

-------------------------- -----

Profit for the period - - - - 96,071 96,071

Movement in fair value

of cash flow hedges - - - 905 - 905

Transfers to cost of

sales - - - 1,706 - 1,706

Deferred tax on hedging

movements - - - (522) - (522)

-------------------------- ----- --------- --------- ------------ --------- ---------- ----------

Total comprehensive

income for the period - - - 2,089 96,071 98,160

Issue of treasury shares - - - - 810 810

Share based payments - - - - 250 250

Deferred tax on share

based payments - - - - (861) (861)

Current corporation

tax on share options

exercised 6 - - - - 157 157

Ordinary dividends paid 9 - - - - (41,458) (41,458)

Special distributions

to shareholders - - - - (141,727) (141,727)

-------------------------- ----- --------- --------- ------------ --------- ---------- ----------

Total transactions with

owners, recorded directly

in equity - - - - (182,829) (182,829)

--------- --------- ------------ --------- ---------- ----------

As at 4 July 2015 2,028 1,624 43,157 (230) 58,489 105,068

-------------------------- ----- --------- --------- ------------ --------- ---------- ----------

NOTES TO THE INTERIM FINANCIAL STATEMENTS

For the 26 weeks ended 2 January 2016

1 General information

Dunelm Group plc and its subsidiaries ('the group') are

incorporated and domiciled in the UK. The registered office is

Watermead Business Park, Syston Leicestershire.

The primary business activity of the group is the sale of

homewares through a network of UK stores, website and our Dunelm at

Home service.

The group's financial results and cash flows have, historically,

been subject to seasonal trends between the first and second half

of the financial year. Traditionally the second half of the

financial year sees higher revenue and profitability due to the

winter sale and colder weather, however due to the first half of

the financial year ending later this year we have captured an

additional week of the winter sale revenue in these results.

2 Basis of preparation

These condensed interim financial statements For the 26 weeks

ended 2 January 2016 have been prepared in accordance with the

Disclosure and Transparency Rules of the Financial Conduct

Authority (previously the Financial Services Authority) and with

IAS 34, 'Interim financial reporting', as adopted by the European

Union.

The presentation of the condensed financial statements requires

the Directors to make judgements, estimates and assumptions that

affect the application of policies and reported amounts of assets

and liabilities, income and expenses. The estimates and associated

assumptions are based on historical experiences and various other

factors that are believed to be reasonable under the circumstances.

Actual results may differ from these estimates.

The financial information in this document is unaudited, but has

been reviewed by the auditors in accordance with the Auditing

Practices Board guidance on Review of Interim Financial

Information

These condensed interim financial statements do not comprise

statutory accounts within the meaning of section 434 of the

Companies Act 2006 and are not audited. Statutory accounts for the

year ended 4 July 2015 were approved by the Board of Directors on

10 September 2015 and delivered to the Registrar of Companies. The

report of the auditors on those accounts was unqualified, did not

contain an emphasis of matter paragraph and did not contain any

statement under section 498 of the Companies Act 2006.

3 Going concern basis

The Group has considerable financial resources together with

long standing relationships with a number of key suppliers and an

established reputation in the retail sector across the UK. Having

assessed the principal risks, the directors considered it

appropriate to adopt the going concern basis of accounting in

preparing the interim financial statements.

4 Accounting policies

The condensed financial statements have been prepared under the

historical cost convention, except for derivative financial

instruments and share-based payments which are stated at their fair

value.

The accounting policies adopted are consistent with those of the

annual financial statements for the year ended 4 July 2015, as

described in those financial statements, except as described

below:

Taxes on income in the interim periods are accrued using the tax

rate that would be applicable to expected total annual profit or

loss.

The drawdowns and repayments made from the revolving credit

facility (RCF) have been disclosed net rather than gross within the

cash flow.

The condensed interim financial statements should be read in

conjunction with the annual financial statements for the year ended

4 July 2015, which have been prepared in accordance with IFRSs as

adopted by the European Union.

5 Segmental reporting

The Group has only one class of business, retail of homewares,

and operates entirely in the UK market.

6 Taxation

The taxation charge for the interim period has been calculated

on the basis of the estimated effective tax rate for the full year

of 21.2% (26 weeks ended 27 December 2014: 21.5%).

7 Financial risk management and financial instruments

Financial risk factors

The Group's activities expose it to a variety of financial risks

including foreign currency risk, fair value interest rate risk,

credit risk and liquidity risk. The condensed interim financial

statements do not include all financial risk management information

and disclosures required in the annual financial statements; they

should be read in conjunction with the Group's annual financial

statements as at 4 July 2015. There have been no changes in any

risk management policies since the year end.

Fair value estimation

Financial instruments (hedging) carried at fair value are

required to be measured by reference to the following levels:

Level 1: quoted prices in active markets for identical assets or

liabilities;

Level 2: inputs other than quoted prices included within Level 1

that are observable for the asset or liability, either directly

(i.e. as prices) or indirectly (i.e. derived from prices); and

Level 3: inputs for the asset or liability that are not based on

observable market data (unobservable inputs).

All financial instruments carried at fair value have been

measured by a Level 2 valuation method, based on observable market

data.

8 Earnings per share

Basic earnings per share is calculated by dividing the profit

for the period attributable to equity holders of the Company by the

weighted average number of Ordinary Shares in issue during the

period excluding ordinary shares purchased by the Company and held

as treasury shares.

For diluted earnings per share, the weighted average number of

Ordinary Shares in issue is adjusted to assume conversion of all

dilutive potential Ordinary Shares. These represent share options

granted to employees where the exercise price is less than the

average market price of the Company's Ordinary Shares during the

period.

(MORE TO FOLLOW) Dow Jones Newswires

February 10, 2016 02:00 ET (07:00 GMT)

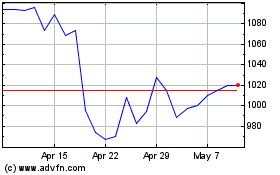

Dunelm (LSE:DNLM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Dunelm (LSE:DNLM)

Historical Stock Chart

From Apr 2023 to Apr 2024